| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921131500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

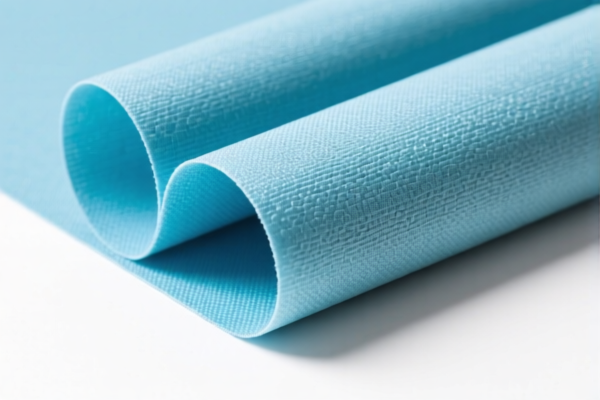

Product Name: Polyurethane Textile Composite Films

Classification HS Codes and Tax Details:

- HS CODE: 3921131100

- Description: Polyurethane textile composite films, which are plastic sheets, films, foils, and strips combined with textile materials.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to general polyurethane textile composites without specific restrictions on fiber composition.

-

HS CODE: 3921131500

- Description: Polyurethane textile composite films where synthetic fibers weigh more than any single natural fiber.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is for products with a specific fiber weight ratio.

-

HS CODE: 3921131950

- Description: Honeycomb polyurethane composite films combined with textile materials, with no restrictions on plant fiber weight.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is for honeycomb structures with no specific fiber weight limitations.

-

HS CODE: 3921902550

- Description: Polyester fiber composite films with a weight exceeding 1.492 kg/m², where synthetic fibers dominate in weight.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to heavier composite films with a dominant synthetic fiber content.

-

HS CODE: 3921131100 (repeated)

- Description: High-strength polyurethane textile composite films, meeting the material and structural definitions of the code.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This is a duplicate entry; ensure the product's exact specifications match the code description.

✅ Proactive Advice:

- Verify Material Composition: Confirm the exact fiber composition (e.g., synthetic vs. natural) and structure (e.g., honeycomb, high-strength) to ensure correct HS code selection.

- Check Unit Price and Weight: The weight per square meter may affect the applicable HS code (e.g., 3921902550 requires >1.492 kg/m²).

- Certifications Required: Ensure compliance with any required certifications (e.g., textile content verification, safety standards).

- April 11, 2025 Deadline: Be aware of the additional 30% tariff after this date. Plan import timelines accordingly.

-

Anti-Dumping Duties: While not explicitly mentioned here, be cautious of potential anti-dumping duties on related materials (iron/aluminum) if applicable. Product Name: Polyurethane Textile Composite Films

Classification HS Codes and Tax Details: -

HS CODE: 3921131100

- Description: Polyurethane textile composite films, which are plastic sheets, films, foils, and strips combined with textile materials.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to general polyurethane textile composites without specific restrictions on fiber composition.

-

HS CODE: 3921131500

- Description: Polyurethane textile composite films where synthetic fibers weigh more than any single natural fiber.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is for products with a specific fiber weight ratio.

-

HS CODE: 3921131950

- Description: Honeycomb polyurethane composite films combined with textile materials, with no restrictions on plant fiber weight.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is for honeycomb structures with no specific fiber weight limitations.

-

HS CODE: 3921902550

- Description: Polyester fiber composite films with a weight exceeding 1.492 kg/m², where synthetic fibers dominate in weight.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to heavier composite films with a dominant synthetic fiber content.

-

HS CODE: 3921131100 (repeated)

- Description: High-strength polyurethane textile composite films, meeting the material and structural definitions of the code.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This is a duplicate entry; ensure the product's exact specifications match the code description.

✅ Proactive Advice:

- Verify Material Composition: Confirm the exact fiber composition (e.g., synthetic vs. natural) and structure (e.g., honeycomb, high-strength) to ensure correct HS code selection.

- Check Unit Price and Weight: The weight per square meter may affect the applicable HS code (e.g., 3921902550 requires >1.492 kg/m²).

- Certifications Required: Ensure compliance with any required certifications (e.g., textile content verification, safety standards).

- April 11, 2025 Deadline: Be aware of the additional 30% tariff after this date. Plan import timelines accordingly.

- Anti-Dumping Duties: While not explicitly mentioned here, be cautious of potential anti-dumping duties on related materials (iron/aluminum) if applicable.

Customer Reviews

No reviews yet.