| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921131500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

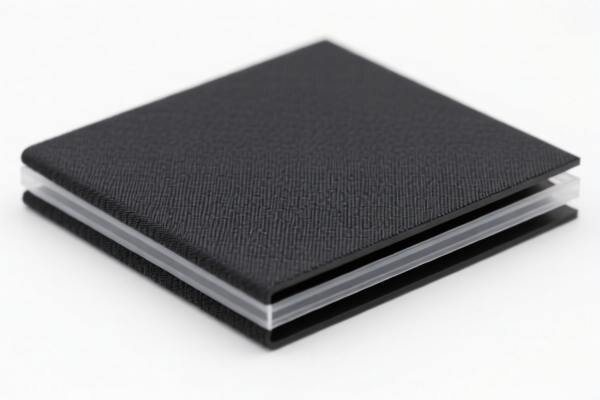

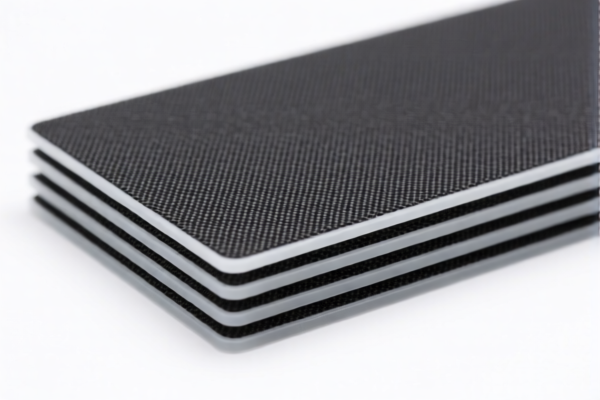

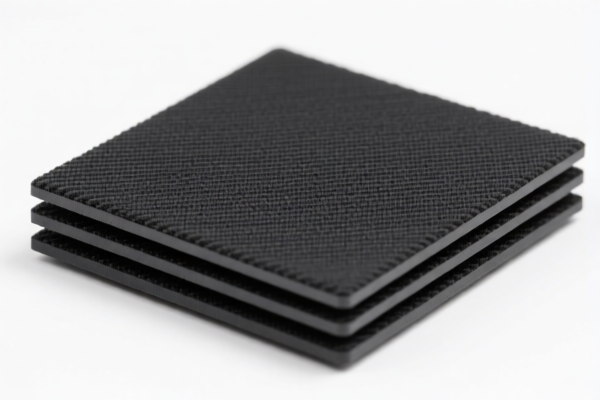

Product Name: Polyurethane Textile Composite Flexible Plates

Classification HS Codes and Tax Details:

🔍 HS Code: 3921131950

Description: Honeycomb polyurethane plastic sheets, films, foils, and strips combined with textile materials, without restrictions on plant fiber weight percentage.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

🔍 HS Code: 3921131100

Description: Polyurethane honeycomb plastic combined with textile materials, where synthetic fibers exceed other single textile fibers, and plastic content exceeds 70%.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

🔍 HS Code: 3921131500

Description: Polyurethane plastic combined with textile materials.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

📌 Key Notes and Recommendations:

- Tariff Changes After April 11, 2025: A 30% additional tariff will be applied to all three HS codes. Ensure your import timeline accounts for this increase.

- Material Composition Matters: The classification depends heavily on the percentage of plastic and textile content, as well as the type of textile fiber used (e.g., synthetic vs. plant-based).

- Certifications Required: Confirm if any specific certifications (e.g., textile origin, environmental compliance) are needed for customs clearance.

- Unit Price Verification: Accurate product description and unit price are essential for proper classification and tax calculation.

- Check for Anti-Dumping Duties: Although not explicitly mentioned here, be aware that anti-dumping duties may apply depending on the country of origin and product type.

✅ Proactive Advice:

- Consult with a customs broker to confirm the most accurate HS code based on your product's exact composition.

- Keep detailed documentation on the material composition, including percentages of plastic and textile components.

- Monitor policy updates after April 11, 2025, as additional tariffs may affect your import costs significantly.

Product Name: Polyurethane Textile Composite Flexible Plates

Classification HS Codes and Tax Details:

🔍 HS Code: 3921131950

Description: Honeycomb polyurethane plastic sheets, films, foils, and strips combined with textile materials, without restrictions on plant fiber weight percentage.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

🔍 HS Code: 3921131100

Description: Polyurethane honeycomb plastic combined with textile materials, where synthetic fibers exceed other single textile fibers, and plastic content exceeds 70%.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

🔍 HS Code: 3921131500

Description: Polyurethane plastic combined with textile materials.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

📌 Key Notes and Recommendations:

- Tariff Changes After April 11, 2025: A 30% additional tariff will be applied to all three HS codes. Ensure your import timeline accounts for this increase.

- Material Composition Matters: The classification depends heavily on the percentage of plastic and textile content, as well as the type of textile fiber used (e.g., synthetic vs. plant-based).

- Certifications Required: Confirm if any specific certifications (e.g., textile origin, environmental compliance) are needed for customs clearance.

- Unit Price Verification: Accurate product description and unit price are essential for proper classification and tax calculation.

- Check for Anti-Dumping Duties: Although not explicitly mentioned here, be aware that anti-dumping duties may apply depending on the country of origin and product type.

✅ Proactive Advice:

- Consult with a customs broker to confirm the most accurate HS code based on your product's exact composition.

- Keep detailed documentation on the material composition, including percentages of plastic and textile components.

- Monitor policy updates after April 11, 2025, as additional tariffs may affect your import costs significantly.

Customer Reviews

No reviews yet.