Found 4 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131910 | Doc | 60.3% | CN | US | 2025-05-12 |

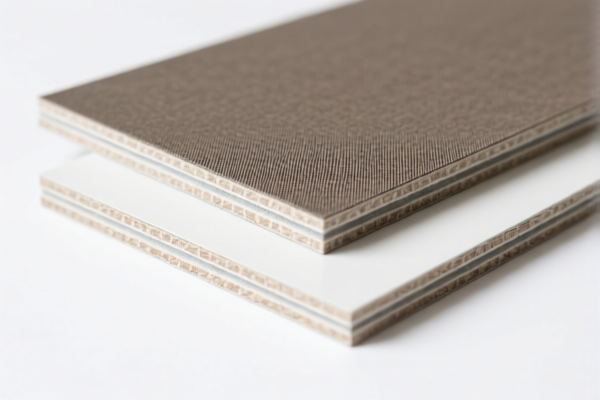

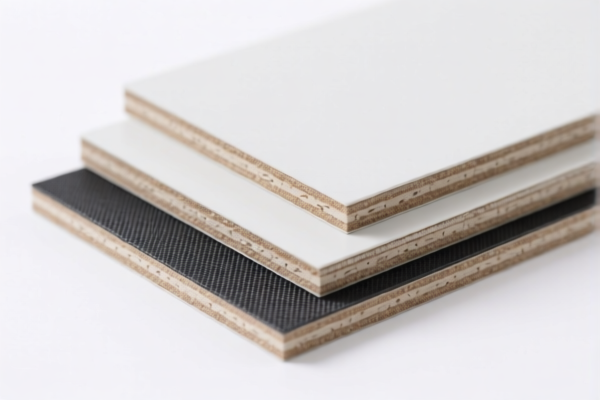

Product Name: Polyurethane Textile Composite Furniture Boards

Classification HS Codes and Tax Details:

- HS CODE: 3921131950

- Description: Polyurethane textile composite furniture boards, classified under 3921.13.19.50, fall under the "Other" category.

- Total Tax Rate: 60.3%

-

Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921131500

- Description: Polyurethane textile composite furniture boards, classified under 3921.13.15.00, include "polyurethane plastics" and "plastics combined with textile materials."

- Total Tax Rate: 61.5%

-

Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

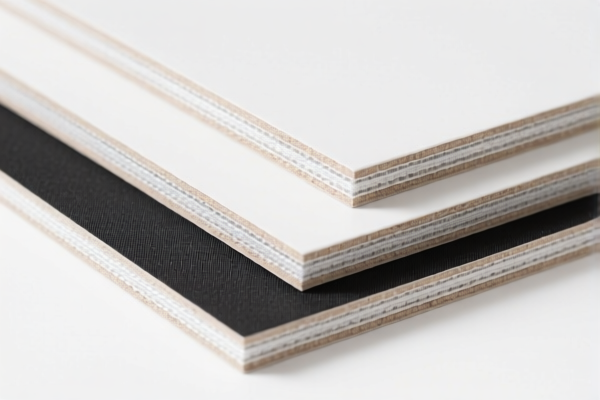

HS CODE: 3921131100

- Description: Polyurethane textile composite furniture boards, classified under 3921.13.11.00, include "polyurethane plastics" and "plastics combined with textile materials," and the product name contains the word "textile."

- Total Tax Rate: 59.2%

-

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921131910

- Description: Polyurethane textile composite boards, classified under 3921.13.19.10, include "polyurethane" and "combined with textile materials," and the textile component by weight exceeds any single textile fiber.

- Total Tax Rate: 60.3%

-

Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921131950 (Duplicate)

- Description: Polyurethane textile composite boards, classified under 3921.13.19.10 or 3921.13.19.50, require further confirmation of the weight percentage of plant fibers to determine the exact HS code.

- Total Tax Rate: 60.3%

- Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

- Tariff Increase Alert: A special tariff of 30.0% will be applied after April 11, 2025 for all the above HS codes. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the weight percentage of textile and plant fibers in the product to determine the correct HS code (e.g., 3921131910 vs. 3921131950).

- Certifications Required: Check if any customs certifications or product compliance documents are needed for import (e.g., material composition reports, origin certificates).

- Unit Price Review: Verify the unit price and product description to ensure accurate classification and avoid potential customs delays or penalties.

Let me know if you need help with HS code selection or customs documentation.

Product Name: Polyurethane Textile Composite Furniture Boards

Classification HS Codes and Tax Details:

- HS CODE: 3921131950

- Description: Polyurethane textile composite furniture boards, classified under 3921.13.19.50, fall under the "Other" category.

- Total Tax Rate: 60.3%

-

Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921131500

- Description: Polyurethane textile composite furniture boards, classified under 3921.13.15.00, include "polyurethane plastics" and "plastics combined with textile materials."

- Total Tax Rate: 61.5%

-

Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921131100

- Description: Polyurethane textile composite furniture boards, classified under 3921.13.11.00, include "polyurethane plastics" and "plastics combined with textile materials," and the product name contains the word "textile."

- Total Tax Rate: 59.2%

-

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921131910

- Description: Polyurethane textile composite boards, classified under 3921.13.19.10, include "polyurethane" and "combined with textile materials," and the textile component by weight exceeds any single textile fiber.

- Total Tax Rate: 60.3%

-

Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921131950 (Duplicate)

- Description: Polyurethane textile composite boards, classified under 3921.13.19.10 or 3921.13.19.50, require further confirmation of the weight percentage of plant fibers to determine the exact HS code.

- Total Tax Rate: 60.3%

- Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

- Tariff Increase Alert: A special tariff of 30.0% will be applied after April 11, 2025 for all the above HS codes. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the weight percentage of textile and plant fibers in the product to determine the correct HS code (e.g., 3921131910 vs. 3921131950).

- Certifications Required: Check if any customs certifications or product compliance documents are needed for import (e.g., material composition reports, origin certificates).

- Unit Price Review: Verify the unit price and product description to ensure accurate classification and avoid potential customs delays or penalties.

Let me know if you need help with HS code selection or customs documentation.

Customer Reviews

No reviews yet.