| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921131500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131910 | Doc | 60.3% | CN | US | 2025-05-12 |

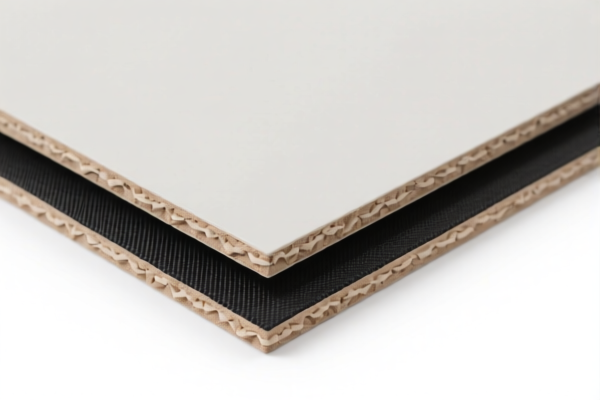

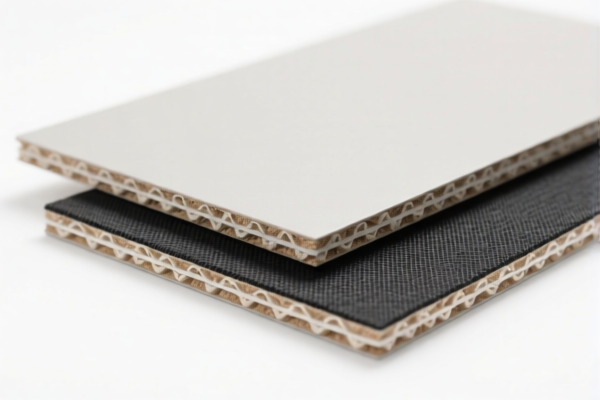

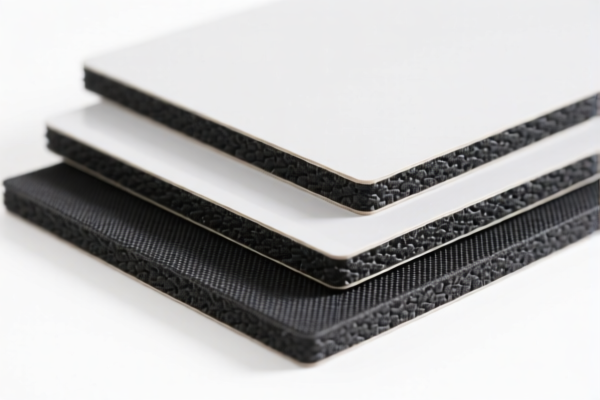

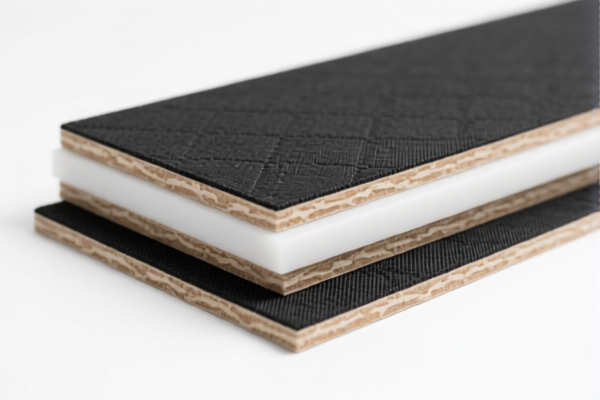

Product Name: Polyurethane Textile Composite Interior Boards

Classification HS Codes and Tax Details:

✅ HS Code: 3921131100

Description:

- Polyurethane textile composite interior boards, where the plastic content exceeds 70%, and the textile component is primarily synthetic fibers (more than any other single fiber type).

Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

✅ HS Code: 3921131500

Description:

- Polyurethane textile composite interior boards, composed of polyurethane plastic and textile materials, but not specifically restricted by fiber type.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS Code: 3921131950

Description:

- Polyurethane textile composite decorative panels, where the textile component is not restricted by fiber type, and the product falls under the "Other" category.

Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS Code: 3921131910

Description:

- Polyurethane textile composite decorative panels, where the textile component by weight exceeds any other single fiber type.

Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all four HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for this product category. However, it is recommended to verify if any anti-dumping measures apply based on the country of origin. -

Certifications Required:

Ensure that the product meets all relevant import certifications (e.g., safety, environmental, or textile standards) depending on the destination country. -

Material and Unit Price Verification:

Confirm the exact composition (e.g., percentage of synthetic vs. natural fibers) and unit price to ensure correct HS code classification and tax calculation.

📌 Proactive Advice:

- Double-check the material composition and weight percentages of the textile and plastic components to ensure accurate HS code selection.

- Keep updated records of product specifications and certifications for customs compliance.

- If importing from countries with known anti-dumping measures, conduct a pre-shipment compliance check.

Product Name: Polyurethane Textile Composite Interior Boards

Classification HS Codes and Tax Details:

✅ HS Code: 3921131100

Description:

- Polyurethane textile composite interior boards, where the plastic content exceeds 70%, and the textile component is primarily synthetic fibers (more than any other single fiber type).

Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

✅ HS Code: 3921131500

Description:

- Polyurethane textile composite interior boards, composed of polyurethane plastic and textile materials, but not specifically restricted by fiber type.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS Code: 3921131950

Description:

- Polyurethane textile composite decorative panels, where the textile component is not restricted by fiber type, and the product falls under the "Other" category.

Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

✅ HS Code: 3921131910

Description:

- Polyurethane textile composite decorative panels, where the textile component by weight exceeds any other single fiber type.

Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all four HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for this product category. However, it is recommended to verify if any anti-dumping measures apply based on the country of origin. -

Certifications Required:

Ensure that the product meets all relevant import certifications (e.g., safety, environmental, or textile standards) depending on the destination country. -

Material and Unit Price Verification:

Confirm the exact composition (e.g., percentage of synthetic vs. natural fibers) and unit price to ensure correct HS code classification and tax calculation.

📌 Proactive Advice:

- Double-check the material composition and weight percentages of the textile and plastic components to ensure accurate HS code selection.

- Keep updated records of product specifications and certifications for customs compliance.

- If importing from countries with known anti-dumping measures, conduct a pre-shipment compliance check.

Customer Reviews

No reviews yet.