| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921131500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921131500 | Doc | 61.5% | CN | US | 2025-05-12 |

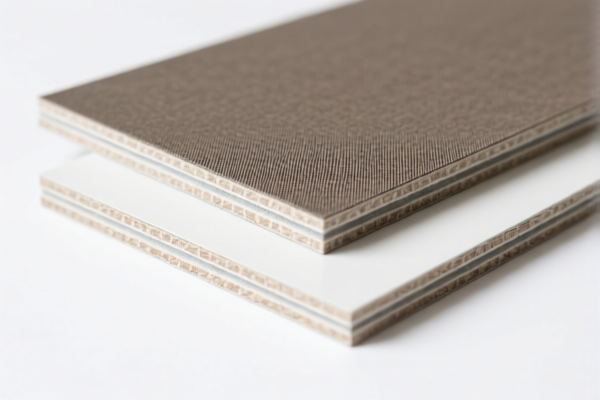

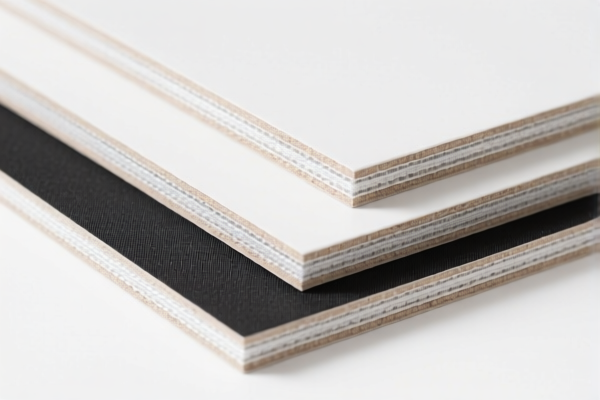

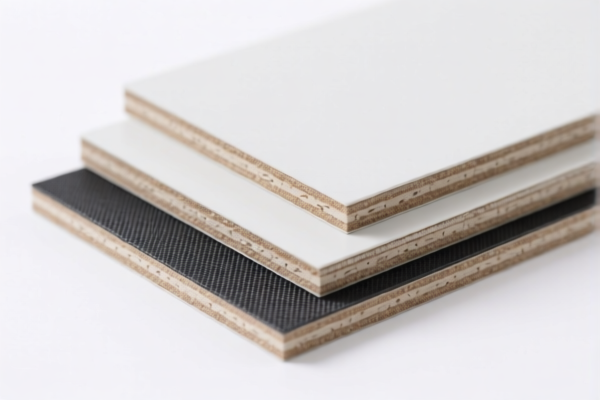

Product Name: Polyurethane Textile Composite Material Boards

Classification HS Codes and Tax Information:

- HS CODE: 3921131500

- Description: Polyurethane textile composite boards, which match the description of "other plastic sheets, films, foils, and strips: honeycomb plastic, polyurethane plastic, plastic combined with textile materials, textile components with synthetic fibers weighing more than any other single textile fiber, other."

-

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921131950

- Description: Polyurethane textile composite boards, which fall under the category of "honeycomb polyurethane plastic sheets, films, foils, and strips combined with textile materials."

-

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921131910

- Description: Polyurethane textile composite boards, which include "polyurethane combined with textile materials," and the textile component by weight exceeds any single textile fiber.

-

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921131100

- Description: Polyurethane textile composite boards, which are described as "plastic combined with textile materials, with plastic weight over 70%, and synthetic fibers in the textile component weighing more than any single natural fiber."

-

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921131500 (Duplicate)

- Description: Polyurethane textile composite structural boards, which match the description of "other plastic sheets, films, foils, and strips: honeycomb plastic, polyurethane plastic, plastic combined with textile materials, textile components with synthetic fibers weighing more than any other single textile fiber, other."

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ Key Notes and Recommendations:

- Tariff Changes After April 11, 2025: All listed HS codes will be subject to an additional 30.0% tariff. Ensure your import timeline is planned accordingly.

- Material Composition: Verify the weight percentage of polyurethane and textile components, as this determines the correct HS code.

- Certifications: Confirm if any customs certifications or product compliance documents are required for import.

- Unit Price: Review the unit price and total value of the goods, as this may affect the application of additional tariffs or anti-dumping duties.

- Anti-Dumping Duties: While not explicitly mentioned, be aware that anti-dumping duties may apply if the product is subject to such measures (e.g., for iron or aluminum products). Confirm with customs or a trade compliance expert if applicable.

📌 Proactive Action Required:

- Double-check the material composition and weight ratio of the product to ensure correct HS code classification.

- Confirm the import date to avoid unexpected tariff increases after April 11, 2025.

-

If importing in bulk, consider customs brokerage services to ensure compliance and minimize delays. Product Name: Polyurethane Textile Composite Material Boards

Classification HS Codes and Tax Information: -

HS CODE: 3921131500

- Description: Polyurethane textile composite boards, which match the description of "other plastic sheets, films, foils, and strips: honeycomb plastic, polyurethane plastic, plastic combined with textile materials, textile components with synthetic fibers weighing more than any other single textile fiber, other."

-

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921131950

- Description: Polyurethane textile composite boards, which fall under the category of "honeycomb polyurethane plastic sheets, films, foils, and strips combined with textile materials."

-

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921131910

- Description: Polyurethane textile composite boards, which include "polyurethane combined with textile materials," and the textile component by weight exceeds any single textile fiber.

-

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921131100

- Description: Polyurethane textile composite boards, which are described as "plastic combined with textile materials, with plastic weight over 70%, and synthetic fibers in the textile component weighing more than any single natural fiber."

-

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921131500 (Duplicate)

- Description: Polyurethane textile composite structural boards, which match the description of "other plastic sheets, films, foils, and strips: honeycomb plastic, polyurethane plastic, plastic combined with textile materials, textile components with synthetic fibers weighing more than any other single textile fiber, other."

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ Key Notes and Recommendations:

- Tariff Changes After April 11, 2025: All listed HS codes will be subject to an additional 30.0% tariff. Ensure your import timeline is planned accordingly.

- Material Composition: Verify the weight percentage of polyurethane and textile components, as this determines the correct HS code.

- Certifications: Confirm if any customs certifications or product compliance documents are required for import.

- Unit Price: Review the unit price and total value of the goods, as this may affect the application of additional tariffs or anti-dumping duties.

- Anti-Dumping Duties: While not explicitly mentioned, be aware that anti-dumping duties may apply if the product is subject to such measures (e.g., for iron or aluminum products). Confirm with customs or a trade compliance expert if applicable.

📌 Proactive Action Required:

- Double-check the material composition and weight ratio of the product to ensure correct HS code classification.

- Confirm the import date to avoid unexpected tariff increases after April 11, 2025.

- If importing in bulk, consider customs brokerage services to ensure compliance and minimize delays.

Customer Reviews

No reviews yet.