Found 4 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921131500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131910 | Doc | 60.3% | CN | US | 2025-05-12 |

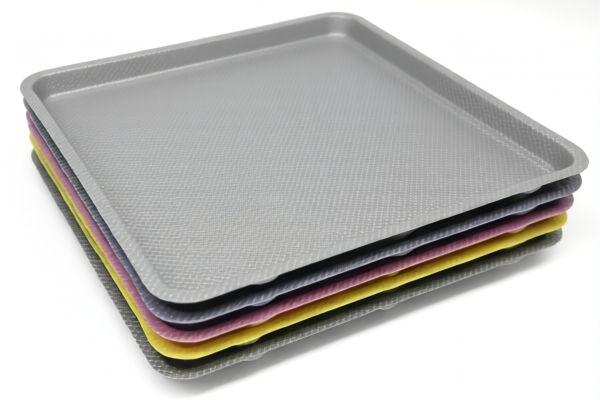

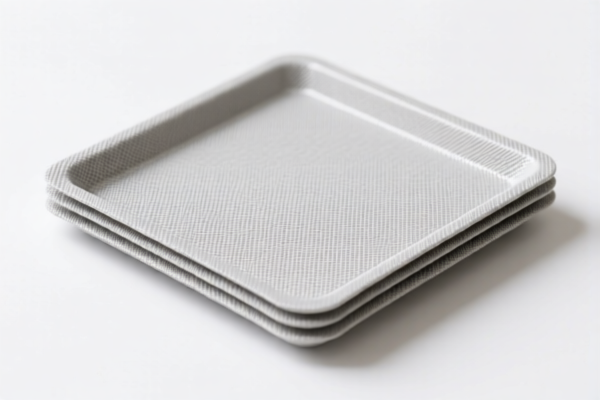

Product Name: Polyurethane Textile Composite Packaging Plates

Classification HS CODEs and Tax Details:

- HS CODE: 3921131500

- Description: Applies to polyurethane plastic sheets, plates, films, foils, and strips with a honeycomb structure, combined with textile materials.

-

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921131100

- Description: Applies to polyurethane plastic combined with textile materials.

-

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921131950

- Description: Applies to polyurethane plastic sheets, plates, films, foils, and strips with a honeycomb structure, combined with textile materials, without restrictions on plant fiber weight percentage.

-

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921131910

- Description: Applies to polyurethane plastic sheets combined with textile materials, where the textile component exceeds the weight of any single textile fiber.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to all four HS codes after this date. Ensure your import timeline accounts for this increase.

- Material Composition: Verify the exact composition of the product (e.g., textile fiber type, weight percentage, and whether it contains a honeycomb structure) to ensure correct HS code classification.

- Certifications: Confirm if any certifications (e.g., textile content, environmental compliance) are required for customs clearance.

- Unit Price: Review the unit price and total value of the goods, as this may affect the application of anti-dumping duties or other trade measures.

- Anti-Dumping Duties: While not explicitly mentioned in the data, be aware that anti-dumping duties may apply to products containing iron or aluminum components. Check with customs or a trade compliance expert if applicable.

✅ Proactive Action Steps:

- Confirm the exact product composition and structure.

- Check the latest HS code updates and tariff changes.

- Prepare documentation (e.g., material composition, certifications, invoices).

-

Consult with customs or a trade compliance expert for final classification and duty calculation. Product Name: Polyurethane Textile Composite Packaging Plates

Classification HS CODEs and Tax Details: -

HS CODE: 3921131500

- Description: Applies to polyurethane plastic sheets, plates, films, foils, and strips with a honeycomb structure, combined with textile materials.

-

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921131100

- Description: Applies to polyurethane plastic combined with textile materials.

-

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921131950

- Description: Applies to polyurethane plastic sheets, plates, films, foils, and strips with a honeycomb structure, combined with textile materials, without restrictions on plant fiber weight percentage.

-

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921131910

- Description: Applies to polyurethane plastic sheets combined with textile materials, where the textile component exceeds the weight of any single textile fiber.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to all four HS codes after this date. Ensure your import timeline accounts for this increase.

- Material Composition: Verify the exact composition of the product (e.g., textile fiber type, weight percentage, and whether it contains a honeycomb structure) to ensure correct HS code classification.

- Certifications: Confirm if any certifications (e.g., textile content, environmental compliance) are required for customs clearance.

- Unit Price: Review the unit price and total value of the goods, as this may affect the application of anti-dumping duties or other trade measures.

- Anti-Dumping Duties: While not explicitly mentioned in the data, be aware that anti-dumping duties may apply to products containing iron or aluminum components. Check with customs or a trade compliance expert if applicable.

✅ Proactive Action Steps:

- Confirm the exact product composition and structure.

- Check the latest HS code updates and tariff changes.

- Prepare documentation (e.g., material composition, certifications, invoices).

- Consult with customs or a trade compliance expert for final classification and duty calculation.

Customer Reviews

No reviews yet.