| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921131500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921131910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

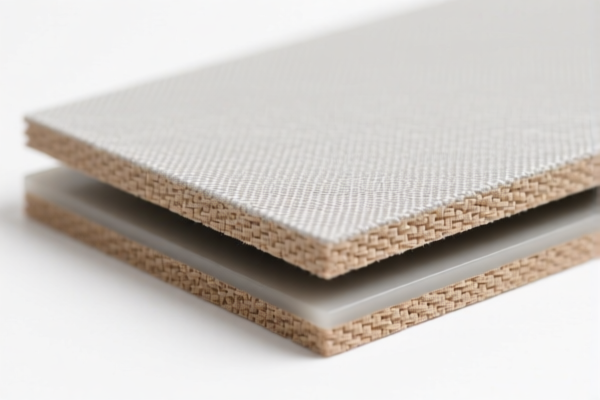

Product Classification: Polyurethane Textile Composite Plates

HS CODEs and Tax Details (April 2025 Update):

- HS CODE: 3921131500

- Description: Polyurethane plastic composite plates, sheets, films, foils, and strips combined with textile materials, where synthetic fibers weigh more than any other single textile fiber.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies when synthetic fibers are the dominant textile component.

-

HS CODE: 3921131950

- Description: Honeycomb polyurethane plastic plates, sheets, films, foils, and strips combined with textile materials.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for honeycomb structures with textile integration.

-

HS CODE: 3921131100

- Description: Polyurethane plastic combined with textile materials, where synthetic fibers exceed any other single textile fiber, and plastic content exceeds 70%.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies when plastic content is over 70% and synthetic fibers dominate.

-

HS CODE: 3921131910

- Description: Polyurethane combined with textile materials, where textile components by weight exceed any single textile fiber.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies when textile content by weight is the dominant component.

Key Tax Rate Changes (April 11, 2025):

- All codes listed above are subject to an additional 30.0% tariff after April 11, 2025.

- This is a significant increase from the previous 25.0% additional tariff.

- Base tariffs vary depending on the composition and structure of the product.

Proactive Advice:

- Verify Material Composition: Ensure the product meets the specific criteria for the selected HS code (e.g., synthetic fiber dominance, plastic content, honeycomb structure).

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., textile or plastic content verification) are required for customs clearance.

- Monitor Tariff Updates: Stay informed about any further changes in tariff rates or policy updates after April 11, 2025.

-

Consult a Customs Broker: For complex classifications or large shipments, consider professional customs brokerage assistance to avoid delays or penalties. Product Classification: Polyurethane Textile Composite Plates

HS CODEs and Tax Details (April 2025 Update): -

HS CODE: 3921131500

- Description: Polyurethane plastic composite plates, sheets, films, foils, and strips combined with textile materials, where synthetic fibers weigh more than any other single textile fiber.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies when synthetic fibers are the dominant textile component.

-

HS CODE: 3921131950

- Description: Honeycomb polyurethane plastic plates, sheets, films, foils, and strips combined with textile materials.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for honeycomb structures with textile integration.

-

HS CODE: 3921131100

- Description: Polyurethane plastic combined with textile materials, where synthetic fibers exceed any other single textile fiber, and plastic content exceeds 70%.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies when plastic content is over 70% and synthetic fibers dominate.

-

HS CODE: 3921131910

- Description: Polyurethane combined with textile materials, where textile components by weight exceed any single textile fiber.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies when textile content by weight is the dominant component.

Key Tax Rate Changes (April 11, 2025):

- All codes listed above are subject to an additional 30.0% tariff after April 11, 2025.

- This is a significant increase from the previous 25.0% additional tariff.

- Base tariffs vary depending on the composition and structure of the product.

Proactive Advice:

- Verify Material Composition: Ensure the product meets the specific criteria for the selected HS code (e.g., synthetic fiber dominance, plastic content, honeycomb structure).

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., textile or plastic content verification) are required for customs clearance.

- Monitor Tariff Updates: Stay informed about any further changes in tariff rates or policy updates after April 11, 2025.

- Consult a Customs Broker: For complex classifications or large shipments, consider professional customs brokerage assistance to avoid delays or penalties.

Customer Reviews

No reviews yet.