Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921135000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921131910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131500 | Doc | 61.5% | CN | US | 2025-05-12 |

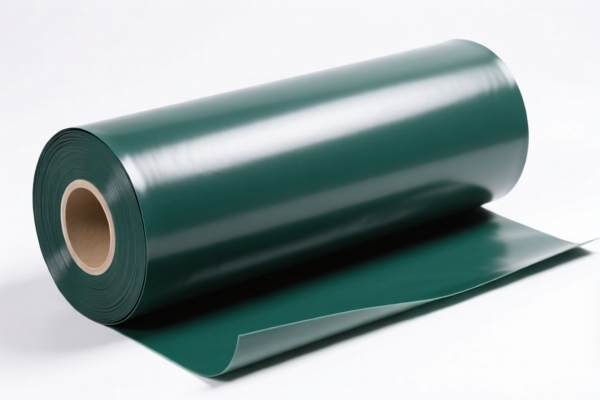

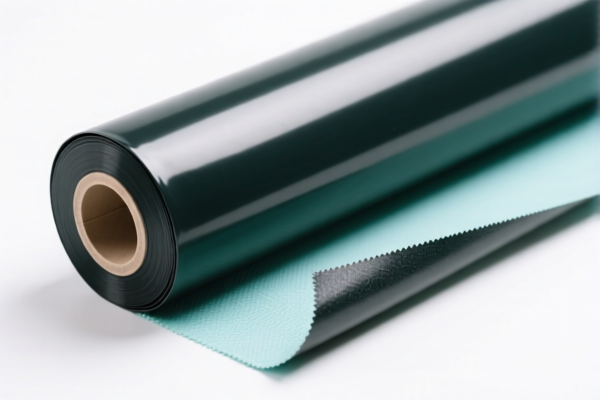

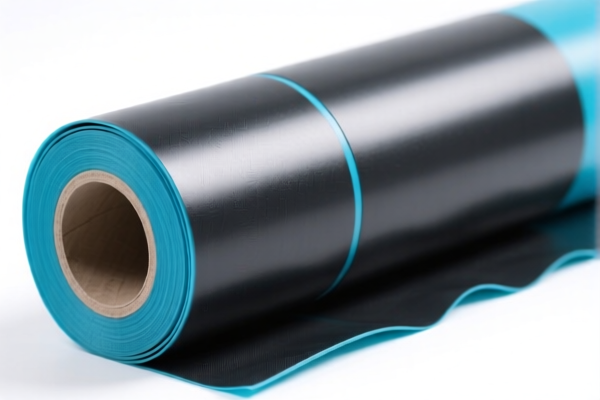

Product Name: Polyurethane Textile Composite Rolls

Classification HS Codes and Tax Details:

✅ HS CODE: 3921131950

- Description: Honeycomb polyurethane plastic sheets, films, foils, and strips combined with textile materials.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Key Notes:

- This code is suitable if the product is a composite of polyurethane and textile materials.

- The textile component must be combined with polyurethane (not just layered or coated).

✅ HS CODE: 3921131500

- Description: Honeycomb plastic, polyurethane plastic combined with textile materials, where the textile component weighs more than any single textile fiber.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Key Notes:

- This code applies if the textile component is the dominant weight in the composite.

- Ensure the weight ratio of textile to polyurethane is clearly documented for customs compliance.

✅ HS CODE: 3921135000

- Description: Other plastic sheets, films, foils, and strips, honeycomb structure, polyurethane made, other.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code is for pure polyurethane sheets without significant textile content.

- If the product is not a composite with textiles, this may be the correct classification.

✅ HS CODE: 3921131910

- Description: Polyurethane textile composite sheets, where the textile component weighs more than any single textile fiber.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Key Notes:

- This code is for composite sheets with textile content as the dominant component.

- Ensure the textile weight percentage is clearly stated in documentation.

📌 Proactive Advice:

- Verify Material Composition: Confirm whether the product is a composite of polyurethane and textile, or if it is pure polyurethane.

- Check Weight Ratio: If textile content is present, ensure the weight percentage is documented to determine the correct HS code.

- Document Certifications: Some HS codes may require certifications or technical specifications (e.g., material composition, manufacturing process).

- Watch for April 11, 2025, Tariff Changes: The special tariff of 30% will apply after this date, so plan accordingly for import costs.

- Consult Customs Broker: For complex classifications, it is advisable to seek professional customs advice to avoid delays or penalties.

Product Name: Polyurethane Textile Composite Rolls

Classification HS Codes and Tax Details:

✅ HS CODE: 3921131950

- Description: Honeycomb polyurethane plastic sheets, films, foils, and strips combined with textile materials.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Key Notes:

- This code is suitable if the product is a composite of polyurethane and textile materials.

- The textile component must be combined with polyurethane (not just layered or coated).

✅ HS CODE: 3921131500

- Description: Honeycomb plastic, polyurethane plastic combined with textile materials, where the textile component weighs more than any single textile fiber.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Key Notes:

- This code applies if the textile component is the dominant weight in the composite.

- Ensure the weight ratio of textile to polyurethane is clearly documented for customs compliance.

✅ HS CODE: 3921135000

- Description: Other plastic sheets, films, foils, and strips, honeycomb structure, polyurethane made, other.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code is for pure polyurethane sheets without significant textile content.

- If the product is not a composite with textiles, this may be the correct classification.

✅ HS CODE: 3921131910

- Description: Polyurethane textile composite sheets, where the textile component weighs more than any single textile fiber.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Key Notes:

- This code is for composite sheets with textile content as the dominant component.

- Ensure the textile weight percentage is clearly stated in documentation.

📌 Proactive Advice:

- Verify Material Composition: Confirm whether the product is a composite of polyurethane and textile, or if it is pure polyurethane.

- Check Weight Ratio: If textile content is present, ensure the weight percentage is documented to determine the correct HS code.

- Document Certifications: Some HS codes may require certifications or technical specifications (e.g., material composition, manufacturing process).

- Watch for April 11, 2025, Tariff Changes: The special tariff of 30% will apply after this date, so plan accordingly for import costs.

- Consult Customs Broker: For complex classifications, it is advisable to seek professional customs advice to avoid delays or penalties.

Customer Reviews

No reviews yet.