| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921131910 | Doc | 60.3% | CN | US | 2025-05-12 |

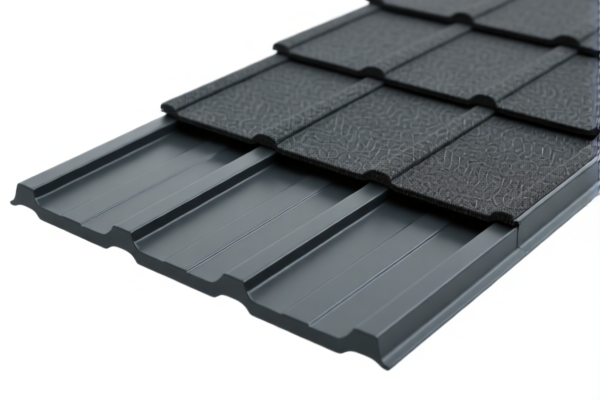

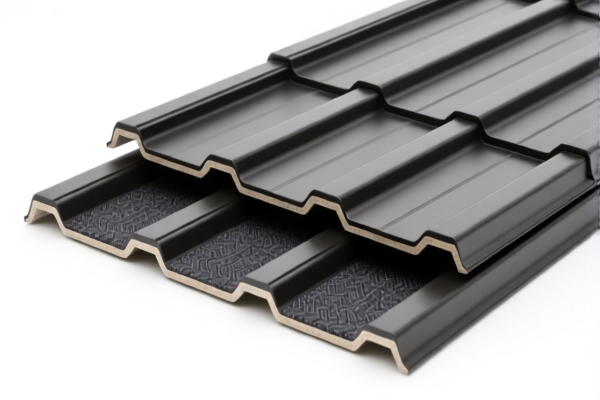

Product Classification and Tax Information for "Polyurethane Textile Composite Roofing Panels"

Below is a structured summary of the HS codes and associated tariff information for your product:

1. HS CODE: 3921131950

Product Description:

- Name: Polyurethane Textile Composite Roofing Panels

- Description Match: "Honeycomb polyurethane plastic sheets, plates, films, foils, and strips combined with textile materials, other"

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

Notes:

- This code is suitable if the product is not specifically classified under more detailed categories (e.g., not explicitly for building or wall use).

- Ensure the product description clearly states it is a roofing panel and not a wall panel or general-purpose panel.

2. HS CODE: 3921131910

Product Description:

- Name: Textile Composite Polyurethane Panel

- Description Match: "Honeycomb polyurethane plastic sheets combined with textile materials, where textile components by weight exceed any single textile fiber"

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

Notes:

- This code applies if the textile component by weight exceeds any single textile fiber.

- Confirm the material composition and weight ratio of textile vs. polyurethane to ensure compliance.

3. HS CODE: 3921131500

Product Description:

- Name: Polyurethane Textile Composite Building Panel

- Description Match: "Polyurethane plastic sheets combined with textile materials, for building use"

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Notes:

- This code is specific to building use, so it is ideal for roofing or wall panels used in construction.

- Ensure the product is clearly labeled or described as "for building use".

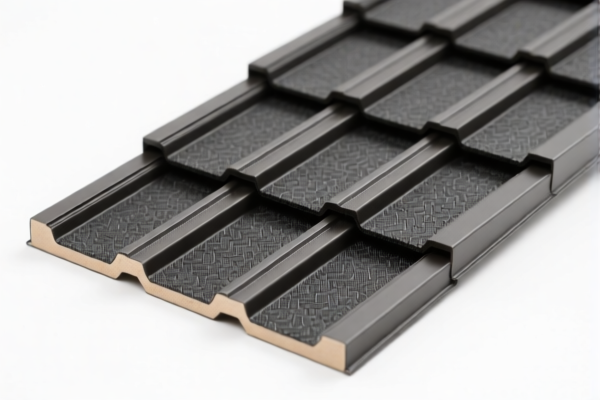

4. HS CODE: 3921131100

Product Description:

- Name: Polyurethane Textile Composite Wall Panel

- Description Match: "Polyurethane plastic combined with textile materials, with textile content by weight exceeding any single textile fiber, and plastic content over 70%"

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

Notes:

- This code is specific to wall panels and requires plastic content over 70%.

- If your product is a roofing panel, this may not be the correct code unless it is also used for walls.

5. HS CODE: 3921131910 (Duplicate Entry)

Product Description:

- Name: Polyurethane Textile Composite Wall Panel

- Description Match: Same as above, but with a different product name.

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

Notes:

- This is a duplicate entry for the same HS code.

- Ensure the product name and description match the HS code description to avoid misclassification.

✅ Proactive Advice for Customs Compliance:

- Verify Material Composition: Confirm the weight ratio of polyurethane vs. textile components, especially if the textile content exceeds any single fiber.

- Check Product Use: If the product is for roofing, ensure it is classified under the building use category (e.g., 3921131500).

- Review Tariff Dates: The special tariff after April 11, 2025 applies to all listed codes. Ensure your import timeline accounts for this.

- Certifications: Confirm if any certifications (e.g., fire resistance, building standards) are required for import or use in the destination country.

- Unit Price: Be prepared to provide unit price and product specifications for customs verification.

Let me know if you need help with certification requirements or customs documentation for this product.

Product Classification and Tax Information for "Polyurethane Textile Composite Roofing Panels"

Below is a structured summary of the HS codes and associated tariff information for your product:

1. HS CODE: 3921131950

Product Description:

- Name: Polyurethane Textile Composite Roofing Panels

- Description Match: "Honeycomb polyurethane plastic sheets, plates, films, foils, and strips combined with textile materials, other"

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

Notes:

- This code is suitable if the product is not specifically classified under more detailed categories (e.g., not explicitly for building or wall use).

- Ensure the product description clearly states it is a roofing panel and not a wall panel or general-purpose panel.

2. HS CODE: 3921131910

Product Description:

- Name: Textile Composite Polyurethane Panel

- Description Match: "Honeycomb polyurethane plastic sheets combined with textile materials, where textile components by weight exceed any single textile fiber"

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

Notes:

- This code applies if the textile component by weight exceeds any single textile fiber.

- Confirm the material composition and weight ratio of textile vs. polyurethane to ensure compliance.

3. HS CODE: 3921131500

Product Description:

- Name: Polyurethane Textile Composite Building Panel

- Description Match: "Polyurethane plastic sheets combined with textile materials, for building use"

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Notes:

- This code is specific to building use, so it is ideal for roofing or wall panels used in construction.

- Ensure the product is clearly labeled or described as "for building use".

4. HS CODE: 3921131100

Product Description:

- Name: Polyurethane Textile Composite Wall Panel

- Description Match: "Polyurethane plastic combined with textile materials, with textile content by weight exceeding any single textile fiber, and plastic content over 70%"

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

Notes:

- This code is specific to wall panels and requires plastic content over 70%.

- If your product is a roofing panel, this may not be the correct code unless it is also used for walls.

5. HS CODE: 3921131910 (Duplicate Entry)

Product Description:

- Name: Polyurethane Textile Composite Wall Panel

- Description Match: Same as above, but with a different product name.

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

Notes:

- This is a duplicate entry for the same HS code.

- Ensure the product name and description match the HS code description to avoid misclassification.

✅ Proactive Advice for Customs Compliance:

- Verify Material Composition: Confirm the weight ratio of polyurethane vs. textile components, especially if the textile content exceeds any single fiber.

- Check Product Use: If the product is for roofing, ensure it is classified under the building use category (e.g., 3921131500).

- Review Tariff Dates: The special tariff after April 11, 2025 applies to all listed codes. Ensure your import timeline accounts for this.

- Certifications: Confirm if any certifications (e.g., fire resistance, building standards) are required for import or use in the destination country.

- Unit Price: Be prepared to provide unit price and product specifications for customs verification.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.