| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921131500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921135000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920632000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

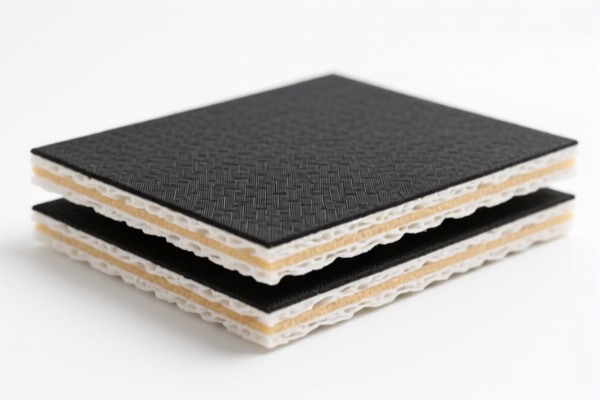

Product Classification: Polyurethane Textile Composite Sandwich Panel

HS CODE: 3921131500

🔍 Tariff Overview (as of current regulations):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

📌 Key Notes on Tax Rates:

-

April 11 Special Tariff:

A 30.0% additional tariff will be imposed on all imports after April 11, 2025. This is a time-sensitive policy and must be considered in your import planning. -

No Anti-Dumping Duties:

As of now, there are no specific anti-dumping duties reported for this product category (polyurethane textile composite sandwich panels).

📦 Classification Considerations:

-

Material Composition:

Ensure the product is polyurethane-based with a textile composite layer. If the textile layer is minimal or not the primary component, the classification may change. -

Unit Price and Certification:

Verify the material composition and unit price to ensure correct classification. Some customs authorities may require technical specifications or certifications (e.g., material composition reports, product standards). -

Alternative HS Codes:

If the product is not textile-based, consider other codes such as: - 3921135000 (Polyurethane sandwich panels, general)

- 3920632000 (Polycarbonate sandwich panels)

- 3920690000 (Polyester composite panels)

✅ Proactive Advice:

-

Confirm Product Composition:

Double-check the material and structure of the product to ensure it fits the description of "polyurethane textile composite sandwich panel." -

Check for Certification Requirements:

Some countries may require import permits or technical documentation for composite materials. -

Plan for April 11, 2025, Tariff Increase:

If you plan to import after this date, budget for the 30.0% additional tariff to avoid unexpected costs. -

Consult a Customs Broker:

For complex or high-value imports, it is advisable to seek professional customs compliance assistance to avoid misclassification or delays.

Let me know if you need help with certification requirements or import documentation for this product.

Product Classification: Polyurethane Textile Composite Sandwich Panel

HS CODE: 3921131500

🔍 Tariff Overview (as of current regulations):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

📌 Key Notes on Tax Rates:

-

April 11 Special Tariff:

A 30.0% additional tariff will be imposed on all imports after April 11, 2025. This is a time-sensitive policy and must be considered in your import planning. -

No Anti-Dumping Duties:

As of now, there are no specific anti-dumping duties reported for this product category (polyurethane textile composite sandwich panels).

📦 Classification Considerations:

-

Material Composition:

Ensure the product is polyurethane-based with a textile composite layer. If the textile layer is minimal or not the primary component, the classification may change. -

Unit Price and Certification:

Verify the material composition and unit price to ensure correct classification. Some customs authorities may require technical specifications or certifications (e.g., material composition reports, product standards). -

Alternative HS Codes:

If the product is not textile-based, consider other codes such as: - 3921135000 (Polyurethane sandwich panels, general)

- 3920632000 (Polycarbonate sandwich panels)

- 3920690000 (Polyester composite panels)

✅ Proactive Advice:

-

Confirm Product Composition:

Double-check the material and structure of the product to ensure it fits the description of "polyurethane textile composite sandwich panel." -

Check for Certification Requirements:

Some countries may require import permits or technical documentation for composite materials. -

Plan for April 11, 2025, Tariff Increase:

If you plan to import after this date, budget for the 30.0% additional tariff to avoid unexpected costs. -

Consult a Customs Broker:

For complex or high-value imports, it is advisable to seek professional customs compliance assistance to avoid misclassification or delays.

Let me know if you need help with certification requirements or import documentation for this product.

Customer Reviews

No reviews yet.