| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921131500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

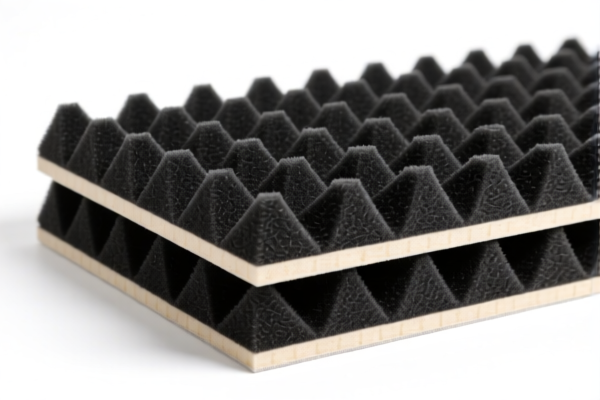

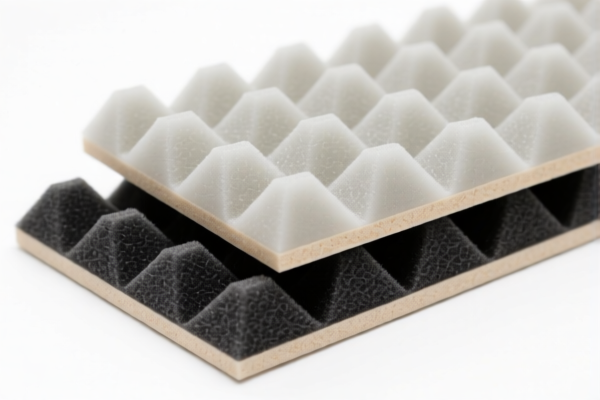

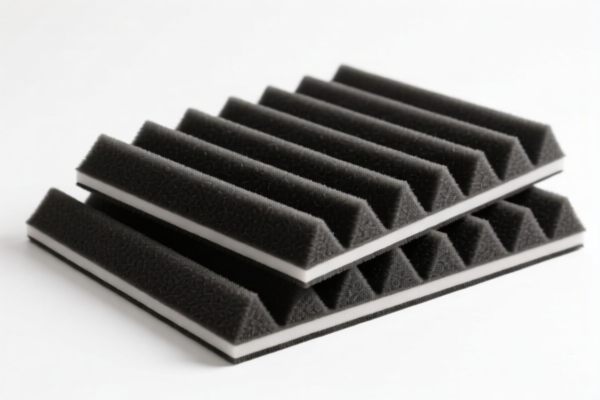

Product Name: Polyurethane Textile Composite Soundproof Boards

Classification HS Codes and Tax Details:

🔍 HS CODE: 3921131950

Description: Honeycomb polyurethane plastic sheets, plates, films, foils, and strips combined with textile materials, without restrictions on the weight percentage of plant fibers.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Key Notes:

- This code applies to honeycomb structures with textile composites.

- No specific restrictions on plant fiber content.

🔍 HS CODE: 3921131910

Description: Polyurethane boards combined with textile materials, where the textile component by weight exceeds any single textile fiber.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Key Notes:

- Textile content must be the dominant component by weight.

- Ensure documentation confirms textile weight percentage.

🔍 HS CODE: 3921131500

Description: Polyurethane plastic sheets combined with textile materials, meeting the description of 8–10 digit HS codes.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Key Notes:

- This code may apply to more general composite structures.

- Verify if the product description aligns with the 8–10 digit HS code description.

🔍 HS CODE: 3921131100 (Duplicate Entry)

Description: Polyurethane plastic sheets combined with textile materials, where synthetic fiber weight exceeds any other single textile fiber, and plastic content exceeds 70%.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code is for products with high plastic content (over 70%) and synthetic fiber dominance.

- Confirm the composition of the product to ensure it meets the 70% plastic threshold.

📌 Proactive Advice:

- Verify Material Composition: Confirm the exact weight percentages of polyurethane and textile components, especially synthetic vs. natural fibers.

- Check Documentation: Ensure product descriptions and technical specifications align with the HS code requirements.

- Certifications: Some HS codes may require specific certifications (e.g., textile content verification).

- April 11, 2025 Deadline: Be aware of the additional 30% tariff after this date.

- Unit Price: Review the unit price to assess the impact of the total tax rate on your product’s cost.

Let me know if you need help selecting the most appropriate HS code for your specific product.

Product Name: Polyurethane Textile Composite Soundproof Boards

Classification HS Codes and Tax Details:

🔍 HS CODE: 3921131950

Description: Honeycomb polyurethane plastic sheets, plates, films, foils, and strips combined with textile materials, without restrictions on the weight percentage of plant fibers.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Key Notes:

- This code applies to honeycomb structures with textile composites.

- No specific restrictions on plant fiber content.

🔍 HS CODE: 3921131910

Description: Polyurethane boards combined with textile materials, where the textile component by weight exceeds any single textile fiber.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Key Notes:

- Textile content must be the dominant component by weight.

- Ensure documentation confirms textile weight percentage.

🔍 HS CODE: 3921131500

Description: Polyurethane plastic sheets combined with textile materials, meeting the description of 8–10 digit HS codes.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Key Notes:

- This code may apply to more general composite structures.

- Verify if the product description aligns with the 8–10 digit HS code description.

🔍 HS CODE: 3921131100 (Duplicate Entry)

Description: Polyurethane plastic sheets combined with textile materials, where synthetic fiber weight exceeds any other single textile fiber, and plastic content exceeds 70%.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code is for products with high plastic content (over 70%) and synthetic fiber dominance.

- Confirm the composition of the product to ensure it meets the 70% plastic threshold.

📌 Proactive Advice:

- Verify Material Composition: Confirm the exact weight percentages of polyurethane and textile components, especially synthetic vs. natural fibers.

- Check Documentation: Ensure product descriptions and technical specifications align with the HS code requirements.

- Certifications: Some HS codes may require specific certifications (e.g., textile content verification).

- April 11, 2025 Deadline: Be aware of the additional 30% tariff after this date.

- Unit Price: Review the unit price to assess the impact of the total tax rate on your product’s cost.

Let me know if you need help selecting the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.