| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

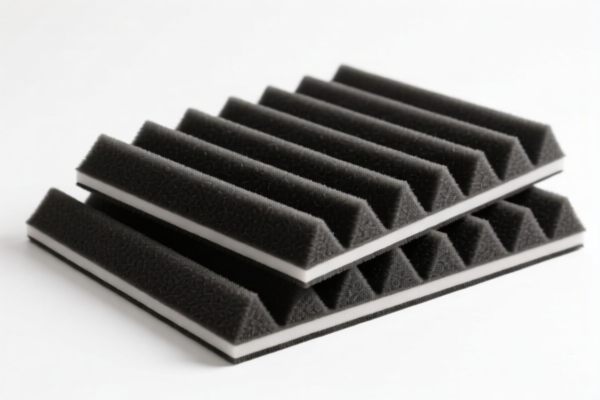

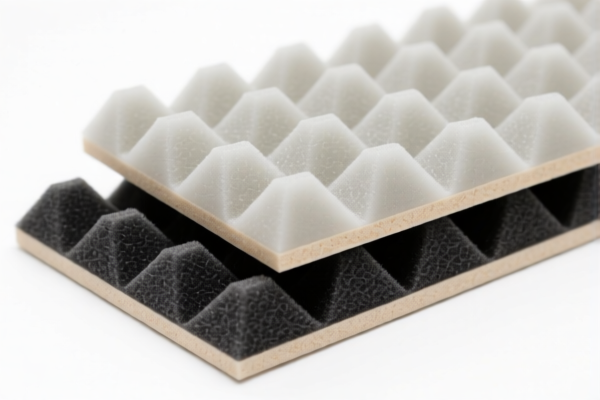

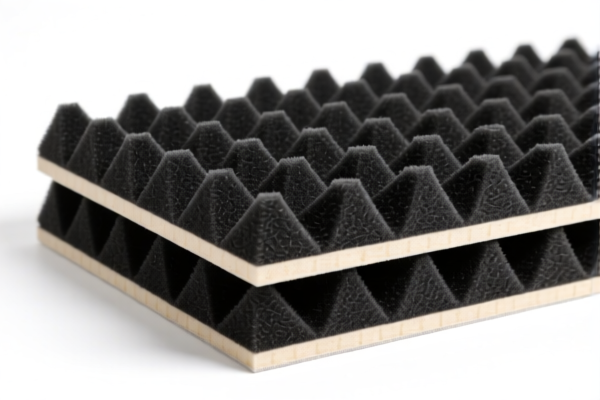

Product Name: Polyurethane Textile Composite Soundproof Panel

Classification HS Code Analysis:

Below are the HS codes and corresponding tariff details for the declared product:

🔹 HS Code: 3921131500

Description: Polyurethane plastic sheets combined with textile materials

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to general polyurethane plastic sheets combined with textile materials.

- No specific restrictions on fiber content or plastic percentage.

🔹 HS Code: 3921131100

Description: Polyurethane plastic combined with textile materials, where synthetic fiber weight exceeds any single natural fiber, and plastic content exceeds 70%

Total Tax Rate: 59.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is more favorable in terms of base tariff.

- Applicable only if synthetic fiber weight is greater than any single natural fiber and plastic content is over 70%.

🔹 HS Code: 3921131950

Description: Honeycomb polyurethane plastic sheets, films, foils, and strips combined with textile materials, without restrictions on plant fiber weight

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to honeycomb structures.

- No restrictions on plant fiber content.

🔹 HS Code: 3921131910

Description: Polyurethane plastic combined with textile materials, where textile content by weight exceeds any single textile fiber

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for general polyurethane-textile composites where textile content is dominant by weight.

- Not restricted to specific fiber types.

📌 Important Reminders:

- April 11, 2025 Special Tariff: All the above codes are subject to an additional 30% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Material Composition: Ensure the product meets the specific fiber and plastic content requirements for the most favorable HS code.

- Certifications: Verify if any certifications (e.g., fire resistance, acoustic performance) are required for import compliance.

- Unit Price: Confirm the unit price and material breakdown to avoid misclassification and potential penalties.

✅ Proactive Advice:

- Verify the exact composition of your product (e.g., fiber types, plastic percentage, structure).

- Consult a customs broker or classification expert to confirm the most accurate HS code.

- Plan for the 2025 tariff increase to avoid unexpected costs during customs clearance.

Product Name: Polyurethane Textile Composite Soundproof Panel

Classification HS Code Analysis:

Below are the HS codes and corresponding tariff details for the declared product:

🔹 HS Code: 3921131500

Description: Polyurethane plastic sheets combined with textile materials

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to general polyurethane plastic sheets combined with textile materials.

- No specific restrictions on fiber content or plastic percentage.

🔹 HS Code: 3921131100

Description: Polyurethane plastic combined with textile materials, where synthetic fiber weight exceeds any single natural fiber, and plastic content exceeds 70%

Total Tax Rate: 59.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is more favorable in terms of base tariff.

- Applicable only if synthetic fiber weight is greater than any single natural fiber and plastic content is over 70%.

🔹 HS Code: 3921131950

Description: Honeycomb polyurethane plastic sheets, films, foils, and strips combined with textile materials, without restrictions on plant fiber weight

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to honeycomb structures.

- No restrictions on plant fiber content.

🔹 HS Code: 3921131910

Description: Polyurethane plastic combined with textile materials, where textile content by weight exceeds any single textile fiber

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for general polyurethane-textile composites where textile content is dominant by weight.

- Not restricted to specific fiber types.

📌 Important Reminders:

- April 11, 2025 Special Tariff: All the above codes are subject to an additional 30% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Material Composition: Ensure the product meets the specific fiber and plastic content requirements for the most favorable HS code.

- Certifications: Verify if any certifications (e.g., fire resistance, acoustic performance) are required for import compliance.

- Unit Price: Confirm the unit price and material breakdown to avoid misclassification and potential penalties.

✅ Proactive Advice:

- Verify the exact composition of your product (e.g., fiber types, plastic percentage, structure).

- Consult a customs broker or classification expert to confirm the most accurate HS code.

- Plan for the 2025 tariff increase to avoid unexpected costs during customs clearance.

Customer Reviews

No reviews yet.