| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921131500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

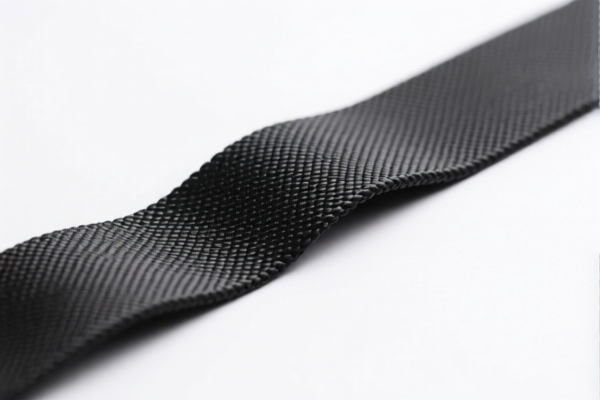

Product Name: Polyurethane Textile Composite Strip

Classification: Plastic products combined with textile materials, specifically polyurethane composites.

🔍 HS CODE Classification Overview

Below are the relevant HS codes and their associated tariff details for Polyurethane Textile Composite Strip:

📦 HS CODE: 3921131950

Description:

- Other plastic sheets, plates, films, foils, and strips: honeycomb structure: polyurethane: combined with textile materials: other

Tariff Details:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

📦 HS CODE: 3921131100

Description:

- Polyurethane plastic: combined with textile materials

Tariff Details:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

📦 HS CODE: 3921131500

Description:

- Polyurethane plastic: combined with textile materials (composite)

Tariff Details:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in your customs planning. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for this product category in the provided data. However, it is advisable to verify if any anti-dumping measures apply based on the country of origin and product composition.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed a polyurethane textile composite and not a different type of composite (e.g., rubber or foam).

- Check Unit Price and Classification: The HS code may vary based on the specific structure (e.g., honeycomb, composite, etc.) and intended use.

- Certifications Required: Confirm if any technical documentation or certifications (e.g., material safety, textile compliance) are required for customs clearance.

- Monitor Tariff Changes: Keep track of the April 11, 2025 deadline to avoid unexpected increases in import costs.

✅ Summary of Tax Rates (by HS Code)

| HS Code | Base Tariff | Additional Tariff | April 11, 2025 Tariff | Total Tax Rate |

|---|---|---|---|---|

| 3921131950 | 5.3% | 25.0% | 30.0% | 60.3% |

| 3921131100 | 4.2% | 25.0% | 30.0% | 59.2% |

| 3921131500 | 6.5% | 25.0% | 30.0% | 61.5% |

If you have more details about the product (e.g., thickness, structure, end-use), I can help you further refine the HS code and tax calculation.

Product Name: Polyurethane Textile Composite Strip

Classification: Plastic products combined with textile materials, specifically polyurethane composites.

🔍 HS CODE Classification Overview

Below are the relevant HS codes and their associated tariff details for Polyurethane Textile Composite Strip:

📦 HS CODE: 3921131950

Description:

- Other plastic sheets, plates, films, foils, and strips: honeycomb structure: polyurethane: combined with textile materials: other

Tariff Details:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

📦 HS CODE: 3921131100

Description:

- Polyurethane plastic: combined with textile materials

Tariff Details:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

📦 HS CODE: 3921131500

Description:

- Polyurethane plastic: combined with textile materials (composite)

Tariff Details:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in your customs planning. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for this product category in the provided data. However, it is advisable to verify if any anti-dumping measures apply based on the country of origin and product composition.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed a polyurethane textile composite and not a different type of composite (e.g., rubber or foam).

- Check Unit Price and Classification: The HS code may vary based on the specific structure (e.g., honeycomb, composite, etc.) and intended use.

- Certifications Required: Confirm if any technical documentation or certifications (e.g., material safety, textile compliance) are required for customs clearance.

- Monitor Tariff Changes: Keep track of the April 11, 2025 deadline to avoid unexpected increases in import costs.

✅ Summary of Tax Rates (by HS Code)

| HS Code | Base Tariff | Additional Tariff | April 11, 2025 Tariff | Total Tax Rate |

|---|---|---|---|---|

| 3921131950 | 5.3% | 25.0% | 30.0% | 60.3% |

| 3921131100 | 4.2% | 25.0% | 30.0% | 59.2% |

| 3921131500 | 6.5% | 25.0% | 30.0% | 61.5% |

If you have more details about the product (e.g., thickness, structure, end-use), I can help you further refine the HS code and tax calculation.

Customer Reviews

No reviews yet.