| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921131500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

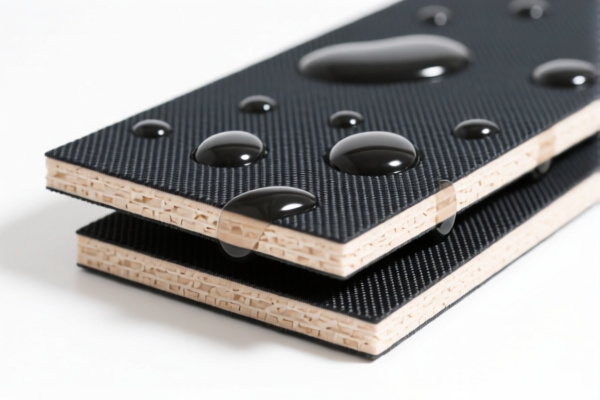

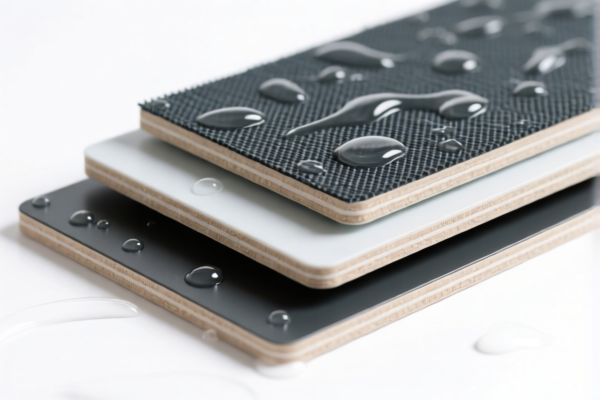

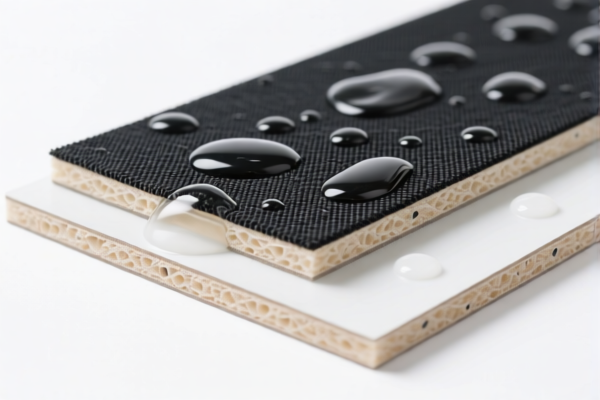

Product Name: Polyurethane Textile Composite Waterproof Boards

Classification HS Codes and Tax Details:

🔍 HS Code: 3921131950

Description:

- Honeycomb polyurethane plastic sheets, films, foils, and strips combined with textile materials, without restrictions on the weight percentage of plant fibers.

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

Notes:

- This code applies to products where the plant fiber content is not specified or restricted.

- Ensure the product description clearly states whether plant fiber content is limited or not to avoid misclassification.

🔍 HS Code: 3921131100

Description:

- Polyurethane plastic combined with textile materials, where the plastic content exceeds 70%.

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

Notes:

- This code is for products with a clear plastic content over 70%.

- If the product contains more than 70% plastic, this code is more favorable in terms of base tariff.

🔍 HS Code: 3921131500

Description:

- Polyurethane plastic combined with textile materials, falling under the "Other (229)" category.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Notes:

- This code is for products that do not fit the above categories and are classified under "Other."

- This is the highest total tax rate among the listed options.

📌 Important Reminders:

- Verify Material Composition: Confirm the exact percentage of polyurethane and textile content in your product to ensure correct classification.

- Check for Certifications: Some products may require specific certifications (e.g., fire resistance, environmental compliance) for import.

- April 11, 2025, Deadline: Be aware of the additional 30% tariff imposed after this date. Plan your import schedule accordingly.

- Unit Price and Packaging: Ensure the unit price and packaging details are clear, as customs may inspect based on these factors.

✅ Proactive Advice:

- Consult a Customs Broker: For complex classifications, especially if the product contains multiple materials or is a composite.

- Document Everything: Keep records of product specifications, material breakdowns, and any certifications.

- Monitor Policy Updates: Tariff rates and classifications can change, so stay informed about any new regulations or updates.

Let me know if you need help with a specific product specification or customs documentation.

Product Name: Polyurethane Textile Composite Waterproof Boards

Classification HS Codes and Tax Details:

🔍 HS Code: 3921131950

Description:

- Honeycomb polyurethane plastic sheets, films, foils, and strips combined with textile materials, without restrictions on the weight percentage of plant fibers.

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

Notes:

- This code applies to products where the plant fiber content is not specified or restricted.

- Ensure the product description clearly states whether plant fiber content is limited or not to avoid misclassification.

🔍 HS Code: 3921131100

Description:

- Polyurethane plastic combined with textile materials, where the plastic content exceeds 70%.

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

Notes:

- This code is for products with a clear plastic content over 70%.

- If the product contains more than 70% plastic, this code is more favorable in terms of base tariff.

🔍 HS Code: 3921131500

Description:

- Polyurethane plastic combined with textile materials, falling under the "Other (229)" category.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Notes:

- This code is for products that do not fit the above categories and are classified under "Other."

- This is the highest total tax rate among the listed options.

📌 Important Reminders:

- Verify Material Composition: Confirm the exact percentage of polyurethane and textile content in your product to ensure correct classification.

- Check for Certifications: Some products may require specific certifications (e.g., fire resistance, environmental compliance) for import.

- April 11, 2025, Deadline: Be aware of the additional 30% tariff imposed after this date. Plan your import schedule accordingly.

- Unit Price and Packaging: Ensure the unit price and packaging details are clear, as customs may inspect based on these factors.

✅ Proactive Advice:

- Consult a Customs Broker: For complex classifications, especially if the product contains multiple materials or is a composite.

- Document Everything: Keep records of product specifications, material breakdowns, and any certifications.

- Monitor Policy Updates: Tariff rates and classifications can change, so stay informed about any new regulations or updates.

Let me know if you need help with a specific product specification or customs documentation.

Customer Reviews

No reviews yet.