| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921131500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921131910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

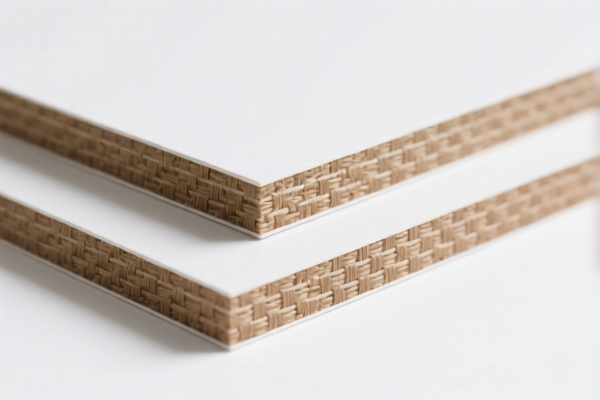

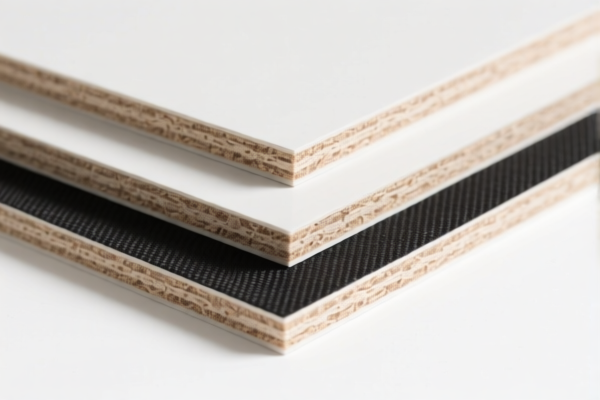

Product Name: Polyurethane Textile Laminated Boards

Classification HS Codes and Tax Details:

🔍 HS Code: 3921131500

Description:

Polyurethane plastic boards, sheets, films, foils, and strips combined with textile materials, where synthetic fibers weigh more than any other single textile fiber.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

🔍 HS Code: 3921131950

Description:

Honeycomb polyurethane plastic boards, sheets, films, foils, and strips combined with textile materials.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

🔍 HS Code: 3921131100

Description:

Polyurethane plastic combined with textile materials, where synthetic fibers weigh more than any other single textile fiber, and plastic content exceeds 70%.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

🔍 HS Code: 3921131910

Description:

Polyurethane combined with textile materials, where textile components weigh more than any single textile fiber.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning.

- Anti-dumping duties: Not applicable for this product category.

- Material Composition: The classification depends heavily on the weight ratio of synthetic fibers vs. other textile fibers and plastic content. Ensure your product description and technical specifications align with the correct HS code.

- Certifications: Verify if any import certifications (e.g., REACH, RoHS, or customs documentation) are required for the product in the destination country.

✅ Proactive Advice:

- Confirm Material Composition: Ensure the exact weight percentages of synthetic fibers and plastic are known to select the correct HS code.

- Review Tariff Dates: If importing after April 11, 2025, the 30% additional tariff will apply. Consider this in pricing and compliance strategies.

- Consult Customs Broker: For complex classifications, it is advisable to consult a customs broker or a classification expert to avoid misclassification penalties.

Product Name: Polyurethane Textile Laminated Boards

Classification HS Codes and Tax Details:

🔍 HS Code: 3921131500

Description:

Polyurethane plastic boards, sheets, films, foils, and strips combined with textile materials, where synthetic fibers weigh more than any other single textile fiber.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

🔍 HS Code: 3921131950

Description:

Honeycomb polyurethane plastic boards, sheets, films, foils, and strips combined with textile materials.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

🔍 HS Code: 3921131100

Description:

Polyurethane plastic combined with textile materials, where synthetic fibers weigh more than any other single textile fiber, and plastic content exceeds 70%.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

🔍 HS Code: 3921131910

Description:

Polyurethane combined with textile materials, where textile components weigh more than any single textile fiber.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning.

- Anti-dumping duties: Not applicable for this product category.

- Material Composition: The classification depends heavily on the weight ratio of synthetic fibers vs. other textile fibers and plastic content. Ensure your product description and technical specifications align with the correct HS code.

- Certifications: Verify if any import certifications (e.g., REACH, RoHS, or customs documentation) are required for the product in the destination country.

✅ Proactive Advice:

- Confirm Material Composition: Ensure the exact weight percentages of synthetic fibers and plastic are known to select the correct HS code.

- Review Tariff Dates: If importing after April 11, 2025, the 30% additional tariff will apply. Consider this in pricing and compliance strategies.

- Consult Customs Broker: For complex classifications, it is advisable to consult a customs broker or a classification expert to avoid misclassification penalties.

Customer Reviews

No reviews yet.