| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3905911000 | Doc | 59.0% | CN | US | 2025-05-12 |

| 3901306000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3905190000 | Doc | 59.0% | CN | US | 2025-05-12 |

| 3905120000 | Doc | 59.0% | CN | US | 2025-05-12 |

| 3905915000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3905290000 | Doc | 59.0% | CN | US | 2025-05-12 |

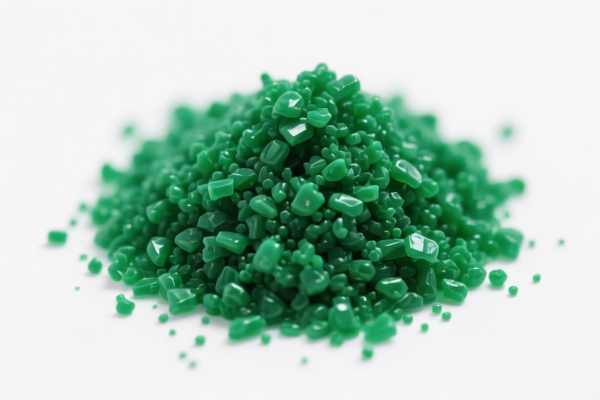

Product Name: Polyvinyl Acetate Copolymer Resin

Classification: HS Code (Harmonized System Code)

Language: English

Response Style: Structured bullet points with clear logic and tax rate highlights

✅ HS Code Classification Overview

Below are the HS codes and associated tariff details for Polyvinyl Acetate Copolymer Resin:

🔢 HS Code 3905911000

- Description: Acetate vinyl ester copolymer resin, classified under HS code 3905.

- Total Tax Rate: 59.0%

- Base Tariff: 4.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a common classification for general-purpose copolymer resins.

🔢 HS Code 3901306000

- Description: Acetate vinyl copolymer resin, classified under HS code 390190 (other acetate vinyl copolymers).

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Higher base tariff due to specific classification under 3901.

🔢 HS Code 3905190000

- Description: Acetate vinyl copolymer resin, classified under HS code 3905.

- Total Tax Rate: 59.0%

- Base Tariff: 4.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: General classification for copolymer resins under 3905.

🔢 HS Code 3905120000

- Description: Polyvinyl acetate resin, classified under HS code 3905120000.

- Total Tax Rate: 59.0%

- Base Tariff: 4.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Specific to polyvinyl acetate resins.

🔢 HS Code 3905915000

- Description: Ethylene vinyl acetate copolymer resin, classified under HS code 3905.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Higher base tariff due to specific polymer type.

🔢 HS Code 3905290000

- Description: Ethylene vinyl acetate copolymer resin, classified under HS code 3905.

- Total Tax Rate: 59.0%

- Base Tariff: 4.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: General classification for ethylene vinyl acetate resins.

⚠️ Important Notes and Recommendations

- April 11, 2025 Special Tariff: All listed HS codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline aligns with this policy.

- Anti-dumping duties: Not applicable for this product category (no mention of iron or aluminum).

- Certifications: Verify if your product requires any specific certifications (e.g., REACH, RoHS, or customs documentation).

- Material and Unit Price: Confirm the exact chemical composition and unit price to ensure correct HS code classification and tax calculation.

- Customs Declaration: Work with a qualified customs broker or compliance officer to ensure accurate classification and avoid penalties.

📌 Proactive Advice

- Double-check the exact chemical structure of your product to ensure it matches the HS code description.

- If your product is used in specific industries (e.g., construction, adhesives), confirm if any additional regulations apply.

- Keep updated records of material specifications, supplier documentation, and certifications for customs compliance.

Let me know if you need help selecting the most appropriate HS code for your specific product.

Product Name: Polyvinyl Acetate Copolymer Resin

Classification: HS Code (Harmonized System Code)

Language: English

Response Style: Structured bullet points with clear logic and tax rate highlights

✅ HS Code Classification Overview

Below are the HS codes and associated tariff details for Polyvinyl Acetate Copolymer Resin:

🔢 HS Code 3905911000

- Description: Acetate vinyl ester copolymer resin, classified under HS code 3905.

- Total Tax Rate: 59.0%

- Base Tariff: 4.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a common classification for general-purpose copolymer resins.

🔢 HS Code 3901306000

- Description: Acetate vinyl copolymer resin, classified under HS code 390190 (other acetate vinyl copolymers).

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Higher base tariff due to specific classification under 3901.

🔢 HS Code 3905190000

- Description: Acetate vinyl copolymer resin, classified under HS code 3905.

- Total Tax Rate: 59.0%

- Base Tariff: 4.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: General classification for copolymer resins under 3905.

🔢 HS Code 3905120000

- Description: Polyvinyl acetate resin, classified under HS code 3905120000.

- Total Tax Rate: 59.0%

- Base Tariff: 4.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Specific to polyvinyl acetate resins.

🔢 HS Code 3905915000

- Description: Ethylene vinyl acetate copolymer resin, classified under HS code 3905.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Higher base tariff due to specific polymer type.

🔢 HS Code 3905290000

- Description: Ethylene vinyl acetate copolymer resin, classified under HS code 3905.

- Total Tax Rate: 59.0%

- Base Tariff: 4.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: General classification for ethylene vinyl acetate resins.

⚠️ Important Notes and Recommendations

- April 11, 2025 Special Tariff: All listed HS codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline aligns with this policy.

- Anti-dumping duties: Not applicable for this product category (no mention of iron or aluminum).

- Certifications: Verify if your product requires any specific certifications (e.g., REACH, RoHS, or customs documentation).

- Material and Unit Price: Confirm the exact chemical composition and unit price to ensure correct HS code classification and tax calculation.

- Customs Declaration: Work with a qualified customs broker or compliance officer to ensure accurate classification and avoid penalties.

📌 Proactive Advice

- Double-check the exact chemical structure of your product to ensure it matches the HS code description.

- If your product is used in specific industries (e.g., construction, adhesives), confirm if any additional regulations apply.

- Keep updated records of material specifications, supplier documentation, and certifications for customs compliance.

Let me know if you need help selecting the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.