| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3905300000 | Doc | 58.2% | CN | US | 2025-05-12 |

| 3905998000 | Doc | 60.3% | CN | US | 2025-05-12 |

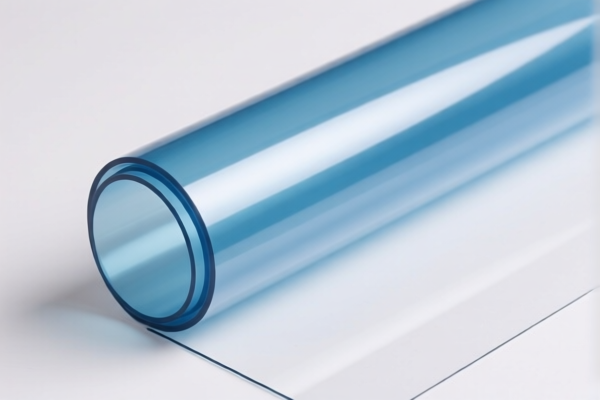

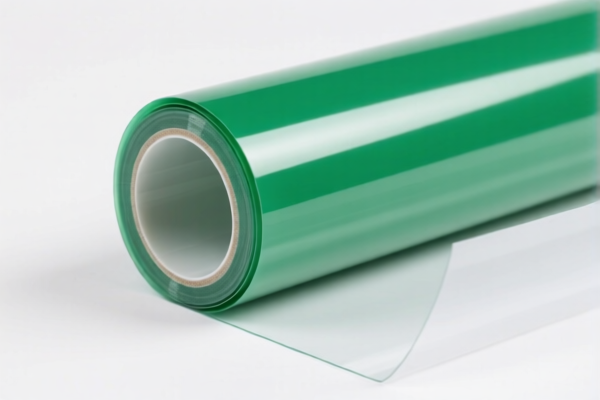

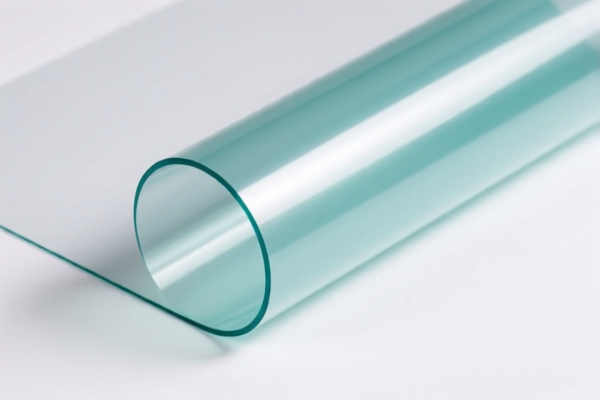

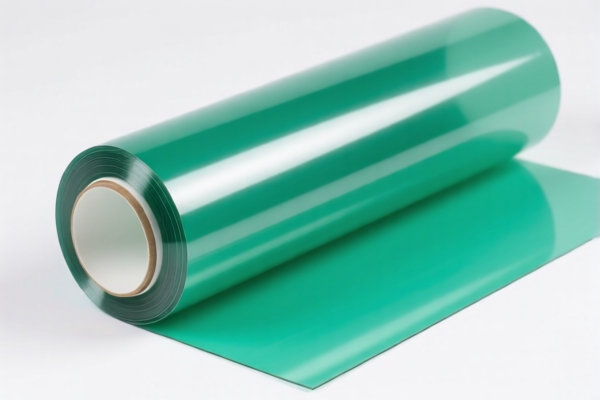

Product Name: Polyvinyl Butyral Safety Film

Classification HS Code:

- 3905300000 – Polyvinyl Butyral Safety Film (ethylene-vinyl butyral polymer)

- 3905998000 – Other primary forms of vinyl polymers (may apply if the product is not specifically classified under 3905300000)

🔍 Classification Summary:

- 3905300000 is the most accurate classification for Polyvinyl Butyral Safety Film, as it specifically refers to ethylene-vinyl butyral polymer, which matches the product description.

- 3905998000 is a broader category for other primary forms of vinyl polymers and may be used if the product does not meet the specific criteria for 3905300000.

📊 Tariff Overview (as of now):

For HS Code 3905300000:

- Base Tariff Rate: 3.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.2%

For HS Code 3905998000:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on imports after this date. This is a time-sensitive policy and must be accounted for in cost planning.

- Anti-dumping duties: Not currently applicable for this product category, but always verify with the latest customs updates.

- Material and Certification: Confirm the exact composition of the Polyvinyl Butyral Safety Film (e.g., thickness, additives, etc.) to ensure correct classification. Some products may require safety certifications or import permits depending on the destination country.

✅ Proactive Advice:

- Verify the product's exact specifications (e.g., whether it is a safety film or just a general film) to ensure correct HS code assignment.

- Check the unit price and total value to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Consult customs or a qualified customs broker for the most up-to-date classification and tariff information, especially if the product is new or complex.

Let me know if you need help with customs documentation or further classification details.

Product Name: Polyvinyl Butyral Safety Film

Classification HS Code:

- 3905300000 – Polyvinyl Butyral Safety Film (ethylene-vinyl butyral polymer)

- 3905998000 – Other primary forms of vinyl polymers (may apply if the product is not specifically classified under 3905300000)

🔍 Classification Summary:

- 3905300000 is the most accurate classification for Polyvinyl Butyral Safety Film, as it specifically refers to ethylene-vinyl butyral polymer, which matches the product description.

- 3905998000 is a broader category for other primary forms of vinyl polymers and may be used if the product does not meet the specific criteria for 3905300000.

📊 Tariff Overview (as of now):

For HS Code 3905300000:

- Base Tariff Rate: 3.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.2%

For HS Code 3905998000:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on imports after this date. This is a time-sensitive policy and must be accounted for in cost planning.

- Anti-dumping duties: Not currently applicable for this product category, but always verify with the latest customs updates.

- Material and Certification: Confirm the exact composition of the Polyvinyl Butyral Safety Film (e.g., thickness, additives, etc.) to ensure correct classification. Some products may require safety certifications or import permits depending on the destination country.

✅ Proactive Advice:

- Verify the product's exact specifications (e.g., whether it is a safety film or just a general film) to ensure correct HS code assignment.

- Check the unit price and total value to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Consult customs or a qualified customs broker for the most up-to-date classification and tariff information, especially if the product is new or complex.

Let me know if you need help with customs documentation or further classification details.

Customer Reviews

No reviews yet.