Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101040 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3916200020 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

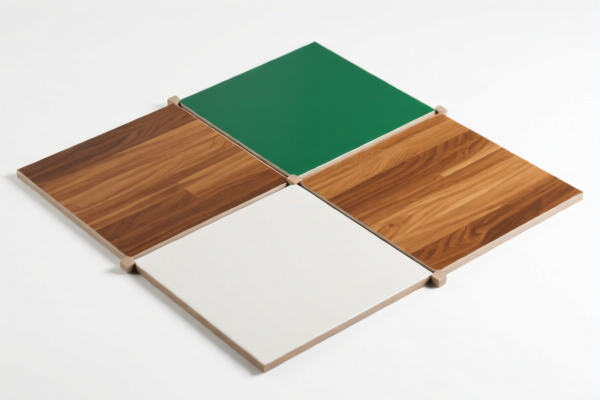

Here is the structured analysis and customs compliance guidance for Polyvinyl Chloride (PVC) Floor Tiles based on the provided HS codes and tariff information:

🔍 HS Code Classification Overview

| HS Code | Description | Total Tax Rate | Base Tariff | Additional Tariff | April 11, 2025 Special Tariff |

|---|---|---|---|---|---|

| 3918102000 | PVC floor tiles, floor materials, etc. | 60.3% | 5.3% | 25.0% | 30.0% |

| 3918101040 | PVC floor tiles for indoor use, non-self-adhesive | 60.3% | 5.3% | 25.0% | 30.0% |

| 3916200020 | PVC floor profiles | 60.8% | 5.8% | 25.0% | 30.0% |

| 3918901000 | PVC plastic floor tiles | 60.3% | 5.3% | 25.0% | 30.0% |

| 3918102000 | PVC floor tiles for ground laying | 60.3% | 5.3% | 25.0% | 30.0% |

📌 Key Tax Rate Changes and Notes

- Base Tariff: Ranges from 5.3% to 5.8%, depending on the specific product type.

- Additional Tariff: 25.0% applied to all listed HS codes.

- April 11, 2025 Special Tariff: 30.0% added after April 11, 2025 (important for import planning).

- Total Tax Rate: 60.3% to 60.8%, depending on the product.

⚠️ Time-Sensitive Policy Alert

- Additional tariffs of 30.0% will be imposed after April 11, 2025. This is a critical date for importers to consider when planning shipments and budgeting for customs costs.

📦 Proactive Compliance Advice

- Verify Material Composition: Ensure the product is indeed made of PVC and not mixed with other materials, as this can affect classification.

- Check Unit Price and Packaging: Tariff rates may vary based on the unit of measurement (e.g., per square meter vs. per box).

- Certifications Required: Confirm if any certifications (e.g., fire resistance, environmental standards) are needed for import into the destination country.

- Consult with Customs Broker: For accurate classification and to avoid misdeclaration penalties, especially with similar HS codes like 3918102000 (listed twice with different descriptions).

📌 Summary of Actions Required

- Confirm the exact product description and intended use (e.g., indoor vs. outdoor, self-adhesive vs. non-self-adhesive).

- Ensure HS code accuracy to avoid misclassification and additional penalties.

- Plan for increased tariffs after April 11, 2025.

- Maintain documentation (e.g., invoices, product specs, certifications) for customs compliance.

Let me know if you need help with HS code selection or tariff calculation for a specific product. Here is the structured analysis and customs compliance guidance for Polyvinyl Chloride (PVC) Floor Tiles based on the provided HS codes and tariff information:

🔍 HS Code Classification Overview

| HS Code | Description | Total Tax Rate | Base Tariff | Additional Tariff | April 11, 2025 Special Tariff |

|---|---|---|---|---|---|

| 3918102000 | PVC floor tiles, floor materials, etc. | 60.3% | 5.3% | 25.0% | 30.0% |

| 3918101040 | PVC floor tiles for indoor use, non-self-adhesive | 60.3% | 5.3% | 25.0% | 30.0% |

| 3916200020 | PVC floor profiles | 60.8% | 5.8% | 25.0% | 30.0% |

| 3918901000 | PVC plastic floor tiles | 60.3% | 5.3% | 25.0% | 30.0% |

| 3918102000 | PVC floor tiles for ground laying | 60.3% | 5.3% | 25.0% | 30.0% |

📌 Key Tax Rate Changes and Notes

- Base Tariff: Ranges from 5.3% to 5.8%, depending on the specific product type.

- Additional Tariff: 25.0% applied to all listed HS codes.

- April 11, 2025 Special Tariff: 30.0% added after April 11, 2025 (important for import planning).

- Total Tax Rate: 60.3% to 60.8%, depending on the product.

⚠️ Time-Sensitive Policy Alert

- Additional tariffs of 30.0% will be imposed after April 11, 2025. This is a critical date for importers to consider when planning shipments and budgeting for customs costs.

📦 Proactive Compliance Advice

- Verify Material Composition: Ensure the product is indeed made of PVC and not mixed with other materials, as this can affect classification.

- Check Unit Price and Packaging: Tariff rates may vary based on the unit of measurement (e.g., per square meter vs. per box).

- Certifications Required: Confirm if any certifications (e.g., fire resistance, environmental standards) are needed for import into the destination country.

- Consult with Customs Broker: For accurate classification and to avoid misdeclaration penalties, especially with similar HS codes like 3918102000 (listed twice with different descriptions).

📌 Summary of Actions Required

- Confirm the exact product description and intended use (e.g., indoor vs. outdoor, self-adhesive vs. non-self-adhesive).

- Ensure HS code accuracy to avoid misclassification and additional penalties.

- Plan for increased tariffs after April 11, 2025.

- Maintain documentation (e.g., invoices, product specs, certifications) for customs compliance.

Let me know if you need help with HS code selection or tariff calculation for a specific product.

Customer Reviews

No reviews yet.