Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917210000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917220000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3926909910 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3926909910 | Doc | 42.8% | CN | US | 2025-05-12 |

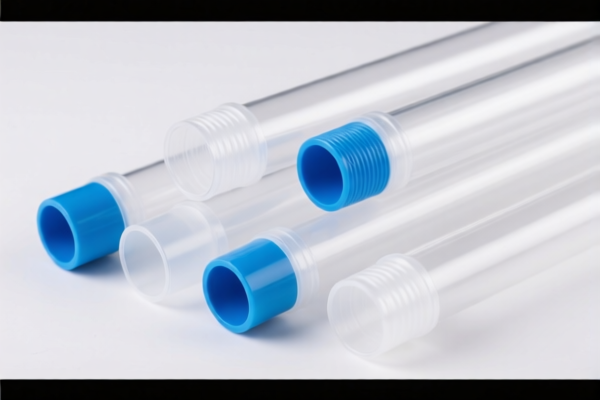

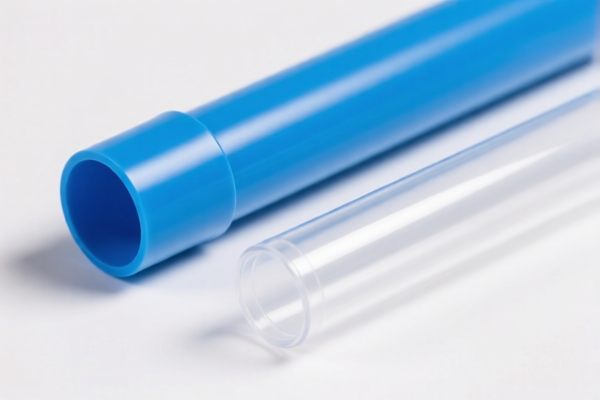

Product Classification: Polyvinyl Chloride Plastic Laboratory Pipes

HS CODE: 3917320050

🔍 Classification Summary

- Product Name: Polyvinyl Chloride (PVC) Plastic Laboratory Pipes

- HS Code: 3917320050

- Total Tax Rate: 58.1%

📊 Tariff Breakdown

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (PVC is not a metal product)

⏰ Time-sensitive Policy Alert

- April 11, 2025 Special Tariff:

- A 30.0% additional tariff will be imposed after April 11, 2025.

- This is a significant increase from the current 25.0% additional tariff.

- Impact: Total tax rate will jump to 58.1% (3.1% + 25.0% + 30.0%) after this date.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of polyvinyl chloride (PVC) and not a different polymer (e.g., polyethylene or polypropylene), as this affects HS code classification.

- Check Unit Price and Quantity: Tariff calculations depend on the value and quantity of the goods.

- Certifications Required: Confirm if any customs documentation or certifications (e.g., material safety data sheets, product standards) are needed for import clearance.

- Monitor Tariff Updates: Stay informed about tariff changes after April 11, 2025, as this could significantly increase import costs.

📌 Alternative HS Codes for Similar Products

- 3917210000 – Polyethylene Plastic Pipes (Total Tax: 58.1%)

- 3917220000 – Polypropylene Laboratory Pipes (Total Tax: 58.1%)

- 3926909910 – Polyethylene Laboratory Containers / Plastic Collection Tubes (Total Tax: 42.8%)

Note: These codes are for similar plastic laboratory products but may not apply to PVC. Always confirm the exact material and product use before classification. Product Classification: Polyvinyl Chloride Plastic Laboratory Pipes

HS CODE: 3917320050

🔍 Classification Summary

- Product Name: Polyvinyl Chloride (PVC) Plastic Laboratory Pipes

- HS Code: 3917320050

- Total Tax Rate: 58.1%

📊 Tariff Breakdown

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (PVC is not a metal product)

⏰ Time-sensitive Policy Alert

- April 11, 2025 Special Tariff:

- A 30.0% additional tariff will be imposed after April 11, 2025.

- This is a significant increase from the current 25.0% additional tariff.

- Impact: Total tax rate will jump to 58.1% (3.1% + 25.0% + 30.0%) after this date.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of polyvinyl chloride (PVC) and not a different polymer (e.g., polyethylene or polypropylene), as this affects HS code classification.

- Check Unit Price and Quantity: Tariff calculations depend on the value and quantity of the goods.

- Certifications Required: Confirm if any customs documentation or certifications (e.g., material safety data sheets, product standards) are needed for import clearance.

- Monitor Tariff Updates: Stay informed about tariff changes after April 11, 2025, as this could significantly increase import costs.

📌 Alternative HS Codes for Similar Products

- 3917210000 – Polyethylene Plastic Pipes (Total Tax: 58.1%)

- 3917220000 – Polypropylene Laboratory Pipes (Total Tax: 58.1%)

- 3926909910 – Polyethylene Laboratory Containers / Plastic Collection Tubes (Total Tax: 42.8%)

Note: These codes are for similar plastic laboratory products but may not apply to PVC. Always confirm the exact material and product use before classification.

Customer Reviews

No reviews yet.