Found 4 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4421998027 | Doc | 6.5¢/gross+30.0% | CN | US | 2025-05-12 |

| 4421998030 | Doc | 6.5¢/gross+30.0% | CN | US | 2025-05-12 |

| 4421998500 | Doc | 34.8% | CN | US | 2025-05-12 |

| 4421998033 | Doc | 6.5¢/gross+30.0% | CN | US | 2025-05-12 |

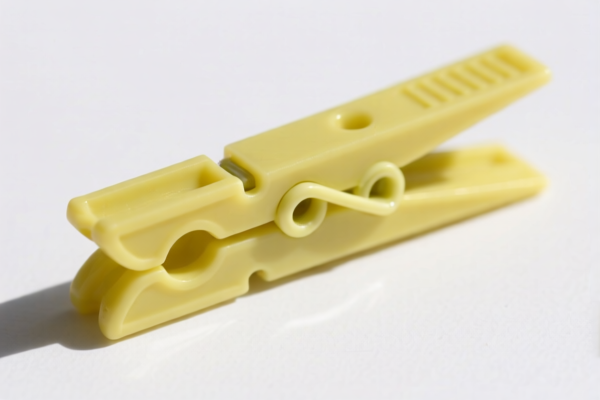

Product Classification: Premium Wood Clothes Pins

HS CODE: 4421.99.80.27, 4421.99.80.30, 4421.99.85.00, 4421.99.80.33

🔍 Classification Summary

- HS Code 4421.99.80.27: Spring-type wooden clothes pins (other types)

- HS Code 4421.99.80.30: Spring-type wooden clothes pins with value > $1.35 but ≤ $1.70 per unit

- HS Code 4421.99.85.00: Other types of wooden clothes pins (not spring-type)

- HS Code 4421.99.80.33: Spring-type wooden clothes pins with value > $1.70 per unit

📊 Tariff Overview

1. Base Tariff Rates

- 4421.99.80.27, 4421.99.80.30, 4421.99.80.33:

- Base Tariff: 6.5¢ per gross (i.e., per 144 units)

- 4421.99.85.00:

- Base Tariff: 4.8%

2. Additional Tariffs (April 11, 2025 onwards)

- All codes:

- Additional Tariff: 30.0% (applies to all four HS codes)

- Note: This is a time-sensitive policy and will be in effect after April 11, 2025.

3. Anti-dumping duties

- Not applicable for wooden clothes pins (not iron or aluminum products).

⚠️ Important Notes and Alerts

- April 11, 2025 Tariff Increase:

- A 30% additional tariff will be applied to all four HS codes after April 11, 2025.

- This could significantly increase the total cost of importation.

- Value-based classification:

- HS codes 4421.99.80.30 and 4421.99.80.33 are value-dependent.

- Ensure the unit price of your product is accurately calculated to avoid misclassification.

- Material and Certification:

- Confirm the material is wood and not mixed with other materials (e.g., metal).

- Check if certifications (e.g., FSC, CE, etc.) are required for import or sale in the destination market.

✅ Proactive Advice

- Verify the product's unit price to determine the correct HS code.

- Check the material composition to ensure it is purely wooden.

- Review the customs documentation and prepare for the 30% additional tariff after April 11, 2025.

- Consult a customs broker or trade compliance expert for accurate classification and duty calculation.

Let me know if you need help with duty calculation examples or certification requirements.

Product Classification: Premium Wood Clothes Pins

HS CODE: 4421.99.80.27, 4421.99.80.30, 4421.99.85.00, 4421.99.80.33

🔍 Classification Summary

- HS Code 4421.99.80.27: Spring-type wooden clothes pins (other types)

- HS Code 4421.99.80.30: Spring-type wooden clothes pins with value > $1.35 but ≤ $1.70 per unit

- HS Code 4421.99.85.00: Other types of wooden clothes pins (not spring-type)

- HS Code 4421.99.80.33: Spring-type wooden clothes pins with value > $1.70 per unit

📊 Tariff Overview

1. Base Tariff Rates

- 4421.99.80.27, 4421.99.80.30, 4421.99.80.33:

- Base Tariff: 6.5¢ per gross (i.e., per 144 units)

- 4421.99.85.00:

- Base Tariff: 4.8%

2. Additional Tariffs (April 11, 2025 onwards)

- All codes:

- Additional Tariff: 30.0% (applies to all four HS codes)

- Note: This is a time-sensitive policy and will be in effect after April 11, 2025.

3. Anti-dumping duties

- Not applicable for wooden clothes pins (not iron or aluminum products).

⚠️ Important Notes and Alerts

- April 11, 2025 Tariff Increase:

- A 30% additional tariff will be applied to all four HS codes after April 11, 2025.

- This could significantly increase the total cost of importation.

- Value-based classification:

- HS codes 4421.99.80.30 and 4421.99.80.33 are value-dependent.

- Ensure the unit price of your product is accurately calculated to avoid misclassification.

- Material and Certification:

- Confirm the material is wood and not mixed with other materials (e.g., metal).

- Check if certifications (e.g., FSC, CE, etc.) are required for import or sale in the destination market.

✅ Proactive Advice

- Verify the product's unit price to determine the correct HS code.

- Check the material composition to ensure it is purely wooden.

- Review the customs documentation and prepare for the 30% additional tariff after April 11, 2025.

- Consult a customs broker or trade compliance expert for accurate classification and duty calculation.

Let me know if you need help with duty calculation examples or certification requirements.

Customer Reviews

No reviews yet.