| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3901400000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901905501 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901400000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901400000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901905501 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901400000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3905911000 | Doc | 59.0% | CN | US | 2025-05-12 |

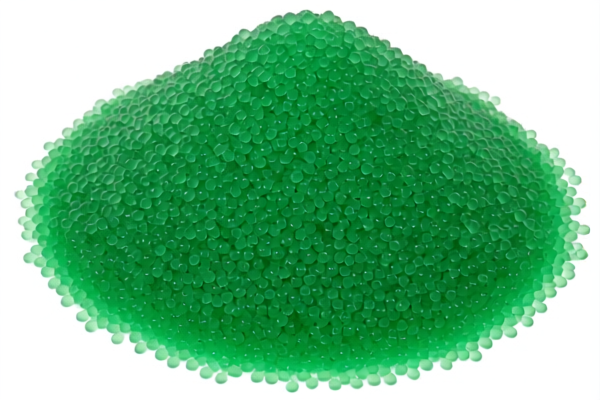

Product Name: Primary Ethylene Alpha Olefin Copolymer Resin

Classification: Based on the provided HS codes and descriptions, the product falls under Chapter 39 (Plastics and articles thereof), specifically Heading 3901 (Plastics, primary shapes of plastics, of polyethylene) and Heading 3905 (Plastics, primary shapes of plastics, of other polyolefins).

✅ HS CODES AND TAX DETAILS

1. HS Code: 3901400000

Description:

- Ethylene-α-olefin copolymer resin with specific gravity less than 0.94

- Ethylene-α-olefin copolymer particles

- Ethylene-α-olefin copolymer film

- Ethylene-hexene copolymer resin

Tariff Summary:

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

2. HS Code: 3901905501

Description:

- Ethylene-α-olefin copolymer

- Ethylene copolymer resin

Tariff Summary:

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

3. HS Code: 3905911000

Description:

- Vinyl copolymer resin (other polyolefins)

Tariff Summary:

- Total Tax Rate: 59.0%

- Breakdown:

- Base Tariff: 4.0%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

⚠️ Important Notes and Alerts

-

April 2, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 2, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning. -

No Anti-Dumping Duties Mentioned:

As of now, there are no specific anti-dumping duties listed for this product category (e.g., on iron or aluminum). However, always verify with the latest customs updates or consult a customs broker for confirmation.

📌 Proactive Advice for Importers

-

Verify Material Specifications:

Ensure the product is correctly classified based on its chemical composition, specific gravity, and physical form (e.g., film, particles, resin). -

Check Unit Price and Certification Requirements:

Confirm whether certifications (e.g., REACH, RoHS, or other local regulations) are required for importation. -

Monitor Tariff Updates:

Keep track of tariff changes after April 2, 2025, as they may significantly impact the total import cost. -

Consult a Customs Broker:

For complex or high-value shipments, it is advisable to seek professional customs compliance assistance to avoid delays or penalties.

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools.

Product Name: Primary Ethylene Alpha Olefin Copolymer Resin

Classification: Based on the provided HS codes and descriptions, the product falls under Chapter 39 (Plastics and articles thereof), specifically Heading 3901 (Plastics, primary shapes of plastics, of polyethylene) and Heading 3905 (Plastics, primary shapes of plastics, of other polyolefins).

✅ HS CODES AND TAX DETAILS

1. HS Code: 3901400000

Description:

- Ethylene-α-olefin copolymer resin with specific gravity less than 0.94

- Ethylene-α-olefin copolymer particles

- Ethylene-α-olefin copolymer film

- Ethylene-hexene copolymer resin

Tariff Summary:

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

2. HS Code: 3901905501

Description:

- Ethylene-α-olefin copolymer

- Ethylene copolymer resin

Tariff Summary:

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

3. HS Code: 3905911000

Description:

- Vinyl copolymer resin (other polyolefins)

Tariff Summary:

- Total Tax Rate: 59.0%

- Breakdown:

- Base Tariff: 4.0%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

⚠️ Important Notes and Alerts

-

April 2, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 2, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning. -

No Anti-Dumping Duties Mentioned:

As of now, there are no specific anti-dumping duties listed for this product category (e.g., on iron or aluminum). However, always verify with the latest customs updates or consult a customs broker for confirmation.

📌 Proactive Advice for Importers

-

Verify Material Specifications:

Ensure the product is correctly classified based on its chemical composition, specific gravity, and physical form (e.g., film, particles, resin). -

Check Unit Price and Certification Requirements:

Confirm whether certifications (e.g., REACH, RoHS, or other local regulations) are required for importation. -

Monitor Tariff Updates:

Keep track of tariff changes after April 2, 2025, as they may significantly impact the total import cost. -

Consult a Customs Broker:

For complex or high-value shipments, it is advisable to seek professional customs compliance assistance to avoid delays or penalties.

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools.

Customer Reviews

No reviews yet.