| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920200015 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3926400010 | Doc | 35.3% | CN | US | 2025-05-12 |

| 3920200020 | Doc | 59.2% | CN | US | 2025-05-12 |

| 5515290090 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5808900010 | Doc | 58.9% | CN | US | 2025-05-12 |

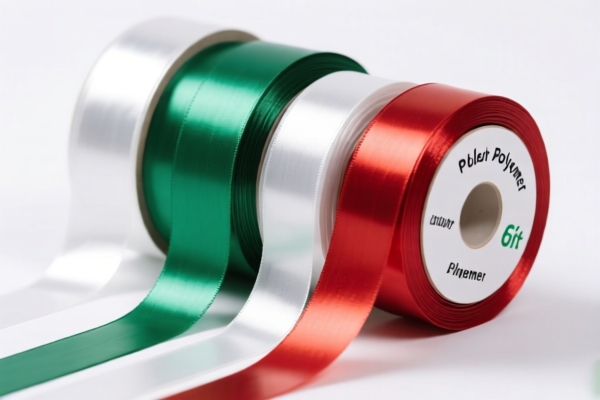

Here is the structured classification and tax information for the Propylene Polymer Gift Wrapping Ribbon and related products, based on the provided HS codes and tariff details:

✅ HS CODE: 3920200015

Product Name: 聚丙烯装饰包装丝带 (Polypropylene Decorative Packaging Ribbon)

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code applies to polypropylene decorative ribbons.

- High total tax rate due to multiple layers of tariffs.

- Proactive Advice: Confirm the exact material composition and whether it's considered a decorative or functional item.

✅ HS CODE: 3926400010

Product Name: 礼品包装丝带 (Gift Packaging Ribbon)

- Base Tariff Rate: 5.3%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 35.3%

- Key Notes:

- This code is for general gift packaging ribbons, not specifically polypropylene.

- No additional tariff currently, but a 30% special tariff will apply after April 11, 2025.

- Proactive Advice: Verify if the product is made of polypropylene or another material to ensure correct classification.

✅ HS CODE: 3920200020

Product Name: 丙烯塑料礼品包装膜 (Propylene Plastic Gift Packaging Film)

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code applies to propylene plastic packaging film, not ribbon.

- Similar to 3920200015, with the same tax structure.

- Proactive Advice: Ensure the product is not misclassified as a ribbon if it is actually a film.

✅ HS CODE: 5515290090

Product Name: 丙烯纤维无纺布礼品包装 (Propylene Fiber Nonwoven Gift Packaging)

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Key Notes:

- This code applies to nonwoven fabric made from propylene fibers.

- No base tariff, but high additional and special tariffs.

- Proactive Advice: Confirm the fiber content and whether it's considered a textile or plastic product.

✅ HS CODE: 5808900010

Product Name: 丙烯编织装饰带 (Propylene Woven Decorative Band)

- Base Tariff Rate: 3.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.9%

- Key Notes:

- This code applies to woven decorative bands made from propylene.

- High total tax rate due to additional and special tariffs.

- Proactive Advice: Confirm the weaving method and intended use (decorative vs. functional).

📌 Important Reminders:

- April 11, 2025 Special Tariff: All listed products will be subject to an additional 30% tariff after this date.

- Material Verification: Ensure the product is correctly classified based on material (e.g., polypropylene vs. propylene fiber).

- Certifications: Check if any certifications (e.g., REACH, RoHS) are required for import.

- Unit Price: Verify the unit price and total value for accurate customs valuation.

Let me know if you need help with classification based on product specifications or documentation. Here is the structured classification and tax information for the Propylene Polymer Gift Wrapping Ribbon and related products, based on the provided HS codes and tariff details:

✅ HS CODE: 3920200015

Product Name: 聚丙烯装饰包装丝带 (Polypropylene Decorative Packaging Ribbon)

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code applies to polypropylene decorative ribbons.

- High total tax rate due to multiple layers of tariffs.

- Proactive Advice: Confirm the exact material composition and whether it's considered a decorative or functional item.

✅ HS CODE: 3926400010

Product Name: 礼品包装丝带 (Gift Packaging Ribbon)

- Base Tariff Rate: 5.3%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 35.3%

- Key Notes:

- This code is for general gift packaging ribbons, not specifically polypropylene.

- No additional tariff currently, but a 30% special tariff will apply after April 11, 2025.

- Proactive Advice: Verify if the product is made of polypropylene or another material to ensure correct classification.

✅ HS CODE: 3920200020

Product Name: 丙烯塑料礼品包装膜 (Propylene Plastic Gift Packaging Film)

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code applies to propylene plastic packaging film, not ribbon.

- Similar to 3920200015, with the same tax structure.

- Proactive Advice: Ensure the product is not misclassified as a ribbon if it is actually a film.

✅ HS CODE: 5515290090

Product Name: 丙烯纤维无纺布礼品包装 (Propylene Fiber Nonwoven Gift Packaging)

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Key Notes:

- This code applies to nonwoven fabric made from propylene fibers.

- No base tariff, but high additional and special tariffs.

- Proactive Advice: Confirm the fiber content and whether it's considered a textile or plastic product.

✅ HS CODE: 5808900010

Product Name: 丙烯编织装饰带 (Propylene Woven Decorative Band)

- Base Tariff Rate: 3.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.9%

- Key Notes:

- This code applies to woven decorative bands made from propylene.

- High total tax rate due to additional and special tariffs.

- Proactive Advice: Confirm the weaving method and intended use (decorative vs. functional).

📌 Important Reminders:

- April 11, 2025 Special Tariff: All listed products will be subject to an additional 30% tariff after this date.

- Material Verification: Ensure the product is correctly classified based on material (e.g., polypropylene vs. propylene fiber).

- Certifications: Check if any certifications (e.g., REACH, RoHS) are required for import.

- Unit Price: Verify the unit price and total value for accurate customs valuation.

Let me know if you need help with classification based on product specifications or documentation.

Customer Reviews

No reviews yet.