Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5503400000 | Doc | 59.3% | CN | US | 2025-05-12 |

| 5402499140 | Doc | 63.0% | CN | US | 2025-05-12 |

| 5607491000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 5607493000 | Doc | 58.6% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

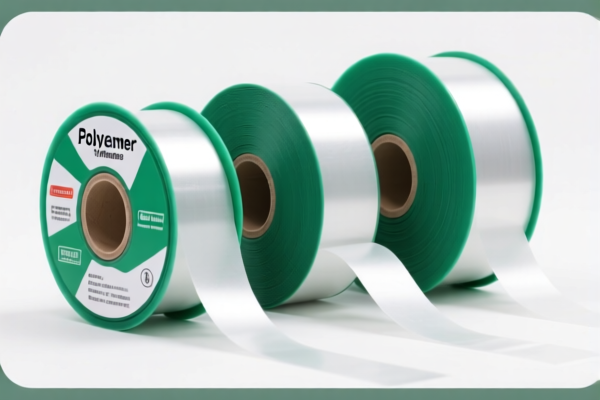

Product Name: Propylene Polymer Ribbon Rolls for Packaging

Classification Analysis and Customs Compliance Guidance:

✅ HS CODE: 5607491000

Description: Ropes, cords, cables, and ropes made of polypropylene

Total Tax Rate: 57.7%

🔍 Tax Breakdown:

- Base Tariff Rate: 2.7%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (product is polypropylene, not metal)

⏱️ Time-sensitive Policy Alert:

- April 2, 2025 Special Tariff: A 30.0% additional tariff will be imposed on this product after April 2, 2025.

- This is a critical date for customs clearance and cost estimation.

📌 Proactive Advice:

- Verify Material Composition: Ensure the product is 100% polypropylene and not blended with other materials (e.g., polyethylene), as this may affect classification.

- Check Unit Price and Packaging: Confirm whether the product is sold in bulk or retail packaging, as this may influence the applicable HS code.

- Certifications Required: Some countries may require material safety certifications or environmental compliance documents for imported polymer products.

- Consult with Customs Broker: For accurate classification and to avoid delays, it is recommended to work with a customs broker familiar with polymer-based packaging materials.

📌 Alternative HS Codes (for reference):

- 5503400000 – Synthetic short fibers, for spinning (e.g., polypropylene fibers)

- 5402499140 – Synthetic filament yarns (e.g., polyester or polypropylene)

- 3920995000 – Plastic sheets, films, etc. (if the ribbon is considered a film or sheet)

Note: If the product is woven or processed into a fabric-like structure, it may fall under 5503400000 or 5402499140 instead of 5607491000.

📌 Summary:

- Recommended HS Code: 5607491000

- Total Tax Rate: 57.7% (2.7% base + 25% general + 30% after April 2, 2025)

- Action Required: Confirm product composition, packaging, and compliance documents before import.

Product Name: Propylene Polymer Ribbon Rolls for Packaging

Classification Analysis and Customs Compliance Guidance:

✅ HS CODE: 5607491000

Description: Ropes, cords, cables, and ropes made of polypropylene

Total Tax Rate: 57.7%

🔍 Tax Breakdown:

- Base Tariff Rate: 2.7%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (product is polypropylene, not metal)

⏱️ Time-sensitive Policy Alert:

- April 2, 2025 Special Tariff: A 30.0% additional tariff will be imposed on this product after April 2, 2025.

- This is a critical date for customs clearance and cost estimation.

📌 Proactive Advice:

- Verify Material Composition: Ensure the product is 100% polypropylene and not blended with other materials (e.g., polyethylene), as this may affect classification.

- Check Unit Price and Packaging: Confirm whether the product is sold in bulk or retail packaging, as this may influence the applicable HS code.

- Certifications Required: Some countries may require material safety certifications or environmental compliance documents for imported polymer products.

- Consult with Customs Broker: For accurate classification and to avoid delays, it is recommended to work with a customs broker familiar with polymer-based packaging materials.

📌 Alternative HS Codes (for reference):

- 5503400000 – Synthetic short fibers, for spinning (e.g., polypropylene fibers)

- 5402499140 – Synthetic filament yarns (e.g., polyester or polypropylene)

- 3920995000 – Plastic sheets, films, etc. (if the ribbon is considered a film or sheet)

Note: If the product is woven or processed into a fabric-like structure, it may fall under 5503400000 or 5402499140 instead of 5607491000.

📌 Summary:

- Recommended HS Code: 5607491000

- Total Tax Rate: 57.7% (2.7% base + 25% general + 30% after April 2, 2025)

- Action Required: Confirm product composition, packaging, and compliance documents before import.

Customer Reviews

No reviews yet.