| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8212100000 | Doc | 37.5% | CN | US | 2025-05-12 |

| 7326903500 | Doc | 87.8% | CN | US | 2025-05-12 |

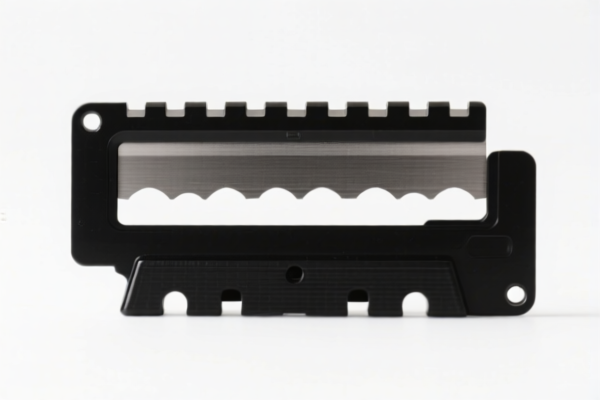

Razor Holder HS Code Classification & Duty Analysis

Based on the provided information, you have two potential HS codes for your "Razor Holder" declaration. Let's break down each one and what it means for your import process.

Important Note: The correct HS code is crucial for accurate duty calculation and smooth customs clearance. The final determination depends on the exact composition and function of your product.

1. HS Code: 8212.10.00.00 – Razors and Razor Blades

- Chapter 82: Metalworking tools, including hand tools. This chapter covers a wide range of tools used for shaping, cutting, or treating metal.

- 8212: Razors and razor blades, including razor blade blanks in strips, and base metal parts thereof. This specifically focuses on items used for shaving.

- 8212.10: Razors. This narrows it down to the actual razor instruments themselves.

- 8212.10.00.00: This is the most specific code, covering all types of razors.

Duty Information:

- Basic Duty: 0.0%

- Additional Duty: 7.5% (Currently)

- Additional Duty (Post April 2, 2025): 30%

- Total Duty: 37.5% (Currently)

Considerations:

- Product Definition: This code is most appropriate if your "Razor Holder" is the actual razor instrument used for shaving (disposable or reusable).

- Material: The material composition of the razor is important. While this code doesn't specify material restrictions, it's good to be aware of potential implications.

- Parts: If the razor holder includes significant non-metal parts, this code might not be the best fit.

2. HS Code: 7326.90.35.00 – Other articles of iron or steel

- Chapter 73: Iron or steel articles. This chapter covers a broad range of products made from iron or steel.

- 7326: Other articles of iron or steel. This is a catch-all category for items not specifically classified elsewhere in Chapter 73.

- 7326.90: Other. This further narrows down the category.

- 7326.90.35.00: Containers of a kind normally carried on the person, in the pocket or in the handbag. This code is for small containers typically used for personal items.

Duty Information:

- Basic Duty: 7.8%

- Additional Duty: 25.0% (Currently)

- Additional Duty (Post April 2, 2025): 30% (Steel and Aluminum products)

- Total Duty: 87.8% (Currently)

Considerations:

- Product Definition: This code is more appropriate if your "Razor Holder" is a container designed to hold razors, rather than the razor itself. Think of a case, pouch, or stand.

- Material: The material is very important here. The 25% (or 30% post April 2, 2025) additional duty specifically applies to steel and aluminum products. If your container is made of plastic or another material, the duty rate might be different.

- Function: Is the primary function of the item to contain the razor, or be the razor?

Recommendations:

- Clarify Product Definition: Precisely define what your "Razor Holder" is. Is it the shaving instrument itself, or a container for it?

- Material Verification: Confirm the exact material composition of your product. This is critical for accurate duty calculation.

- Consider Certification: Depending on the material and intended use, you may need to provide certifications (e.g., material safety data sheets, compliance reports).

- Consult with a Customs Broker: For complex cases or if you are unsure about the correct HS code, it is highly recommended to consult with a licensed customs broker. They can provide expert guidance and ensure compliance with all relevant regulations.

- Prepare for April 2, 2025: Be aware of the upcoming duty changes and factor them into your cost calculations.

Disclaimer: This information is for general guidance only and does not constitute professional customs advice. Duty rates and regulations are subject to change. Always verify the latest information with the relevant customs authorities or a licensed customs broker.

Customer Reviews

The HS Code explanation was spot-on. I’m glad I came across this page before submitting my import documentation.

I found the export guidelines for the US very helpful. The page is well-organized and easy to read.

The tariff details for plastic doors are clear and precise. Definitely saved me time researching.

Useful data on HS Code 3925, but I wish there were more examples of similar products for comparison.

Detailed and accurate information about the US import tariffs. Perfect for someone new to international trade.