| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

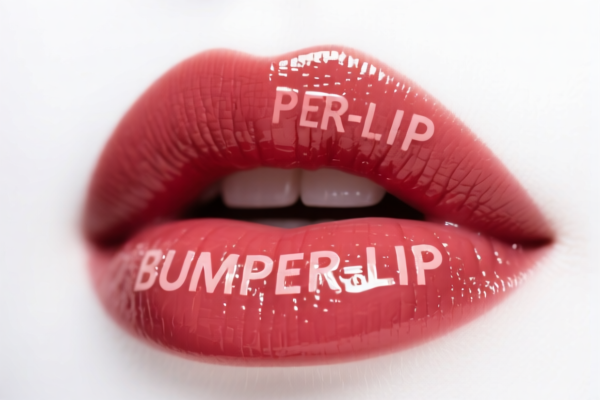

Okay, let's break down the classification and potential import considerations for these items, focusing on the "REAR BUMPER LIP" declaration. Here's a structured analysis, aiming for clarity and actionable advice:

Overall Approach: We'll examine each item provided, determine the most likely HS Code, and highlight key considerations for import. Since you've declared "REAR BUMPER LIP", we'll prioritize that classification.

Item 1: Parts and accessories of motor vehicles (headings 8701 to 8705): Bumpers and parts thereof

- Description: Parts and accessories of the motor vehicles of headings 8701 to 8705: Bumpers and parts thereof: Bumpers and parts thereof: Of tractors suitable for agricultural use

- HS Code: (Currently blank - this is where we need to focus)

- Breakdown of HS Code Structure (First 6 digits are crucial):

- 87: Vehicles and parts thereof. This is the broad category.

- 01-05: Specifies the type of vehicle (e.g., motor cars, buses, trucks). Since it's a "part", we're within this range.

- Further Digits: Refine the part type. Bumpers fall under this section.

- Potential HS Codes & Considerations:

- 8716.90.00.00: Parts and accessories of vehicles of heading 8711 (cycles, motor cycles, mopeds). This is a possibility if the bumper lip is for a motorcycle.

- 8716.80.00.00: Bumpers and anti-roll bars for vehicles of heading 8701 to 8705. This is the most likely HS Code for a rear bumper lip intended for a standard car, truck, or bus.

- Important Notes:

- Vehicle Type: Crucially, you must confirm the exact vehicle type the bumper lip is designed for. The HS Code changes based on whether it's for a car, truck, agricultural tractor, etc.

- Material: The material of the bumper lip (plastic, metal, carbon fiber) can influence the specific sub-classification within 8716.

- Function: Is it purely cosmetic, or does it provide structural protection?

Item 2: Fittings for furniture, coachwork or the like: Handles and knobs

- Description: Other articles of plastics and articles of other materials of headings 3901 to 3914: Fittings for furniture, coachwork or the like: Handles and knobs

- HS Code: 3926.30.00

- Breakdown of HS Code Structure:

- 39: Plastics and articles thereof.

- 26: Plastics, non-refractory.

- 30: Fittings for furniture, coachwork or the like.

- Notes: This HS Code is unlikely to be correct for a rear bumper lip. It's more suited for small plastic components like handles or knobs. It appears to be a misclassification.

Item 3: Other articles of plastics and articles of other materials

- Description: Other articles of plastics and articles of other materials of headings 3901 to 3914: Other: Other Other

- HS Code: 3926.90.99.89

- Breakdown of HS Code Structure:

- 39: Plastics and articles thereof.

- 26: Plastics, non-refractory.

- 90: Other plastics and articles thereof.

- 99: Other

- 89: Other

- Notes: This is a very broad "catch-all" HS Code. While it could apply, it's not ideal. It suggests the item doesn't fit neatly into other categories.

- Tax Information: The listed tax rate (Base: 5.3%, Additional: 7.5%, Post 2025.4.2: 30%) is important.

Recommendations & Next Steps (Crucial for "REAR BUMPER LIP"):

- Confirm Vehicle Type: Absolutely essential. Is it for a car, truck, SUV, tractor, motorcycle?

- Material Composition: What is the bumper lip made of? (e.g., PP, ABS plastic, carbon fiber, metal).

- Functionality: Is it purely aesthetic, or does it offer impact protection?

- Re-evaluate HS Code: Based on the above, strongly consider 8716.80.00.00 (Bumpers and anti-roll bars) as the primary candidate.

- Check for Certifications: Depending on the vehicle type and destination country, you may need certifications (e.g., E-mark for European markets, DOT compliance for the US).

- Accurate Valuation: Ensure the declared value (single price) is accurate, as this impacts duty calculations.

- Consult a Customs Broker: For complex cases or high-value shipments, a customs broker can provide expert guidance and ensure compliance.

Disclaimer: I am an AI and cannot provide definitive customs classifications. This information is for guidance only. Always verify with official customs authorities or a qualified customs broker.

Customer Reviews

No reviews yet.