| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4419909100 | Doc | 40.7% | CN | US | 2025-05-12 |

| 4421918800 | Doc | 30.0% | CN | US | 2025-05-12 |

| 7323999080 | Doc | 83.4% | CN | US | 2025-05-12 |

| 3924104000 | Doc | 33.4% | CN | US | 2025-05-12 |

| 7615109100 | Doc | 65.6% | CN | US | 2025-05-12 |

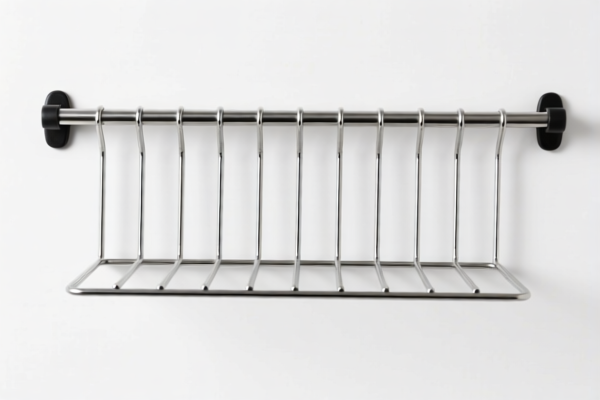

Okay, let's break down the HS codes and tax implications for your "RECIPE RACK" declaration. I'll provide a structured analysis to help you understand the classification and potential costs.

Understanding HS Codes: A Quick Primer

HS codes (Harmonized System codes) are internationally standardized codes used to classify traded products. They're crucial for determining tariffs, trade regulations, and statistical tracking. The first 6 digits are generally standardized globally, while the last digits can vary by country. Here's how to interpret them:

- Chapter (First 2 digits): Broad category of the product.

- Heading (First 4 digits): More specific grouping within the chapter.

- Subheading (First 6 digits): Further refinement of the product.

- National Code (Last digits): Country-specific classification.

Analysis of Your Declared Items

Here's a breakdown of each item, its HS code, and the associated tax implications, based on the information provided:

1. Tableware and kitchenware, of wood (HS Code: 4419.90.91.00)

- Chapter 44: Wood and articles of wood; wood charcoal.

- Heading 4419: Furniture, household articles, etc. of wood.

- Subheading 4419.90: Other.

- Tax:

- Basic Duty: 3.2%

- Additional Duty: 7.5%

- Post April 2, 2025: Additional Duty increases to 30%

- Total Tax: 40.7%

- Notes: This code covers wooden recipe racks not specifically categorized elsewhere. Please confirm the wood type. Certain wood species might have specific import restrictions.

2. Other articles of wood: Of bamboo: Canoe paddles (HS Code: 4421.91.88.00)

- Chapter 44: Wood and articles of wood; wood charcoal.

- Heading 4421: Articles of bamboo and cane.

- Subheading 4421.91: Other articles of bamboo.

- Tax:

- Basic Duty: 0.0%

- Additional Duty: 0.0%

- Post April 2, 2025: Additional Duty increases to 30%

- Total Tax: 30.0%

- Notes: This code is specifically for bamboo recipe racks. Ensure the material is genuinely bamboo.

3. Table, kitchen or other household articles and parts thereof, of iron or steel (HS Code: 7323.99.90.80)

- Chapter 73: Articles of iron or steel.

- Heading 7323: Table, kitchen or other household articles and parts thereof.

- Subheading 7323.99: Other.

- Tax:

- Basic Duty: 3.4%

- Additional Duty: 25.0%

- Post April 2, 2025: Additional Duty increases to 30%

- Total Tax: 83.4%

- Notes: This code covers iron or steel recipe racks. The high tax rate is due to the additional duty on steel products. Please confirm the exact steel alloy used.

4. Tableware, kitchenware, other household articles and hygienic or toilet articles, of plastics (HS Code: 3924.10.40.00)

- Chapter 39: Plastics and articles thereof.

- Heading 3924: Tableware, kitchenware, other household articles and hygienic or toilet articles.

- Subheading 3924.10: Tableware and kitchenware.

- Tax:

- Basic Duty: 3.4%

- Additional Duty: 0.0%

- Post April 2, 2025: Additional Duty increases to 30%

- Total Tax: 33.4%

- Notes: This code is for plastic recipe racks. Confirm the type of plastic used, as some plastics may have specific regulations.

5. Table, kitchen or other household articles and parts thereof, of aluminum (HS Code: 7615.10.91.00)

- Chapter 76: Aluminum and articles thereof.

- Heading 7615: Table, kitchen or other household articles and parts thereof.

- Subheading 7615.10: Table, kitchen or other household articles and parts thereof.

- Tax:

- Basic Duty: 3.1%

- Additional Duty: 7.5%

- Post April 2, 2025: Additional Duty increases to 30%

- Total Tax: 65.6%

- Notes: This code is for aluminum recipe racks. The additional duty applies to steel and aluminum products. Please confirm the exact aluminum alloy used.

Important Reminders & Recommendations:

- Material Verification: Crucially, double-check the exact materials used in each recipe rack. The HS code and tax rate are heavily dependent on the material composition.

- Single Declaration: If you are importing multiple types of recipe racks, consider whether they can be declared under a single HS code if they share similar materials and functionality.

- Valuation: Ensure accurate valuation of your goods. Customs will assess duties based on the declared value.

- Certifications: Depending on the material and intended use, you may need certifications (e.g., food safety certifications for plastic racks).

- Post-April 2, 2025 Duties: Be aware of the significant duty increases coming into effect on April 2, 2025. Plan your imports accordingly.

- Country of Origin: Confirm the country of origin for each item, as this can affect trade agreements and duties.

Disclaimer: I am an AI assistant and this information is for general guidance only. Customs regulations are complex and subject to change. It is highly recommended to consult with a licensed customs broker or import specialist for accurate and up-to-date advice tailored to your specific situation.

Customer Reviews

No reviews yet.