| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919901000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 5609004000 | Doc | 58.9% | CN | US | 2025-05-12 |

| 5404198080 | Doc | 61.9% | CN | US | 2025-05-12 |

| 5405003000 | Doc | 61.9% | CN | US | 2025-05-12 |

| 5405006000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 5807100510 | Doc | 62.9% | CN | US | 2025-05-12 |

| 5807100520 | Doc | 62.9% | CN | US | 2025-05-12 |

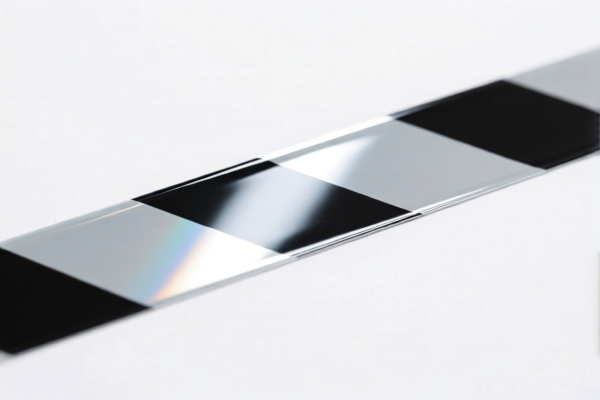

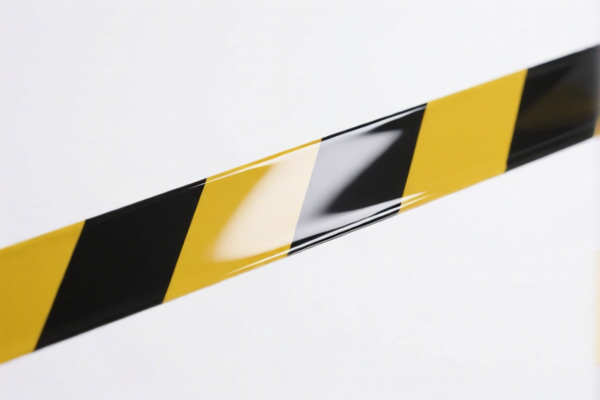

REFLECTIVE STRIP HS Code Classification & Tax Guide

This document provides a detailed breakdown of the HS codes associated with "REFLECTIVE STRIP" based on the provided information, along with corresponding tax details. It's crucial to select the most accurate HS code to ensure proper customs clearance and avoid potential delays or penalties.

Understanding HS Codes:

HS (Harmonized System) codes are internationally standardized product codes used to classify traded products. The first two digits generally indicate the chapter, the next two the subheading, and further digits provide more specific classifications.

Here's a breakdown of each HS code provided, with explanations and important considerations:

1. 3919.90.10.00 – Plastics, self-adhesive, in strips with light-reflecting surface (glass beads)

- 39: Plastics and articles thereof.

- 19: Plates, sheets, film, foil, tape, strip and the like.

- 90: Other (specifically referring to plastics in this category).

- 10.00: Specifically for plastics with a light-reflecting surface produced by glass grains (ballotini).

- Tax: Base Tariff: 6.5%, Additional Tariff: 25.0%, Total Tariff: 61.5% (Note: Additional tariff increases to 30% after April 2, 2025).

- Considerations: This code is suitable for reflective strips made primarily of plastic and utilizing glass beads for reflectivity. Please confirm the exact plastic composition and the method of reflectivity.

2. 5609.00.40.00 – Yarn, strip, cordage, rope or cables, not elsewhere specified (Other)

- 56: Textile fibres and their waste; textile fabrics.

- 09: Articles of yarn, strip or the like.

- 00: Other.

- 40.00: Specifically for items not elsewhere specified.

- Tax: Base Tariff: 3.9%, Additional Tariff: 25.0%, Total Tariff: 58.9% (Note: Additional tariff increases to 30% after April 2, 2025).

- Considerations: This code applies to reflective strips made from woven or knitted yarns or strips. Verify the material composition (natural or synthetic) and construction method.

3. 5404.19.80.80 – Synthetic monofilament, strip (Other)

- 54: Textile fibres.

- 04: Synthetic monofilament of <67 decitex>.

- 19: Other.

- 80.80: Specifically for strip and the like.

- Tax: Base Tariff: 6.9%, Additional Tariff: 25.0%, Total Tariff: 61.9% (Note: Additional tariff increases to 30% after April 2, 2025).

- Considerations: This code is for synthetic monofilament strips. Confirm the decitex value (must be <67) and the specific synthetic material.

4. 5405.00.30.00 – Artificial monofilament

- 54: Textile fibres.

- 05: Artificial monofilament of <67 decitex>.

- 00: Other.

- 30.00: Specifically for monofilament.

- Tax: Base Tariff: 6.9%, Additional Tariff: 25.0%, Total Tariff: 61.9% (Note: Additional tariff increases to 30% after April 2, 2025).

- Considerations: This code is for artificial monofilament strips. Confirm the decitex value (must be <67).

5. 5405.00.60.00 – Artificial monofilament (Other)

- 54: Textile fibres.

- 05: Artificial monofilament of <67 decitex>.

- 00: Other.

- 60.00: Specifically for other.

- Tax: Base Tariff: 5.8%, Additional Tariff: 25.0%, Total Tariff: 60.8% (Note: Additional tariff increases to 30% after April 2, 2025).

- Considerations: This code is for artificial monofilament strips. Confirm the decitex value (must be <67).

6. 5807.10.05.10 – Labels, badges, woven, cotton

- 58: Textile fabrics.

- 07: Labels, badges, etc.

- 10: Woven.

- 05.10: Specifically for cotton labels.

- Tax: Base Tariff: 7.9%, Additional Tariff: 25.0%, Total Tariff: 62.9% (Note: Additional tariff increases to 30% after April 2, 2025).

- Considerations: This code applies to woven labels made of cotton. Confirm the material composition.

7. 5807.10.05.20 – Labels, badges, woven, man-made fibers

- 58: Textile fabrics.

- 07: Labels, badges, etc.

- 10: Woven.

- 05.20: Specifically for man-made fiber labels.

- Tax: Base Tariff: 7.9%, Additional Tariff: 25.0%, Total Tariff: 62.9% (Note: Additional tariff increases to 30% after April 2, 2025).

- Considerations: This code applies to woven labels made of man-made fibers. Confirm the material composition.

Important Reminders & Recommendations:

- Material Composition: The exact material composition (e.g., specific type of plastic, synthetic fiber, cotton blend) is crucial for accurate classification.

- Construction Method: How the strip is made (woven, knitted, extruded, coated) significantly impacts the HS code.

- Decitex Value: For monofilament strips, confirm the decitex value.

- Reflectivity Method: How is the reflectivity achieved? (Glass beads, reflective coating, etc.)

- Certifications: Depending on the intended use of the reflective strips (e.g., safety applications), specific certifications (e.g., EN ISO 20471) may be required.

- Single Invoice: Ensure the single invoice clearly states the material composition, construction method, and intended use of the goods.

- April 2, 2025 Tariff Changes: Be aware of the upcoming tariff changes on April 2, 2025, and factor them into your cost calculations.

Disclaimer: This information is for general guidance only and does not constitute professional customs advice. It is recommended to consult with a licensed customs broker or relevant authority for specific classification and compliance requirements.

Customer Reviews

No reviews yet.