| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3904610010 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3904610090 | Doc | 60.8% | CN | US | 2025-05-12 |

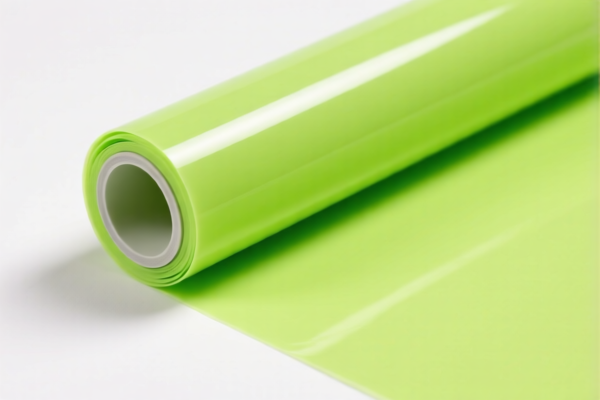

Product Classification: Raw Material for Fluoropolymer Films

HS CODE:

- 3904610010: Granular raw material for polytetrafluoroethylene (PTFE)

- 3904610090: Other forms of raw material for polytetrafluoroethylene (PTFE), including for fluoropolymer films

🔍 Key Tax Rate Breakdown

Both HS codes share the same tax structure:

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 2, 2025): 30.0%

- Total Tax Rate: 60.8%

⏰ Time-Sensitive Policy Alert

- April 2, 2025: Additional tariffs increase from 25.0% to 30.0%.

- This is a critical date for customs clearance and cost estimation.

- If your import is scheduled after this date, the total tax rate will increase by 5 percentage points.

🛑 Anti-Dumping Duties

- Not applicable for fluoropolymer raw materials (PTFE) under these HS codes.

- However, if the product contains iron or aluminum components, check for specific anti-dumping duties applicable to those materials.

📌 Proactive Advice for Importers

- Verify Material Specifications: Confirm whether the raw material is in granular form (HS 3904610010) or other forms (HS 3904610090).

- Check Unit Price and Packaging: Tariff rates may vary based on product form and packaging.

- Certifications Required: Ensure compliance with any technical regulations or certifications (e.g., REACH, RoHS, or industry-specific standards).

- Monitor Tariff Updates: Stay informed about any changes in import policies, especially around the April 2, 2025 deadline.

Let me know if you need help with customs documentation or tariff calculation tools.

Product Classification: Raw Material for Fluoropolymer Films

HS CODE:

- 3904610010: Granular raw material for polytetrafluoroethylene (PTFE)

- 3904610090: Other forms of raw material for polytetrafluoroethylene (PTFE), including for fluoropolymer films

🔍 Key Tax Rate Breakdown

Both HS codes share the same tax structure:

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 2, 2025): 30.0%

- Total Tax Rate: 60.8%

⏰ Time-Sensitive Policy Alert

- April 2, 2025: Additional tariffs increase from 25.0% to 30.0%.

- This is a critical date for customs clearance and cost estimation.

- If your import is scheduled after this date, the total tax rate will increase by 5 percentage points.

🛑 Anti-Dumping Duties

- Not applicable for fluoropolymer raw materials (PTFE) under these HS codes.

- However, if the product contains iron or aluminum components, check for specific anti-dumping duties applicable to those materials.

📌 Proactive Advice for Importers

- Verify Material Specifications: Confirm whether the raw material is in granular form (HS 3904610010) or other forms (HS 3904610090).

- Check Unit Price and Packaging: Tariff rates may vary based on product form and packaging.

- Certifications Required: Ensure compliance with any technical regulations or certifications (e.g., REACH, RoHS, or industry-specific standards).

- Monitor Tariff Updates: Stay informed about any changes in import policies, especially around the April 2, 2025 deadline.

Let me know if you need help with customs documentation or tariff calculation tools.

Customer Reviews

No reviews yet.