| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919901000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3919101050 | Doc | 61.5% | CN | US | 2025-05-12 |

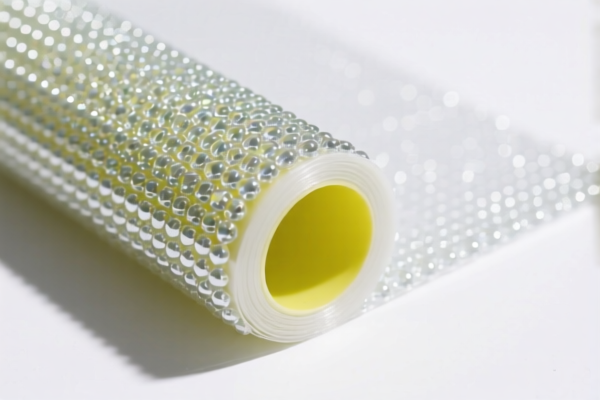

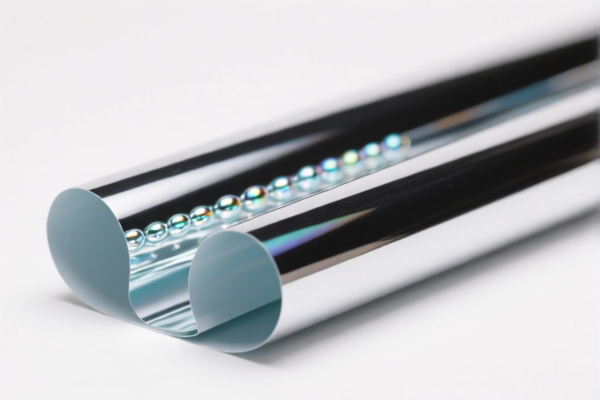

Product Name: Reflective Glass Bead Plastic Safety Film

Classification HS Code:

- 3919901000 – For self-adhesive plastic products with fully or partially reflective surfaces produced by glass beads (glass sand)

- 3919101050 – For self-adhesive plastic sheets, films, etc., with fully or partially reflective surfaces produced by glass beads

🔍 Key Classification Notes:

- Both HS codes apply to self-adhesive plastic products that use glass beads to create a reflective surface.

- The difference lies in the product form:

- 3919901000 is for general plastic products with reflective surfaces.

- 3919101050 is for plastic sheets, films, or similar forms with reflective surfaces.

📊 Tariff Overview (as of now):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.5% (6.5% + 25.0% + 30.0%)

⚠️ Important Policy Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total tax burden.

- No Anti-Dumping Duties Mentioned: No specific anti-dumping duties on iron or aluminum are currently applicable for this product category.

📌 Proactive Advice for Importers:

- Verify Product Composition: Ensure the product is self-adhesive and uses glass beads for reflection. This will determine the correct HS code.

- Check Unit Price and Material: Confirm the material composition and unit price to ensure compliance with customs regulations.

- Certifications Required: Some countries may require safety or quality certifications (e.g., CE, RoHS) for reflective safety films.

- Monitor Tariff Changes: Keep an eye on tariff updates after April 11, 2025, as this could affect your import costs significantly.

- Consult Customs Broker: For complex classifications or large shipments, consider working with a customs broker or compliance expert.

Let me know if you need help with certification requirements or customs documentation for this product.

Product Name: Reflective Glass Bead Plastic Safety Film

Classification HS Code:

- 3919901000 – For self-adhesive plastic products with fully or partially reflective surfaces produced by glass beads (glass sand)

- 3919101050 – For self-adhesive plastic sheets, films, etc., with fully or partially reflective surfaces produced by glass beads

🔍 Key Classification Notes:

- Both HS codes apply to self-adhesive plastic products that use glass beads to create a reflective surface.

- The difference lies in the product form:

- 3919901000 is for general plastic products with reflective surfaces.

- 3919101050 is for plastic sheets, films, or similar forms with reflective surfaces.

📊 Tariff Overview (as of now):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.5% (6.5% + 25.0% + 30.0%)

⚠️ Important Policy Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total tax burden.

- No Anti-Dumping Duties Mentioned: No specific anti-dumping duties on iron or aluminum are currently applicable for this product category.

📌 Proactive Advice for Importers:

- Verify Product Composition: Ensure the product is self-adhesive and uses glass beads for reflection. This will determine the correct HS code.

- Check Unit Price and Material: Confirm the material composition and unit price to ensure compliance with customs regulations.

- Certifications Required: Some countries may require safety or quality certifications (e.g., CE, RoHS) for reflective safety films.

- Monitor Tariff Changes: Keep an eye on tariff updates after April 11, 2025, as this could affect your import costs significantly.

- Consult Customs Broker: For complex classifications or large shipments, consider working with a customs broker or compliance expert.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.