| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919101050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3919101010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 4811412100 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3919102055 | Doc | 60.8% | CN | US | 2025-05-12 |

| 4811493000 | Doc | 55.0% | CN | US | 2025-05-12 |

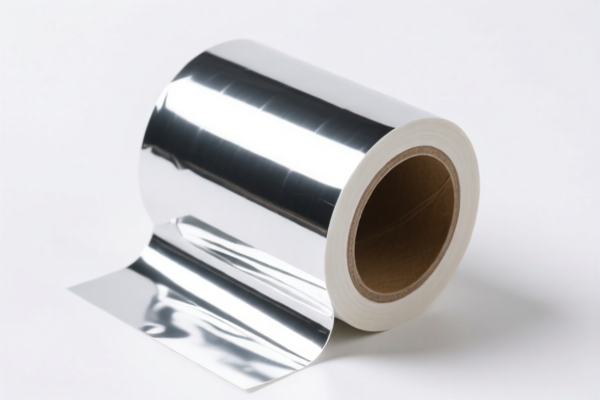

Here is the structured classification and tariff information for the Reflective Self Adhesive Label Roll Material based on the provided HS codes and tax details:

✅ HS CODE: 3919101050

Product Description: Reflective self-adhesive plastic tape roll

Total Tax Rate: 61.5%

Breakdown of Tariffs:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code is specifically for reflective self-adhesive plastic tape rolls.

- The high total tax rate is due to the combination of base and additional tariffs.

- Proactive Advice: Confirm the product is not classified under a different HS code (e.g., 3919101010) based on specific use (e.g., road marking vs. general use).

✅ HS CODE: 3919101010

Product Description: Reflective self-adhesive material (in rolls)

Total Tax Rate: 61.5%

Breakdown of Tariffs:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code applies to reflective self-adhesive materials in rolls, including road marking tape or other reflective uses.

- Proactive Advice: Ensure the product is not misclassified as a general-purpose label (e.g., under 3919102055).

✅ HS CODE: 4811412100

Product Description: Matte self-adhesive label paper roll

Total Tax Rate: 55.0%

Breakdown of Tariffs:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code is for matte self-adhesive label paper rolls.

- Proactive Advice: Confirm the material is not a plastic-based label (which would fall under 3919102055).

✅ HS CODE: 3919102055

Product Description: Plastic self-adhesive matte label roll

Total Tax Rate: 60.8%

Breakdown of Tariffs:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code is for plastic-based matte self-adhesive label rolls.

- Proactive Advice: Verify the material composition and unit price to ensure correct classification.

✅ HS CODE: 4811493000

Product Description: Self-adhesive label paper roll (general)

Total Tax Rate: 55.0%

Breakdown of Tariffs:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code is for general-purpose self-adhesive label paper rolls.

- Proactive Advice: Ensure the product is not a reflective or plastic-based label (which would fall under 3919101050 or 3919102055).

📌 Important Reminders:

- April 11, 2025 Special Tariff: All listed products will be subject to an additional 30.0% tariff after this date.

- Certifications Required: Confirm if any certifications (e.g., safety, environmental, or industry-specific) are required for import.

- Material Verification: Always verify the exact material (plastic, paper, matte, reflective) and unit price to ensure correct HS code classification.

- Tariff Calculation: Total tax = base + additional + special (if applicable).

Let me know if you need help with a specific product or customs documentation. Here is the structured classification and tariff information for the Reflective Self Adhesive Label Roll Material based on the provided HS codes and tax details:

✅ HS CODE: 3919101050

Product Description: Reflective self-adhesive plastic tape roll

Total Tax Rate: 61.5%

Breakdown of Tariffs:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code is specifically for reflective self-adhesive plastic tape rolls.

- The high total tax rate is due to the combination of base and additional tariffs.

- Proactive Advice: Confirm the product is not classified under a different HS code (e.g., 3919101010) based on specific use (e.g., road marking vs. general use).

✅ HS CODE: 3919101010

Product Description: Reflective self-adhesive material (in rolls)

Total Tax Rate: 61.5%

Breakdown of Tariffs:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code applies to reflective self-adhesive materials in rolls, including road marking tape or other reflective uses.

- Proactive Advice: Ensure the product is not misclassified as a general-purpose label (e.g., under 3919102055).

✅ HS CODE: 4811412100

Product Description: Matte self-adhesive label paper roll

Total Tax Rate: 55.0%

Breakdown of Tariffs:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code is for matte self-adhesive label paper rolls.

- Proactive Advice: Confirm the material is not a plastic-based label (which would fall under 3919102055).

✅ HS CODE: 3919102055

Product Description: Plastic self-adhesive matte label roll

Total Tax Rate: 60.8%

Breakdown of Tariffs:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code is for plastic-based matte self-adhesive label rolls.

- Proactive Advice: Verify the material composition and unit price to ensure correct classification.

✅ HS CODE: 4811493000

Product Description: Self-adhesive label paper roll (general)

Total Tax Rate: 55.0%

Breakdown of Tariffs:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code is for general-purpose self-adhesive label paper rolls.

- Proactive Advice: Ensure the product is not a reflective or plastic-based label (which would fall under 3919101050 or 3919102055).

📌 Important Reminders:

- April 11, 2025 Special Tariff: All listed products will be subject to an additional 30.0% tariff after this date.

- Certifications Required: Confirm if any certifications (e.g., safety, environmental, or industry-specific) are required for import.

- Material Verification: Always verify the exact material (plastic, paper, matte, reflective) and unit price to ensure correct HS code classification.

- Tariff Calculation: Total tax = base + additional + special (if applicable).

Let me know if you need help with a specific product or customs documentation.

Customer Reviews

No reviews yet.