| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919905010 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919101050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3919905010 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919905010 | Doc | 60.8% | CN | US | 2025-05-12 |

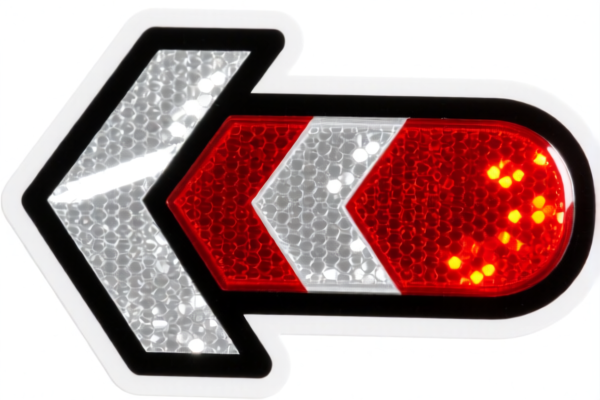

Product Classification and Tariff Analysis for "Reflectorized Plastic Reflector Sticker"

Based on the product description and the provided HS codes, the most relevant classifications and tariff details are as follows:

✅ HS CODE: 3919905010

Description:

- Reflectorized plastic stickers with the term "反光" (reflective) in the product name.

- Fits the description of "self-adhesive plates, sheets, films, tapes, strips, and other flat plastic products."

Tariff Summary:

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (not related to plastic products).

Key Notes:

- This is the most accurate classification for your product based on the description and naming.

- The April 11 Special Tariff is not applicable here, as the special tariff applies to specific categories (e.g., certain steel or aluminum products).

- No anti-dumping duties are applicable for this product category.

⚠️ Alternative HS CODE: 3919101050

Description:

- Self-adhesive plastic sheets, films, tapes, etc., with reflective surfaces made of glass beads.

- Applies to products with a width of ≤20 cm when in roll form.

Tariff Summary:

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

Key Notes:

- This code may apply if your product is in roll form and has a width ≤20 cm.

- If your product is not in roll form, this code may not be applicable.

⚠️ Alternative HS CODE: 3921905050

Description:

- Other plastic sheets, films, etc., including reflective films.

- Reflective films are considered a type of plastic film.

Tariff Summary:

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff (General): 0.0%

- Special Tariff after April 2, 2025: 30.0%

Key Notes:

- This code may be applicable if your product is classified as a plastic film rather than a self-adhesive sticker.

- The additional tariff is 0.0%, which is lower than the other options, but only if the product is correctly classified under this code.

📌 Proactive Advice for Importers:

- Verify the product form: Is it a sticker (self-adhesive) or a film (non-adhesive)? This will determine the correct HS code.

- Check the width: If the product is in roll form, ensure the width is ≤20 cm to qualify for HS code 3919101050.

- Confirm the material: Ensure the product is plastic-based and not made of metal or other materials.

- Check for certifications: Some reflective products may require safety or performance certifications (e.g., for traffic or safety use).

- Monitor the April 2, 2025, tariff change: If your product is classified under 3919905010 or 3919101050, the additional tariff will increase by 5% after this date.

✅ Recommended Action:

- If your product is a self-adhesive reflective sticker, use HS CODE 3919905010.

- If your product is a reflective film in roll form, consider HS CODE 3919101050.

- If your product is a non-adhesive reflective film, consider HS CODE 3921905050.

- Always confirm with customs or a classification expert to ensure compliance and avoid delays. Product Classification and Tariff Analysis for "Reflectorized Plastic Reflector Sticker"

Based on the product description and the provided HS codes, the most relevant classifications and tariff details are as follows:

✅ HS CODE: 3919905010

Description:

- Reflectorized plastic stickers with the term "反光" (reflective) in the product name.

- Fits the description of "self-adhesive plates, sheets, films, tapes, strips, and other flat plastic products."

Tariff Summary:

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (not related to plastic products).

Key Notes:

- This is the most accurate classification for your product based on the description and naming.

- The April 11 Special Tariff is not applicable here, as the special tariff applies to specific categories (e.g., certain steel or aluminum products).

- No anti-dumping duties are applicable for this product category.

⚠️ Alternative HS CODE: 3919101050

Description:

- Self-adhesive plastic sheets, films, tapes, etc., with reflective surfaces made of glass beads.

- Applies to products with a width of ≤20 cm when in roll form.

Tariff Summary:

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

Key Notes:

- This code may apply if your product is in roll form and has a width ≤20 cm.

- If your product is not in roll form, this code may not be applicable.

⚠️ Alternative HS CODE: 3921905050

Description:

- Other plastic sheets, films, etc., including reflective films.

- Reflective films are considered a type of plastic film.

Tariff Summary:

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff (General): 0.0%

- Special Tariff after April 2, 2025: 30.0%

Key Notes:

- This code may be applicable if your product is classified as a plastic film rather than a self-adhesive sticker.

- The additional tariff is 0.0%, which is lower than the other options, but only if the product is correctly classified under this code.

📌 Proactive Advice for Importers:

- Verify the product form: Is it a sticker (self-adhesive) or a film (non-adhesive)? This will determine the correct HS code.

- Check the width: If the product is in roll form, ensure the width is ≤20 cm to qualify for HS code 3919101050.

- Confirm the material: Ensure the product is plastic-based and not made of metal or other materials.

- Check for certifications: Some reflective products may require safety or performance certifications (e.g., for traffic or safety use).

- Monitor the April 2, 2025, tariff change: If your product is classified under 3919905010 or 3919101050, the additional tariff will increase by 5% after this date.

✅ Recommended Action:

- If your product is a self-adhesive reflective sticker, use HS CODE 3919905010.

- If your product is a reflective film in roll form, consider HS CODE 3919101050.

- If your product is a non-adhesive reflective film, consider HS CODE 3921905050.

- Always confirm with customs or a classification expert to ensure compliance and avoid delays.

Customer Reviews

No reviews yet.