| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 9405920000 | Doc | 58.7% | CN | US | 2025-05-12 |

| 3919102055 | Doc | 60.8% | CN | US | 2025-05-12 |

| 4811512040 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4811596000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 9001100050 | Doc | 61.7% | CN | US | 2025-05-12 |

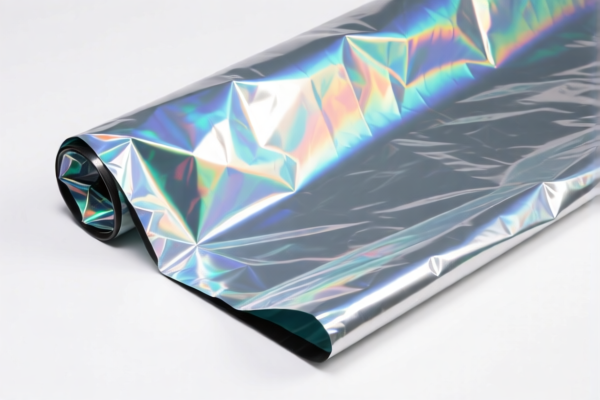

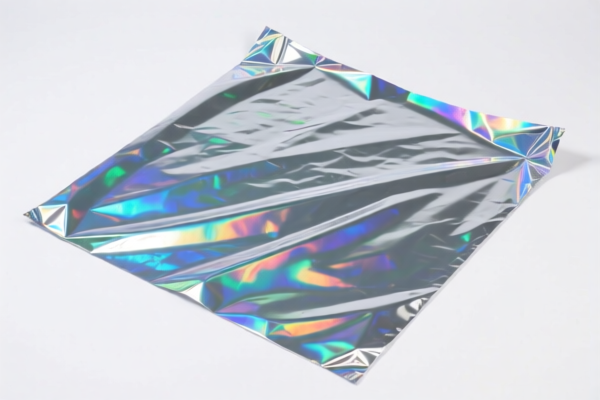

Product Name: Reflectorized Plastic Roll

Classification Analysis and Tax Information:

- HS CODE: 9405920000

- Description: Plastic rolls used for reflective purposes, such as reflective sheets or covers.

- Total Tax Rate: 58.7%

- Breakdown:

- Base Tariff: 3.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is the most relevant classification for your product, as it directly matches the reflective use of plastic rolls.

-

Other Possible Classifications (for reference):

-

HS CODE: 3919102055

- Description: Plastic protective film rolls, width not exceeding 20 cm.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification is for narrower plastic films, not reflective materials.

-

HS CODE: 4811512040

- Description: Matte plastic-coated paper rolls, weight over 150 g/m².

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for paper with plastic coating, not reflective plastic rolls.

-

HS CODE: 4811596000

- Description: Plastic-coated paper or paperboard rolls, with plastic coating, impregnated, or covered.

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for paper-based products with plastic coating, not reflective plastic rolls.

-

HS CODE: 9001100050

- Description: Plastic optical fiber rolls used for fiber communication.

- Total Tax Rate: 61.7%

- Breakdown:

- Base Tariff: 6.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for optical fiber, not reflective plastic rolls.

Key Tax Rate Changes (April 11, 2025):

- All classifications listed above will have an additional 30.0% tariff imposed after April 11, 2025.

- This is a time-sensitive policy, so it is crucial to plan your import schedule accordingly.

Proactive Advice:

- Verify the material composition of the plastic roll (e.g., is it reflective, coated, or optical fiber-based?) to ensure correct classification.

- Check the unit price and total value of the product, as this may affect the application of additional tariffs.

- Confirm required certifications (e.g., safety, environmental, or technical standards) for customs clearance.

- Consult a customs broker or tax expert if the product is used in specialized industries (e.g., construction, safety equipment, or telecommunications).

Product Name: Reflectorized Plastic Roll

Classification Analysis and Tax Information:

- HS CODE: 9405920000

- Description: Plastic rolls used for reflective purposes, such as reflective sheets or covers.

- Total Tax Rate: 58.7%

- Breakdown:

- Base Tariff: 3.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is the most relevant classification for your product, as it directly matches the reflective use of plastic rolls.

-

Other Possible Classifications (for reference):

-

HS CODE: 3919102055

- Description: Plastic protective film rolls, width not exceeding 20 cm.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification is for narrower plastic films, not reflective materials.

-

HS CODE: 4811512040

- Description: Matte plastic-coated paper rolls, weight over 150 g/m².

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for paper with plastic coating, not reflective plastic rolls.

-

HS CODE: 4811596000

- Description: Plastic-coated paper or paperboard rolls, with plastic coating, impregnated, or covered.

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for paper-based products with plastic coating, not reflective plastic rolls.

-

HS CODE: 9001100050

- Description: Plastic optical fiber rolls used for fiber communication.

- Total Tax Rate: 61.7%

- Breakdown:

- Base Tariff: 6.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for optical fiber, not reflective plastic rolls.

Key Tax Rate Changes (April 11, 2025):

- All classifications listed above will have an additional 30.0% tariff imposed after April 11, 2025.

- This is a time-sensitive policy, so it is crucial to plan your import schedule accordingly.

Proactive Advice:

- Verify the material composition of the plastic roll (e.g., is it reflective, coated, or optical fiber-based?) to ensure correct classification.

- Check the unit price and total value of the product, as this may affect the application of additional tariffs.

- Confirm required certifications (e.g., safety, environmental, or technical standards) for customs clearance.

- Consult a customs broker or tax expert if the product is used in specialized industries (e.g., construction, safety equipment, or telecommunications).

Customer Reviews

No reviews yet.