| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3926909925 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3919101050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3919905010 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919101050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3919101050 | Doc | 61.5% | CN | US | 2025-05-12 |

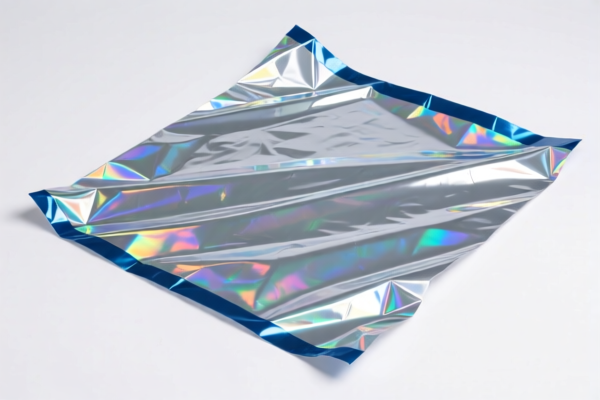

Product Classification and Customs Tariff Analysis for "Reflectorized Plastic Sign"

Here is the detailed breakdown of the HS codes and associated tariffs for your product:

✅ HS CODE: 3926909925

Product Description: Reflectorized triangular warning signs for road use

Total Tax Rate: 42.8%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code is specific to triangular warning signs used on roads.

- The 30.0% special tariff applies after April 11, 2025.

- Anti-dumping duties may apply if the product is made of iron or aluminum (not applicable here).

✅ HS CODE: 3919101050

Product Description: Self-adhesive plastic sheets, films, foils, strips, etc., with reflective surfaces made of glass beads (width ≤ 20 cm)

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code applies to reflective plastic materials used in signs or labels.

- The 30.0% special tariff applies after April 11, 2025.

- Anti-dumping duties may apply if the product is made of iron or aluminum (not applicable here).

✅ HS CODE: 3919905010

Product Description: Reflective sheets

Total Tax Rate: 60.8%

Tariff Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code is for reflective sheets used in signage or safety equipment.

- The 30.0% special tariff applies after April 11, 2025.

- Anti-dumping duties may apply if the product is made of iron or aluminum (not applicable here).

📌 Proactive Advice for Importers:

- Verify the product's exact composition and structure (e.g., is it a sign, a sheet, or a component of a sign?).

- Check the unit price to determine if the product falls under a different HS code based on value.

- Confirm the material (e.g., plastic, glass beads, adhesive) to ensure correct classification.

- Review required certifications (e.g., CE, RoHS, or safety standards for road signs).

- Monitor the April 11, 2025, deadline for the special tariff increase — consider adjusting import timelines or seeking duty relief if applicable.

📅 Important Date Reminder:

- April 11, 2025: A 30.0% additional tariff will be imposed on all three HS codes listed above. Ensure your import plans account for this increase.

Let me know if you need help with HS code selection based on product specifications or documentation requirements. Product Classification and Customs Tariff Analysis for "Reflectorized Plastic Sign"

Here is the detailed breakdown of the HS codes and associated tariffs for your product:

✅ HS CODE: 3926909925

Product Description: Reflectorized triangular warning signs for road use

Total Tax Rate: 42.8%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code is specific to triangular warning signs used on roads.

- The 30.0% special tariff applies after April 11, 2025.

- Anti-dumping duties may apply if the product is made of iron or aluminum (not applicable here).

✅ HS CODE: 3919101050

Product Description: Self-adhesive plastic sheets, films, foils, strips, etc., with reflective surfaces made of glass beads (width ≤ 20 cm)

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code applies to reflective plastic materials used in signs or labels.

- The 30.0% special tariff applies after April 11, 2025.

- Anti-dumping duties may apply if the product is made of iron or aluminum (not applicable here).

✅ HS CODE: 3919905010

Product Description: Reflective sheets

Total Tax Rate: 60.8%

Tariff Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code is for reflective sheets used in signage or safety equipment.

- The 30.0% special tariff applies after April 11, 2025.

- Anti-dumping duties may apply if the product is made of iron or aluminum (not applicable here).

📌 Proactive Advice for Importers:

- Verify the product's exact composition and structure (e.g., is it a sign, a sheet, or a component of a sign?).

- Check the unit price to determine if the product falls under a different HS code based on value.

- Confirm the material (e.g., plastic, glass beads, adhesive) to ensure correct classification.

- Review required certifications (e.g., CE, RoHS, or safety standards for road signs).

- Monitor the April 11, 2025, deadline for the special tariff increase — consider adjusting import timelines or seeking duty relief if applicable.

📅 Important Date Reminder:

- April 11, 2025: A 30.0% additional tariff will be imposed on all three HS codes listed above. Ensure your import plans account for this increase.

Let me know if you need help with HS code selection based on product specifications or documentation requirements.

Customer Reviews

No reviews yet.