| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919101050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3919901000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3919905010 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919101050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3919905010 | Doc | 60.8% | CN | US | 2025-05-12 |

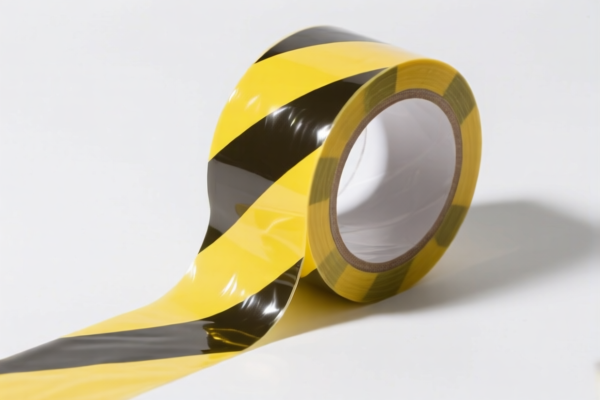

Product Name: Reflectorized Plastic Warning Tape

Classification HS Codes and Tax Details:

✅ HS Code: 3919101050

Description:

Self-adhesive plastic sheets, films, foils, strips, and other flat shapes, whether or not wound into rolls, with a reflective surface produced entirely or partially by glass beads (glass particles), width not exceeding 20 cm.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 2, 2025: 30.0% (applies to this category)

✅ HS Code: 3919901000

Description:

Self-adhesive plastic products with a reflective surface produced entirely or partially by glass beads (glass sand).

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 2, 2025: 30.0% (applies to this category)

✅ HS Code: 3919905010

Description:

Reflective sheets.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Tariff after April 2, 2025: 30.0% (applies to this category)

⚠️ Important Notes:

-

April 2, 2025 Tariff Increase:

All three HS codes are subject to an additional 30.0% tariff after April 2, 2025. This is a time-sensitive policy and must be considered in cost planning. -

No Anti-Dumping Duties Mentioned:

No specific anti-dumping duties on iron or aluminum are listed for this product category. -

Certifications Required:

Verify if your product requires any specific certifications (e.g., CE, RoHS, or safety standards) for import compliance. -

Material and Unit Price:

Confirm the exact material composition and unit price, as these can affect classification and tax calculation.

📌 Proactive Advice:

- Double-check the product description to ensure it matches the HS code description (e.g., width, reflective surface type, and whether it is self-adhesive).

- Consult with customs brokers or a classification expert if the product has multiple components or uses.

- Plan for the April 2, 2025 tariff increase to avoid unexpected costs in your import budget.

Let me know if you need help with a specific product sample or documentation.

Product Name: Reflectorized Plastic Warning Tape

Classification HS Codes and Tax Details:

✅ HS Code: 3919101050

Description:

Self-adhesive plastic sheets, films, foils, strips, and other flat shapes, whether or not wound into rolls, with a reflective surface produced entirely or partially by glass beads (glass particles), width not exceeding 20 cm.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 2, 2025: 30.0% (applies to this category)

✅ HS Code: 3919901000

Description:

Self-adhesive plastic products with a reflective surface produced entirely or partially by glass beads (glass sand).

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 2, 2025: 30.0% (applies to this category)

✅ HS Code: 3919905010

Description:

Reflective sheets.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Tariff after April 2, 2025: 30.0% (applies to this category)

⚠️ Important Notes:

-

April 2, 2025 Tariff Increase:

All three HS codes are subject to an additional 30.0% tariff after April 2, 2025. This is a time-sensitive policy and must be considered in cost planning. -

No Anti-Dumping Duties Mentioned:

No specific anti-dumping duties on iron or aluminum are listed for this product category. -

Certifications Required:

Verify if your product requires any specific certifications (e.g., CE, RoHS, or safety standards) for import compliance. -

Material and Unit Price:

Confirm the exact material composition and unit price, as these can affect classification and tax calculation.

📌 Proactive Advice:

- Double-check the product description to ensure it matches the HS code description (e.g., width, reflective surface type, and whether it is self-adhesive).

- Consult with customs brokers or a classification expert if the product has multiple components or uses.

- Plan for the April 2, 2025 tariff increase to avoid unexpected costs in your import budget.

Let me know if you need help with a specific product sample or documentation.

Customer Reviews

No reviews yet.