Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919905010 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919905010 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919905010 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919101050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3919101050 | Doc | 61.5% | CN | US | 2025-05-12 |

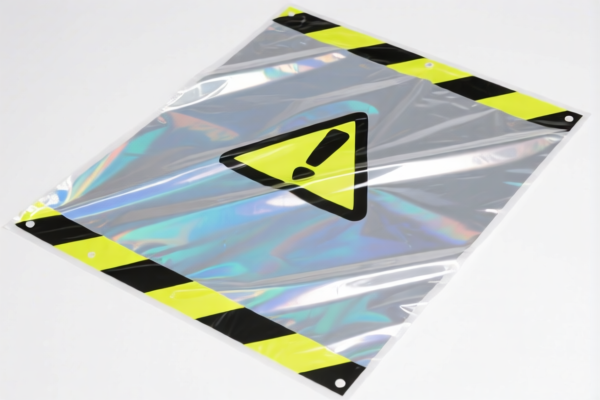

Product Name: Reflectorized Warning Plastic Sheet

HS CODE: 3919905010

🔍 Classification Summary:

- Product Type: Reflectorized plastic sheets used for warning or safety purposes (e.g., warning signs, protective sheets, etc.).

- HS Code: 3919905010 (Plastic articles of heading 3919, not elsewhere specified, including sheets, plates, etc.)

📊 Tariff Breakdown (as of current regulations):

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (April 11, 2025 onwards): 30.0%

- Total Tax Rate: 60.8%

⚠️ Note: The 30.0% additional tariff applies after April 11, 2025. Ensure your import timeline aligns with this policy change.

📌 Key Considerations:

- Material Verification: Confirm the plastic type (e.g., PVC, PET, etc.) and whether it contains any additives or coatings (e.g., reflective materials). This may affect classification.

- Unit Price: Tariff rates can vary based on the declared value and whether the product is considered "simple" or "complex."

- Certifications: Check if any safety or compliance certifications (e.g., CE, ANSI, ISO) are required for import or use in the destination country.

- Product Description: Use precise terminology in customs documentation (e.g., "reflectorized" vs. "non-reflective") to avoid misclassification.

📌 Proactive Advice:

- Double-check HS Code: Ensure the product is not classified under a different heading (e.g., 3919101050 for reflective tape or signs).

- Consult a Customs Broker: For complex or high-value shipments, seek professional assistance to avoid delays or penalties.

- Monitor Policy Updates: Stay informed about any changes in tariff rates or import regulations, especially around the April 11, 2025 deadline.

Let me know if you need help with customs documentation or further classification details.

Product Name: Reflectorized Warning Plastic Sheet

HS CODE: 3919905010

🔍 Classification Summary:

- Product Type: Reflectorized plastic sheets used for warning or safety purposes (e.g., warning signs, protective sheets, etc.).

- HS Code: 3919905010 (Plastic articles of heading 3919, not elsewhere specified, including sheets, plates, etc.)

📊 Tariff Breakdown (as of current regulations):

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (April 11, 2025 onwards): 30.0%

- Total Tax Rate: 60.8%

⚠️ Note: The 30.0% additional tariff applies after April 11, 2025. Ensure your import timeline aligns with this policy change.

📌 Key Considerations:

- Material Verification: Confirm the plastic type (e.g., PVC, PET, etc.) and whether it contains any additives or coatings (e.g., reflective materials). This may affect classification.

- Unit Price: Tariff rates can vary based on the declared value and whether the product is considered "simple" or "complex."

- Certifications: Check if any safety or compliance certifications (e.g., CE, ANSI, ISO) are required for import or use in the destination country.

- Product Description: Use precise terminology in customs documentation (e.g., "reflectorized" vs. "non-reflective") to avoid misclassification.

📌 Proactive Advice:

- Double-check HS Code: Ensure the product is not classified under a different heading (e.g., 3919101050 for reflective tape or signs).

- Consult a Customs Broker: For complex or high-value shipments, seek professional assistance to avoid delays or penalties.

- Monitor Policy Updates: Stay informed about any changes in tariff rates or import regulations, especially around the April 11, 2025 deadline.

Let me know if you need help with customs documentation or further classification details.

Customer Reviews

No reviews yet.