Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920710000 | Doc | 61.2% | CN | US | 2025-05-12 |

| 3921140000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920710000 | Doc | 61.2% | CN | US | 2025-05-12 |

| 3920710000 | Doc | 61.2% | CN | US | 2025-05-12 |

| 3920710000 | Doc | 61.2% | CN | US | 2025-05-12 |

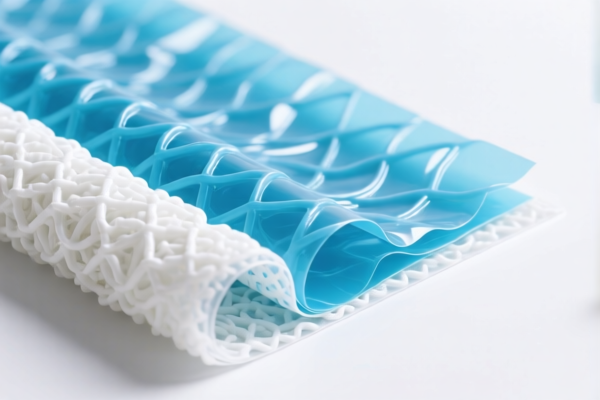

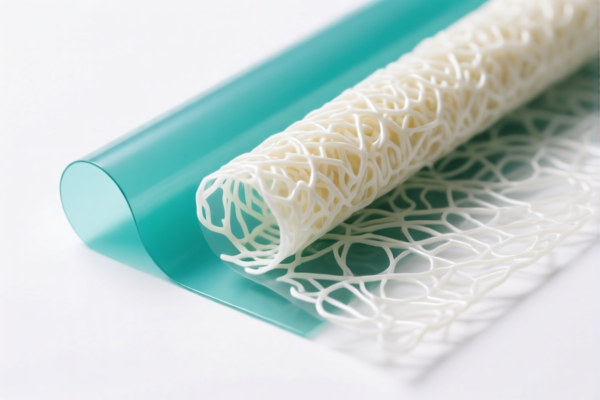

Product Name: Regenerated Cellulose Composite Plastic Films

Classification HS Codes and Tax Details:

- HS CODE: 3920710000

- Description: Films, sheets, plates, etc., made of regenerated cellulose, laminated, backed, or otherwise combined with other materials.

- Total Tax Rate: 61.2%

- Base Tariff Rate: 6.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to various types of regenerated cellulose composite films, including special, protective, and medical films.

-

HS CODE: 3921140000

- Description: Regenerated cellulose films (not laminated or combined with other materials).

- Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code is specific to pure regenerated cellulose films, not combined with other materials.

📌 Key Tax Rate Changes (April 11, 2025 onwards):

- All products under the above HS codes will be subject to an additional 30.0% tariff after April 11, 2025.

- This increase is time-sensitive, so importers must plan accordingly to avoid unexpected costs.

📌 Proactive Advice for Importers:

- Verify the exact product composition (e.g., whether it is laminated, combined with other materials, or pure regenerated cellulose).

- Check the unit price and total value to determine if the product falls under a different HS code or tariff category.

- Confirm required certifications (e.g., medical device approvals for medical films, environmental compliance for special films).

- Review the customs declaration to ensure the correct HS code is used, as misclassification can lead to penalties or delays.

📌 Additional Notes:

- No specific anti-dumping duties are listed for this product category in the provided data.

- No special tariffs related to iron or aluminum apply here, as the product is a plastic composite.

Let me know if you need help with HS code selection or customs documentation.

Product Name: Regenerated Cellulose Composite Plastic Films

Classification HS Codes and Tax Details:

- HS CODE: 3920710000

- Description: Films, sheets, plates, etc., made of regenerated cellulose, laminated, backed, or otherwise combined with other materials.

- Total Tax Rate: 61.2%

- Base Tariff Rate: 6.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to various types of regenerated cellulose composite films, including special, protective, and medical films.

-

HS CODE: 3921140000

- Description: Regenerated cellulose films (not laminated or combined with other materials).

- Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code is specific to pure regenerated cellulose films, not combined with other materials.

📌 Key Tax Rate Changes (April 11, 2025 onwards):

- All products under the above HS codes will be subject to an additional 30.0% tariff after April 11, 2025.

- This increase is time-sensitive, so importers must plan accordingly to avoid unexpected costs.

📌 Proactive Advice for Importers:

- Verify the exact product composition (e.g., whether it is laminated, combined with other materials, or pure regenerated cellulose).

- Check the unit price and total value to determine if the product falls under a different HS code or tariff category.

- Confirm required certifications (e.g., medical device approvals for medical films, environmental compliance for special films).

- Review the customs declaration to ensure the correct HS code is used, as misclassification can lead to penalties or delays.

📌 Additional Notes:

- No specific anti-dumping duties are listed for this product category in the provided data.

- No special tariffs related to iron or aluminum apply here, as the product is a plastic composite.

Let me know if you need help with HS code selection or customs documentation.

Customer Reviews

No reviews yet.