Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921140000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 4411129090 | Doc | 58.9% | CN | US | 2025-05-12 |

| 4411940060 | Doc | 55.0% | CN | US | 2025-05-12 |

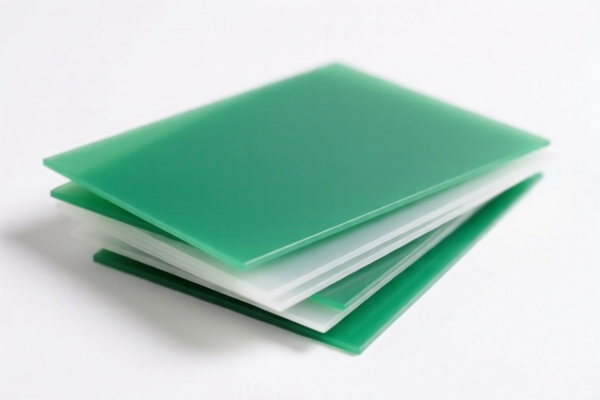

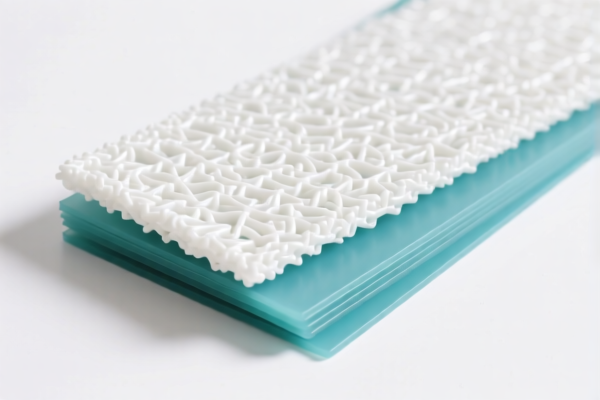

Product Name: Regenerated Cellulose Composite Plastic Sheets

Classification and Tax Information:

✅ HS CODE: 3921140000

- Description: Regenerated cellulose foam board, made of regenerated cellulose, in the form of foam board.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is specifically for regenerated cellulose foam boards.

- Ensure the product is not classified under other HS codes (e.g., 4411 for wood-based products).

- Verify the material composition to confirm it is regenerated cellulose and not a composite with other materials.

✅ HS CODE: 3921905050

- Description: Plastic composite sheet, falls under the category of plastics and plastic products.

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is for plastic composite sheets that are not specifically regenerated cellulose.

- Check the exact composition to ensure it does not fall under a more specific code (e.g., 3921140000).

- No anti-dumping duties currently apply to this category.

✅ HS CODE: 3921902510

- Description: Synthetic fiber composite plastic sheet, combined with textile materials and with a weight exceeding 1.492 kg/m².

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code applies to composite sheets that include textile materials and have a high weight per square meter.

- Verify the weight and material composition to ensure proper classification.

- Check for any textile-related certifications if applicable.

✅ HS CODE: 4411129090

- Description: Regenerated wood fiber board, falls under the category of wood fiber boards.

- Total Tax Rate: 58.9%

- Breakdown:

- Base Tariff: 3.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is for regenerated wood fiber boards, not cellulose-based.

- Ensure the product is not a composite with plastic or other materials.

- Check for any wood product certifications if required.

✅ HS CODE: 4411940060

- Description: Regenerated wood fiber board, with a density not exceeding 0.5 g/cm³, not mechanically processed or surface-covered.

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is for low-density regenerated wood fiber boards that are not processed or covered.

- Verify the density and processing status of the product.

- No base tariff applies, but additional and special tariffs are still in effect.

📌 Proactive Advice:

- Verify the exact material composition of the product to ensure correct HS code classification.

- Check the weight and density if the product is a composite or fiber board.

- Confirm the unit price and total value for accurate customs valuation.

- Review any required certifications (e.g., textile, wood, or plastic-related) before export.

- Be aware of the April 11, 2025, special tariff that applies to all the above codes.

- Consult a customs broker or expert if the product is a hybrid or composite material.

Product Name: Regenerated Cellulose Composite Plastic Sheets

Classification and Tax Information:

✅ HS CODE: 3921140000

- Description: Regenerated cellulose foam board, made of regenerated cellulose, in the form of foam board.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is specifically for regenerated cellulose foam boards.

- Ensure the product is not classified under other HS codes (e.g., 4411 for wood-based products).

- Verify the material composition to confirm it is regenerated cellulose and not a composite with other materials.

✅ HS CODE: 3921905050

- Description: Plastic composite sheet, falls under the category of plastics and plastic products.

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is for plastic composite sheets that are not specifically regenerated cellulose.

- Check the exact composition to ensure it does not fall under a more specific code (e.g., 3921140000).

- No anti-dumping duties currently apply to this category.

✅ HS CODE: 3921902510

- Description: Synthetic fiber composite plastic sheet, combined with textile materials and with a weight exceeding 1.492 kg/m².

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code applies to composite sheets that include textile materials and have a high weight per square meter.

- Verify the weight and material composition to ensure proper classification.

- Check for any textile-related certifications if applicable.

✅ HS CODE: 4411129090

- Description: Regenerated wood fiber board, falls under the category of wood fiber boards.

- Total Tax Rate: 58.9%

- Breakdown:

- Base Tariff: 3.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is for regenerated wood fiber boards, not cellulose-based.

- Ensure the product is not a composite with plastic or other materials.

- Check for any wood product certifications if required.

✅ HS CODE: 4411940060

- Description: Regenerated wood fiber board, with a density not exceeding 0.5 g/cm³, not mechanically processed or surface-covered.

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes:

- This code is for low-density regenerated wood fiber boards that are not processed or covered.

- Verify the density and processing status of the product.

- No base tariff applies, but additional and special tariffs are still in effect.

📌 Proactive Advice:

- Verify the exact material composition of the product to ensure correct HS code classification.

- Check the weight and density if the product is a composite or fiber board.

- Confirm the unit price and total value for accurate customs valuation.

- Review any required certifications (e.g., textile, wood, or plastic-related) before export.

- Be aware of the April 11, 2025, special tariff that applies to all the above codes.

- Consult a customs broker or expert if the product is a hybrid or composite material.

Customer Reviews

No reviews yet.