Found 2 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920710000 | Doc | 61.2% | CN | US | 2025-05-12 |

| 3921140000 | Doc | 61.5% | CN | US | 2025-05-12 |

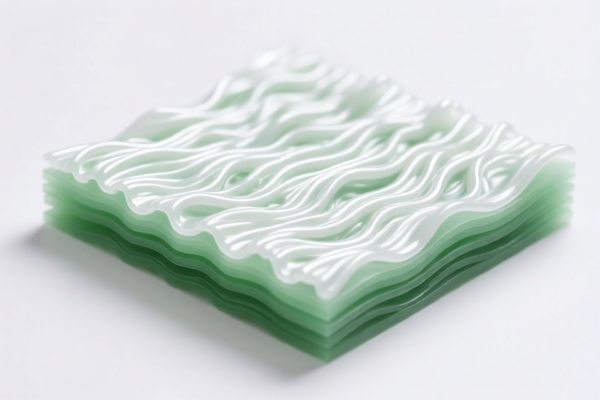

Product Name: Regenerated Cellulose Industrial Plastic Sheets

Classification: HS Code 3920710000 or 3921140000 (depending on product type)

🔍 HS Code Classification Overview

- HS Code 3920710000

- Description: Regenerated cellulose industrial plastic sheets (non-cellular) in the form of sheets, plates, films, foils, or strips.

-

Total Tax Rate: 61.2%

- Base Tariff: 6.2%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

HS Code 3921140000

- Description: Regenerated cellulose foam sheets (cellular) in the form of sheets, plates, films, foils, or strips.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

⚠️ Key Tax Rate Changes (April 2, 2025)

- Additional Tariff (25.0%) applies to all imports under these HS codes.

- Special Tariff (30.0%) will be imposed after April 2, 2025, increasing the total tax burden significantly.

- No anti-dumping duties are currently listed for this product category.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of regenerated cellulose and not a blend with other materials, as this could affect classification.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., environmental, safety, or industry-specific) are required for import.

- Monitor Tariff Updates: Stay informed about any changes in customs policies, especially after April 2, 2025, to avoid unexpected costs.

- Consult a Customs Broker: For complex classifications or large-volume imports, seek professional assistance to ensure compliance and optimize costs.

📅 Time-Sensitive Policy Reminder

- April 2, 2025: A 30.0% additional tariff will be applied to imports under these HS codes. This is a critical date for planning and budgeting.

Let me know if you need help determining which HS code applies to your specific product.

Product Name: Regenerated Cellulose Industrial Plastic Sheets

Classification: HS Code 3920710000 or 3921140000 (depending on product type)

🔍 HS Code Classification Overview

- HS Code 3920710000

- Description: Regenerated cellulose industrial plastic sheets (non-cellular) in the form of sheets, plates, films, foils, or strips.

-

Total Tax Rate: 61.2%

- Base Tariff: 6.2%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

HS Code 3921140000

- Description: Regenerated cellulose foam sheets (cellular) in the form of sheets, plates, films, foils, or strips.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

⚠️ Key Tax Rate Changes (April 2, 2025)

- Additional Tariff (25.0%) applies to all imports under these HS codes.

- Special Tariff (30.0%) will be imposed after April 2, 2025, increasing the total tax burden significantly.

- No anti-dumping duties are currently listed for this product category.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of regenerated cellulose and not a blend with other materials, as this could affect classification.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., environmental, safety, or industry-specific) are required for import.

- Monitor Tariff Updates: Stay informed about any changes in customs policies, especially after April 2, 2025, to avoid unexpected costs.

- Consult a Customs Broker: For complex classifications or large-volume imports, seek professional assistance to ensure compliance and optimize costs.

📅 Time-Sensitive Policy Reminder

- April 2, 2025: A 30.0% additional tariff will be applied to imports under these HS codes. This is a critical date for planning and budgeting.

Let me know if you need help determining which HS code applies to your specific product.

Customer Reviews

No reviews yet.