| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921140000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920710000 | Doc | 61.2% | CN | US | 2025-05-12 |

| 4411940060 | Doc | 55.0% | CN | US | 2025-05-12 |

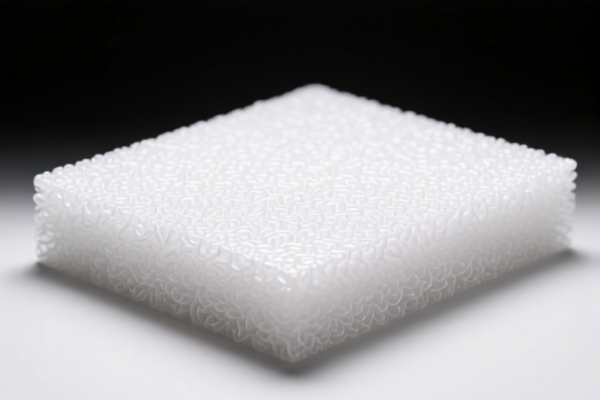

Product Name: Regenerated Cellulose Plastic Honeycomb Board

Classification Analysis and Tax Information:

- HS CODE: 3921140000

- Description: Regenerated cellulose foam board

- Total Tax Rate: 61.5%

- Breakdown of Tax Rates:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Note: This code is specifically for regenerated cellulose foam boards, which aligns with the description of your product if it is a foam-based honeycomb board made from regenerated cellulose.

-

Other Possible HS Codes (for reference):

- 3921902900 – For composite plastic sheets with weight >1.492 kg/m² (not foam-based)

- 3921902550 – For composite plastic sheets with textile components (not applicable if your product is foam-based)

- 3920710000 – For non-cellular plastic sheets made from regenerated cellulose and combined with other materials (if your product is not foam-based)

-

4411129090 – For regenerated wood fiber boards (not applicable if your product is plastic-based)

-

Key Tax Rate Changes:

- April 2, 2025 Special Tariff: An additional 30.0% tariff will be imposed on all the above codes after this date.

- Anti-dumping duties: Not currently applicable for this product category.

-

Additional tariffs: A general 25.0% additional tariff applies to all the above HS codes.

-

Proactive Advice:

- Verify Material Composition: Ensure your product is indeed a foam board made from regenerated cellulose and not a composite or non-foam product.

- Check Unit Price and Weight: Confirm the weight per square meter to ensure it meets the criteria for the selected HS code.

- Certifications Required: Confirm if any specific certifications (e.g., environmental, safety, or material composition) are required for import into the target market.

- Monitor Tariff Updates: Keep an eye on the April 2, 2025, deadline for the special tariff, as it may significantly impact your import costs.

If you have more details about the product's composition or intended use, I can help refine the classification further.

Product Name: Regenerated Cellulose Plastic Honeycomb Board

Classification Analysis and Tax Information:

- HS CODE: 3921140000

- Description: Regenerated cellulose foam board

- Total Tax Rate: 61.5%

- Breakdown of Tax Rates:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Note: This code is specifically for regenerated cellulose foam boards, which aligns with the description of your product if it is a foam-based honeycomb board made from regenerated cellulose.

-

Other Possible HS Codes (for reference):

- 3921902900 – For composite plastic sheets with weight >1.492 kg/m² (not foam-based)

- 3921902550 – For composite plastic sheets with textile components (not applicable if your product is foam-based)

- 3920710000 – For non-cellular plastic sheets made from regenerated cellulose and combined with other materials (if your product is not foam-based)

-

4411129090 – For regenerated wood fiber boards (not applicable if your product is plastic-based)

-

Key Tax Rate Changes:

- April 2, 2025 Special Tariff: An additional 30.0% tariff will be imposed on all the above codes after this date.

- Anti-dumping duties: Not currently applicable for this product category.

-

Additional tariffs: A general 25.0% additional tariff applies to all the above HS codes.

-

Proactive Advice:

- Verify Material Composition: Ensure your product is indeed a foam board made from regenerated cellulose and not a composite or non-foam product.

- Check Unit Price and Weight: Confirm the weight per square meter to ensure it meets the criteria for the selected HS code.

- Certifications Required: Confirm if any specific certifications (e.g., environmental, safety, or material composition) are required for import into the target market.

- Monitor Tariff Updates: Keep an eye on the April 2, 2025, deadline for the special tariff, as it may significantly impact your import costs.

If you have more details about the product's composition or intended use, I can help refine the classification further.

Customer Reviews

No reviews yet.