| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920710000 | Doc | 61.2% | CN | US | 2025-05-12 |

| 3921140000 | Doc | 61.5% | CN | US | 2025-05-12 |

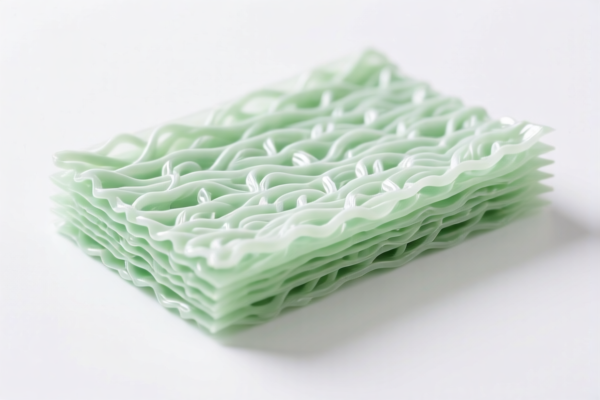

Product Name: Regenerated Cellulose Plastic Sheets

Classification HS Code:

- 3920710000 – Laminated, supported, or otherwise combined with other materials, non-cellular plastic sheets, plates, films, foils, and strips made of regenerated cellulose

- 3921140000 – Plastic sheets, plates, films, foils, and strips made of regenerated cellulose

🔍 Key Classification Notes:

- 3920710000 applies to regenerated cellulose plastic sheets that are combined with other materials (e.g., laminated or layered).

- 3921140000 applies to pure regenerated cellulose plastic sheets, not combined with other materials.

📊 Tariff Overview (as of now):

For 3920710000:

- Base Tariff Rate: 6.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.2%

For 3921140000:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

⏰ Important Policy Notes:

- April 11, 2025 Special Tariff: A 30% additional tariff will be imposed on both HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning.

- No Anti-dumping duties currently reported for these HS codes.

📌 Proactive Advice for Importers:

- Verify the product composition: Ensure whether the plastic sheets are pure regenerated cellulose or combined with other materials to determine the correct HS code.

- Check unit price and material specifications: This will help in accurate classification and tax calculation.

- Review required certifications: Some products may require specific documentation (e.g., material safety data sheets, origin certificates).

- Monitor policy updates: Be aware of any changes in tariff rates or classification rules, especially around the April 11, 2025 deadline.

Let me know if you need help with customs documentation or further classification clarification.

Product Name: Regenerated Cellulose Plastic Sheets

Classification HS Code:

- 3920710000 – Laminated, supported, or otherwise combined with other materials, non-cellular plastic sheets, plates, films, foils, and strips made of regenerated cellulose

- 3921140000 – Plastic sheets, plates, films, foils, and strips made of regenerated cellulose

🔍 Key Classification Notes:

- 3920710000 applies to regenerated cellulose plastic sheets that are combined with other materials (e.g., laminated or layered).

- 3921140000 applies to pure regenerated cellulose plastic sheets, not combined with other materials.

📊 Tariff Overview (as of now):

For 3920710000:

- Base Tariff Rate: 6.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.2%

For 3921140000:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

⏰ Important Policy Notes:

- April 11, 2025 Special Tariff: A 30% additional tariff will be imposed on both HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning.

- No Anti-dumping duties currently reported for these HS codes.

📌 Proactive Advice for Importers:

- Verify the product composition: Ensure whether the plastic sheets are pure regenerated cellulose or combined with other materials to determine the correct HS code.

- Check unit price and material specifications: This will help in accurate classification and tax calculation.

- Review required certifications: Some products may require specific documentation (e.g., material safety data sheets, origin certificates).

- Monitor policy updates: Be aware of any changes in tariff rates or classification rules, especially around the April 11, 2025 deadline.

Let me know if you need help with customs documentation or further classification clarification.

Customer Reviews

No reviews yet.