| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917230000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3926909987 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3926909987 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3926909987 | Doc | 42.8% | CN | US | 2025-05-12 |

| 7304598070 | Doc | 30.0% | CN | US | 2025-05-12 |

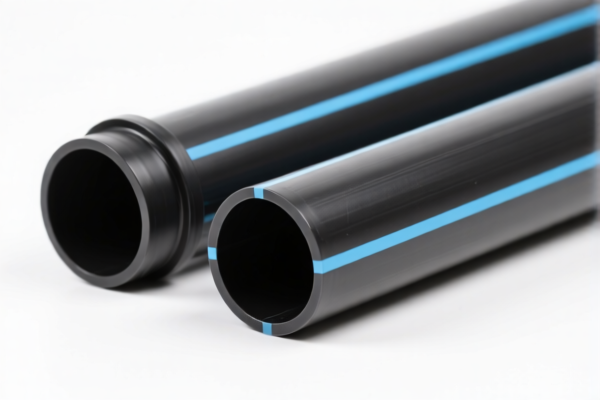

Product Classification: Rigid PVC Industrial Pipes

HS CODEs and Tax Details:

- HS CODE: 3917230000

- Product Description: Hard PVC Pipes

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is specifically for rigid PVC pipes, which are commonly used in industrial and construction applications.

-

HS CODE: 3926909987

- Product Description: Rigid Plastic Pipes / Rigid Plastic Conduits / Rigid Plastic Tubing

- Total Tax Rate: 42.8%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to various types of rigid plastic pipes, including conduits and tubing. Ensure the product description matches the actual item being imported.

-

HS CODE: 7304598070

- Product Description: Industrial Pipes (likely metal-based)

- Total Tax Rate: 30.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for industrial pipes, but it is likely for metal products (e.g., steel or iron). If your product is PVC, this code is not applicable.

Key Considerations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff is imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost calculations and customs declarations. -

Material Verification:

Ensure the product is PVC-based and not metal. If the product is metal, the HS code 7304598070 may apply, but it will be subject to different regulations and tariffs. -

Certifications and Documentation:

- Confirm if any certifications (e.g., ISO, RoHS, or specific import permits) are required for the product.

-

Provide accurate product descriptions and unit prices to avoid classification errors.

-

Anti-Dumping Duties:

If the product is imported from countries under anti-dumping investigations, additional duties may apply. Verify with customs or a trade compliance expert.

Proactive Advice:

- Double-check the material composition of the product to ensure correct HS code classification.

- Review the product’s end-use (e.g., industrial, construction, or electrical) to determine if any specific regulations apply.

-

Consult with customs authorities or a compliance expert if the product is part of a sensitive trade agreement or subject to special duties. Product Classification: Rigid PVC Industrial Pipes

HS CODEs and Tax Details: -

HS CODE: 3917230000

- Product Description: Hard PVC Pipes

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is specifically for rigid PVC pipes, which are commonly used in industrial and construction applications.

-

HS CODE: 3926909987

- Product Description: Rigid Plastic Pipes / Rigid Plastic Conduits / Rigid Plastic Tubing

- Total Tax Rate: 42.8%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to various types of rigid plastic pipes, including conduits and tubing. Ensure the product description matches the actual item being imported.

-

HS CODE: 7304598070

- Product Description: Industrial Pipes (likely metal-based)

- Total Tax Rate: 30.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for industrial pipes, but it is likely for metal products (e.g., steel or iron). If your product is PVC, this code is not applicable.

Key Considerations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff is imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost calculations and customs declarations. -

Material Verification:

Ensure the product is PVC-based and not metal. If the product is metal, the HS code 7304598070 may apply, but it will be subject to different regulations and tariffs. -

Certifications and Documentation:

- Confirm if any certifications (e.g., ISO, RoHS, or specific import permits) are required for the product.

-

Provide accurate product descriptions and unit prices to avoid classification errors.

-

Anti-Dumping Duties:

If the product is imported from countries under anti-dumping investigations, additional duties may apply. Verify with customs or a trade compliance expert.

Proactive Advice:

- Double-check the material composition of the product to ensure correct HS code classification.

- Review the product’s end-use (e.g., industrial, construction, or electrical) to determine if any specific regulations apply.

- Consult with customs authorities or a compliance expert if the product is part of a sensitive trade agreement or subject to special duties.

Customer Reviews

No reviews yet.