Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917210000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917210000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917210000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917210000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917210000 | Doc | 58.1% | CN | US | 2025-05-12 |

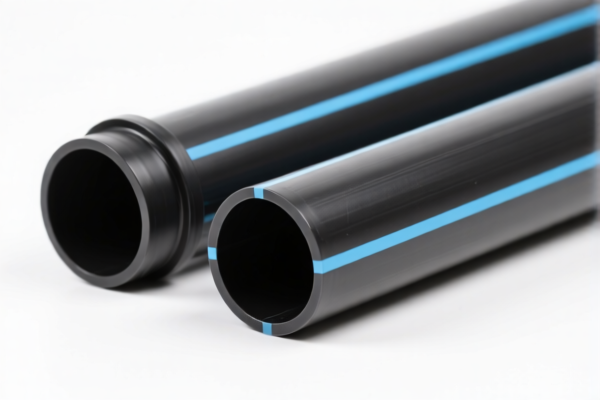

Product Classification: Rigid PVC Irrigation Pipes

HS CODE: 3917210000

🔍 Classification Summary

- Product Name: Rigid PVC (Polyvinyl Chloride) Irrigation Pipes

- HS Code: 3917210000

- Description: This code applies to rigid polyethylene (PE) pipes, tubes, or profiles, including irrigation pipes made of rigid plastic.

- Note: While the HS code listed is for polyethylene, the user has declared PVC (Polyvinyl Chloride) irrigation pipes. This may require reclassification under a different HS code (e.g., 3917200000 for PVC pipes). Please verify the material composition and confirm the correct HS code.

📊 Tariff Breakdown

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 58.1%

⏰ Time-Sensitive Policies

- April 11, 2025 Special Tariff: An additional 30.0% tariff will be applied after April 11, 2025.

- Anti-dumping duties: Not applicable for this product category (plastic pipes).

- Other duties: No specific anti-dumping or countervailing duties are currently listed for rigid plastic pipes.

🛠️ Proactive Advice for Users

- Verify Material: Confirm that the product is indeed made of PVC and not polyethylene (PE), as the HS code 3917210000 is for PE. If it's PVC, the correct code may be 3917200000.

- Check Unit Price: Ensure the declared value and unit price are accurate to avoid discrepancies during customs inspection.

- Certifications Required: Some countries may require product conformity certificates, material safety data sheets (MSDS), or CE marking for irrigation pipes.

- Documentation: Provide clear product descriptions, including specifications such as diameter, wall thickness, and intended use (e.g., irrigation, drainage).

📌 Summary of Key Points

- HS Code: 3917210000 (may be incorrect if the product is PVC, not PE)

- Total Tax Rate: 58.1% (3.1% base + 25% general + 30% after April 11, 2025)

- Special Tariff Alert: 30.0% additional tariff applies after April 11, 2025

- Action Required: Confirm material type and HS code, and ensure all documentation is complete and accurate.

Product Classification: Rigid PVC Irrigation Pipes

HS CODE: 3917210000

🔍 Classification Summary

- Product Name: Rigid PVC (Polyvinyl Chloride) Irrigation Pipes

- HS Code: 3917210000

- Description: This code applies to rigid polyethylene (PE) pipes, tubes, or profiles, including irrigation pipes made of rigid plastic.

- Note: While the HS code listed is for polyethylene, the user has declared PVC (Polyvinyl Chloride) irrigation pipes. This may require reclassification under a different HS code (e.g., 3917200000 for PVC pipes). Please verify the material composition and confirm the correct HS code.

📊 Tariff Breakdown

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 58.1%

⏰ Time-Sensitive Policies

- April 11, 2025 Special Tariff: An additional 30.0% tariff will be applied after April 11, 2025.

- Anti-dumping duties: Not applicable for this product category (plastic pipes).

- Other duties: No specific anti-dumping or countervailing duties are currently listed for rigid plastic pipes.

🛠️ Proactive Advice for Users

- Verify Material: Confirm that the product is indeed made of PVC and not polyethylene (PE), as the HS code 3917210000 is for PE. If it's PVC, the correct code may be 3917200000.

- Check Unit Price: Ensure the declared value and unit price are accurate to avoid discrepancies during customs inspection.

- Certifications Required: Some countries may require product conformity certificates, material safety data sheets (MSDS), or CE marking for irrigation pipes.

- Documentation: Provide clear product descriptions, including specifications such as diameter, wall thickness, and intended use (e.g., irrigation, drainage).

📌 Summary of Key Points

- HS Code: 3917210000 (may be incorrect if the product is PVC, not PE)

- Total Tax Rate: 58.1% (3.1% base + 25% general + 30% after April 11, 2025)

- Special Tariff Alert: 30.0% additional tariff applies after April 11, 2025

- Action Required: Confirm material type and HS code, and ensure all documentation is complete and accurate.

Customer Reviews

No reviews yet.