| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917390020 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917230000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3904210000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3917330000 | Doc | 33.1% | CN | US | 2025-05-12 |

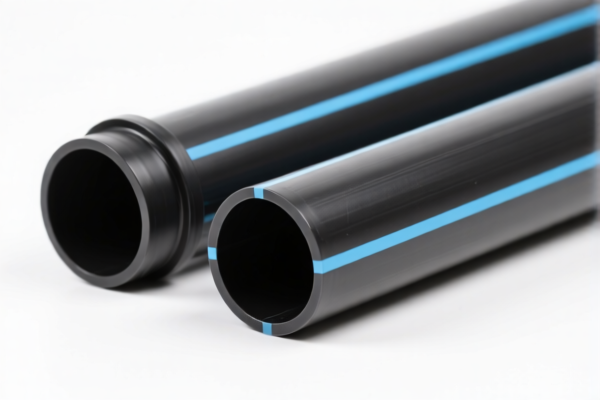

Here is the structured classification and tariff information for Rigid PVC Sprinkler Pipes based on the provided HS codes and tax details:

✅ HS CODE: 3917320010

Product Name: PVC Sprinkler Pipe

Total Tax Rate: 58.1%

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This product is subject to higher tariffs due to the additional 25% and the 30% special tariff after April 11, 2025.

✅ HS CODE: 3917390020

Product Name: PVC Irrigation Pipe

Total Tax Rate: 33.1%

- Base Tariff Rate: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: No additional tariff is applied, but the 30% special tariff will apply after April 11, 2025.

✅ HS CODE: 3917230000

Product Name: Rigid PVC Pipe

Total Tax Rate: 58.1%

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Similar to 3917320010, this product is subject to the same additional and special tariffs.

✅ HS CODE: 3904210000

Product Name: Rigid PVC Resin

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a raw material (PVC resin), not finished product. Higher base tariff applies.

✅ HS CODE: 3917330000

Product Name: PVC Irrigation Pipe

Total Tax Rate: 33.1%

- Base Tariff Rate: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: No additional tariff is applied, but the 30% special tariff will apply after April 11, 2025.

📌 Proactive Advice:

- Verify Material and Unit Price: Ensure the product is correctly classified based on material (e.g., rigid vs. flexible PVC) and intended use (sprinkler vs. irrigation).

- Check Required Certifications: Some products may require specific certifications (e.g., ISO, CE, or local import permits).

- Monitor Tariff Changes: The 30% special tariff after April 11, 2025, is time-sensitive and may significantly impact costs.

- Consider Alternative HS Codes: If your product is not clearly defined, consider consulting a customs broker or using a detailed product description to ensure accurate classification.

Let me know if you need help with customs documentation or tariff calculation tools. Here is the structured classification and tariff information for Rigid PVC Sprinkler Pipes based on the provided HS codes and tax details:

✅ HS CODE: 3917320010

Product Name: PVC Sprinkler Pipe

Total Tax Rate: 58.1%

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This product is subject to higher tariffs due to the additional 25% and the 30% special tariff after April 11, 2025.

✅ HS CODE: 3917390020

Product Name: PVC Irrigation Pipe

Total Tax Rate: 33.1%

- Base Tariff Rate: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: No additional tariff is applied, but the 30% special tariff will apply after April 11, 2025.

✅ HS CODE: 3917230000

Product Name: Rigid PVC Pipe

Total Tax Rate: 58.1%

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Similar to 3917320010, this product is subject to the same additional and special tariffs.

✅ HS CODE: 3904210000

Product Name: Rigid PVC Resin

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a raw material (PVC resin), not finished product. Higher base tariff applies.

✅ HS CODE: 3917330000

Product Name: PVC Irrigation Pipe

Total Tax Rate: 33.1%

- Base Tariff Rate: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: No additional tariff is applied, but the 30% special tariff will apply after April 11, 2025.

📌 Proactive Advice:

- Verify Material and Unit Price: Ensure the product is correctly classified based on material (e.g., rigid vs. flexible PVC) and intended use (sprinkler vs. irrigation).

- Check Required Certifications: Some products may require specific certifications (e.g., ISO, CE, or local import permits).

- Monitor Tariff Changes: The 30% special tariff after April 11, 2025, is time-sensitive and may significantly impact costs.

- Consider Alternative HS Codes: If your product is not clearly defined, consider consulting a customs broker or using a detailed product description to ensure accurate classification.

Let me know if you need help with customs documentation or tariff calculation tools.

Customer Reviews

No reviews yet.