| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3904100000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3904400000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3904905000 | Doc | 61.5% | CN | US | 2025-05-12 |

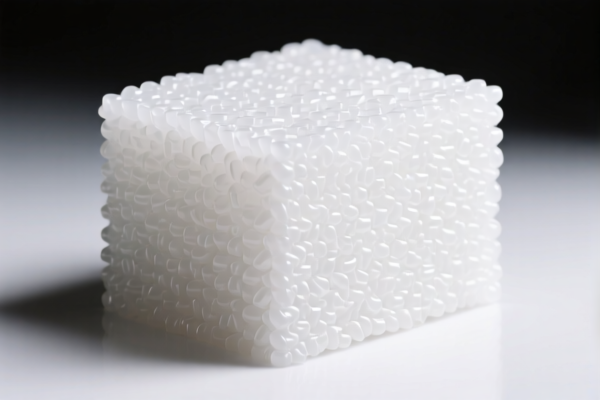

Product Name: Rigid Polyvinyl Chloride Resin

Classification: HS Code 3904 (Polyvinyl Chloride Resin)

✅ HS Code and Tax Information Summary

Below are the HS codes and associated tariff details for Rigid Polyvinyl Chloride Resin:

🔢 HS Code: 3904100000

Description: Applicable to polyvinyl chloride (PVC) resin, in accordance with HS code 3904.

Total Tax Rate: 61.5%

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for general PVC resin, not specific to rigid types.

🔢 HS Code: 3904400000

Description: Applicable to PVC resin materials, in accordance with HS code 3904400000.

Total Tax Rate: 60.3%

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may apply to specific types of PVC resin, such as modified or processed forms.

🔢 HS Code: 3904905000

Description: Applicable to PVC resin particles, suspension resin, bulk resin, chlorinated polyethylene resin, etc., in accordance with HS code 3904.

Total Tax Rate: 61.5%

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for "other" PVC resins not covered by the above two codes.

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all three codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not currently applicable to PVC resin, but always verify with the latest customs updates.

- Material and Certification Requirements: Ensure the product is clearly defined as "rigid" PVC resin and confirm if any certifications (e.g., RoHS, REACH) are required for import.

📌 Proactive Advice for Importers

- Verify Material Specifications: Confirm whether the product is rigid PVC resin and not a modified or blended form, which may fall under a different HS code.

- Check Unit Price and Tax Calculation: The total tax rate is cumulative (base + additional + special), so ensure accurate calculation for customs declarations.

- Stay Updated on Tariff Changes: Monitor any updates post-April 11, 2025, as the special tariff may affect your import costs significantly.

- Consult Customs or Broker: For complex cases, especially if the product is a blend or modified form, seek professional customs advice to avoid misclassification.

Let me know if you need help determining the correct HS code based on your product's specific characteristics.

Product Name: Rigid Polyvinyl Chloride Resin

Classification: HS Code 3904 (Polyvinyl Chloride Resin)

✅ HS Code and Tax Information Summary

Below are the HS codes and associated tariff details for Rigid Polyvinyl Chloride Resin:

🔢 HS Code: 3904100000

Description: Applicable to polyvinyl chloride (PVC) resin, in accordance with HS code 3904.

Total Tax Rate: 61.5%

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for general PVC resin, not specific to rigid types.

🔢 HS Code: 3904400000

Description: Applicable to PVC resin materials, in accordance with HS code 3904400000.

Total Tax Rate: 60.3%

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may apply to specific types of PVC resin, such as modified or processed forms.

🔢 HS Code: 3904905000

Description: Applicable to PVC resin particles, suspension resin, bulk resin, chlorinated polyethylene resin, etc., in accordance with HS code 3904.

Total Tax Rate: 61.5%

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for "other" PVC resins not covered by the above two codes.

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all three codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not currently applicable to PVC resin, but always verify with the latest customs updates.

- Material and Certification Requirements: Ensure the product is clearly defined as "rigid" PVC resin and confirm if any certifications (e.g., RoHS, REACH) are required for import.

📌 Proactive Advice for Importers

- Verify Material Specifications: Confirm whether the product is rigid PVC resin and not a modified or blended form, which may fall under a different HS code.

- Check Unit Price and Tax Calculation: The total tax rate is cumulative (base + additional + special), so ensure accurate calculation for customs declarations.

- Stay Updated on Tariff Changes: Monitor any updates post-April 11, 2025, as the special tariff may affect your import costs significantly.

- Consult Customs or Broker: For complex cases, especially if the product is a blend or modified form, seek professional customs advice to avoid misclassification.

Let me know if you need help determining the correct HS code based on your product's specific characteristics.

Customer Reviews

No reviews yet.