| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101020 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

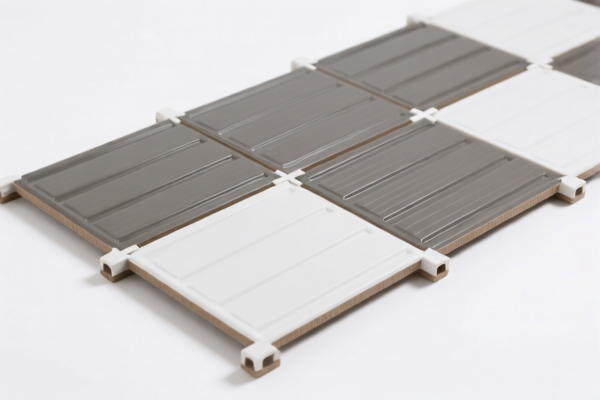

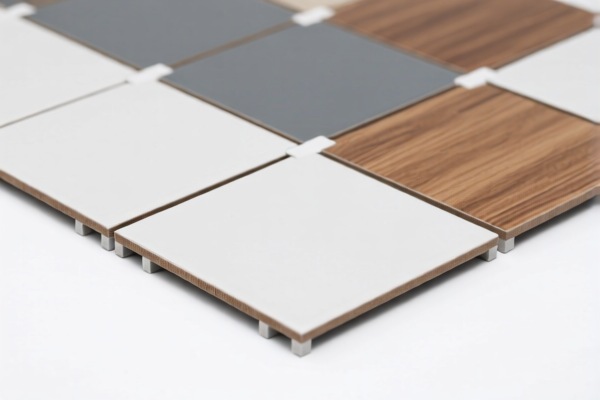

Product Classification: Rolled PVC Floor Tiles

HS CODE: 3918102000 (Primary Code)

Description: Plastic carpets, floor coverings, or wall or ceiling coverings, whether or not self-adhesive, in sheets or tiles; plastic wall or ceiling coverings as defined in Note 9 to this chapter: carpets made of polyvinyl chloride polymers: other

🔍 Tariff Overview (as of now):

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes on Tariff Changes:

- April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total import cost. -

Impact: Total tax rate will rise from 60.3% to 90.3% after this date.

-

No Anti-Dumping Duties Mentioned:

No specific anti-dumping duties on iron or aluminum are applicable for this product category.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is indeed made of PVC (Polyvinyl Chloride) and not a composite or mixed material, which may affect classification.

- Check Unit Price and Packaging: Confirm the unit of measurement (e.g., per square meter or per tile) and packaging details, as this may influence customs valuation.

- Certifications Required: Some countries may require product safety certifications (e.g., CE, SGS, or fire resistance tests) for PVC flooring. Confirm if these are needed for your destination market.

- Monitor Tariff Updates: Keep an eye on April 11, 2025, as the additional tariff will significantly increase the import cost. Consider adjusting pricing or sourcing strategies in advance.

📋 Alternative HS Codes (for Reference):

- 3918101030: For "PVC Roll Flooring" – also falls under the same 3918 category.

- 3918901000: For general plastic floor coverings (not specifically PVC).

- 3918101020: For general plastic floor coverings (not specifically PVC).

All of these codes have the same total tax rate of 60.3%, but the specific HS code should be selected based on the exact product description and material.

If you have more details about the product (e.g., thickness, use case, or destination country), I can provide a more tailored customs compliance analysis.

Product Classification: Rolled PVC Floor Tiles

HS CODE: 3918102000 (Primary Code)

Description: Plastic carpets, floor coverings, or wall or ceiling coverings, whether or not self-adhesive, in sheets or tiles; plastic wall or ceiling coverings as defined in Note 9 to this chapter: carpets made of polyvinyl chloride polymers: other

🔍 Tariff Overview (as of now):

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes on Tariff Changes:

- April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total import cost. -

Impact: Total tax rate will rise from 60.3% to 90.3% after this date.

-

No Anti-Dumping Duties Mentioned:

No specific anti-dumping duties on iron or aluminum are applicable for this product category.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is indeed made of PVC (Polyvinyl Chloride) and not a composite or mixed material, which may affect classification.

- Check Unit Price and Packaging: Confirm the unit of measurement (e.g., per square meter or per tile) and packaging details, as this may influence customs valuation.

- Certifications Required: Some countries may require product safety certifications (e.g., CE, SGS, or fire resistance tests) for PVC flooring. Confirm if these are needed for your destination market.

- Monitor Tariff Updates: Keep an eye on April 11, 2025, as the additional tariff will significantly increase the import cost. Consider adjusting pricing or sourcing strategies in advance.

📋 Alternative HS Codes (for Reference):

- 3918101030: For "PVC Roll Flooring" – also falls under the same 3918 category.

- 3918901000: For general plastic floor coverings (not specifically PVC).

- 3918101020: For general plastic floor coverings (not specifically PVC).

All of these codes have the same total tax rate of 60.3%, but the specific HS code should be selected based on the exact product description and material.

If you have more details about the product (e.g., thickness, use case, or destination country), I can provide a more tailored customs compliance analysis.

Customer Reviews

No reviews yet.