| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101020 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101040 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

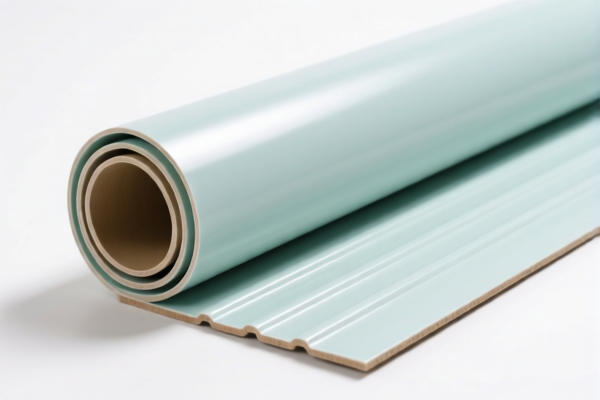

✅ Product Classification: Rolled PVC Floor Tiles

HS CODE: 3918101030, 3918101020, 3918101040, 3918102000

📌 Classification Summary

- Product Name: Rolled PVC Floor Tiles

- HS Code Description: Plastic floor coverings, whether self-adhesive or not, in sheets or tiles (Chapter 3918).

- Material: PVC (Polyvinyl Chloride), a type of plastic.

- Form: Rolled (sheet form), which is included in the HS code description.

📊 Tariff Overview

All listed HS codes have identical tax rates for this product. Here's the breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Note: The additional 30.0% tariff applies after April 11, 2025. Ensure your import timeline is aligned with this policy change.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm that the product is indeed made of PVC (polyvinyl chloride) and not a different type of plastic, as this affects classification.

- Form and Packaging: Ensure the product is in sheet/roll form, not tiles, unless the HS code explicitly includes both (e.g., 3918101030).

- Certifications: Check if any certifications (e.g., fire resistance, environmental compliance) are required for import into the destination country.

- Unit Price: Verify the unit price for accurate duty calculation, especially if the product is subject to anti-dumping duties or tariff-rate quotas.

- Documentation: Maintain proper documentation (e.g., commercial invoice, packing list, certificate of origin) to support the HS code classification.

📌 Anti-Dumping and Countervailing Duties

- Not Applicable: There are currently no known anti-dumping or countervailing duties specifically targeting PVC floor tiles as of now.

- Monitor Updates: Stay informed about any new trade measures or policy changes, especially from the U.S. or EU, which may impose additional duties on imported PVC products.

📌 Proactive Advice

- Double-check HS Code: While multiple HS codes may apply, ensure the most accurate one is used based on the product's exact specifications (e.g., thickness, adhesive type, intended use).

- Consult a Customs Broker: For high-value or complex shipments, consider engaging a customs broker to ensure compliance and avoid delays.

- Track Policy Changes: Keep an eye on April 11, 2025, as the special tariff may significantly increase the total cost of import.

Let me know if you need help with certification requirements, duty calculation, or customs documentation for this product.

✅ Product Classification: Rolled PVC Floor Tiles

HS CODE: 3918101030, 3918101020, 3918101040, 3918102000

📌 Classification Summary

- Product Name: Rolled PVC Floor Tiles

- HS Code Description: Plastic floor coverings, whether self-adhesive or not, in sheets or tiles (Chapter 3918).

- Material: PVC (Polyvinyl Chloride), a type of plastic.

- Form: Rolled (sheet form), which is included in the HS code description.

📊 Tariff Overview

All listed HS codes have identical tax rates for this product. Here's the breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Note: The additional 30.0% tariff applies after April 11, 2025. Ensure your import timeline is aligned with this policy change.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm that the product is indeed made of PVC (polyvinyl chloride) and not a different type of plastic, as this affects classification.

- Form and Packaging: Ensure the product is in sheet/roll form, not tiles, unless the HS code explicitly includes both (e.g., 3918101030).

- Certifications: Check if any certifications (e.g., fire resistance, environmental compliance) are required for import into the destination country.

- Unit Price: Verify the unit price for accurate duty calculation, especially if the product is subject to anti-dumping duties or tariff-rate quotas.

- Documentation: Maintain proper documentation (e.g., commercial invoice, packing list, certificate of origin) to support the HS code classification.

📌 Anti-Dumping and Countervailing Duties

- Not Applicable: There are currently no known anti-dumping or countervailing duties specifically targeting PVC floor tiles as of now.

- Monitor Updates: Stay informed about any new trade measures or policy changes, especially from the U.S. or EU, which may impose additional duties on imported PVC products.

📌 Proactive Advice

- Double-check HS Code: While multiple HS codes may apply, ensure the most accurate one is used based on the product's exact specifications (e.g., thickness, adhesive type, intended use).

- Consult a Customs Broker: For high-value or complex shipments, consider engaging a customs broker to ensure compliance and avoid delays.

- Track Policy Changes: Keep an eye on April 11, 2025, as the special tariff may significantly increase the total cost of import.

Let me know if you need help with certification requirements, duty calculation, or customs documentation for this product.

Customer Reviews

No reviews yet.