| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919102030 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919905040 | Doc | 60.8% | CN | US | 2025-05-12 |

| 7007190000 | Doc | 60.0% | CN | US | 2025-05-12 |

| 7020006000 | Doc | 60.0% | CN | US | 2025-05-12 |

| 9001908000 | Doc | 55.0% | CN | US | 2025-05-12 |

Okay, let's break down the HS codes you've provided for your "SCREEN PROTECTOR" declarations. I'll provide a detailed analysis, focusing on what each code means and potential considerations for import.

Understanding HS Codes: A Quick Primer

HS codes (Harmonized System codes) are internationally standardized codes used to classify traded products. They're crucial for determining tariffs, taxes, and import regulations. The first 6 digits are generally standardized globally, while the last digits can vary by country.

Here's a breakdown of each code you provided:

1. HS Code: 3919.10.20.30 – Self-adhesive plates, sheets, film, foil, tape, strip and other flat shapes, of plastics, whether or not in rolls

- 39: Plastics and articles thereof. This chapter covers a wide range of plastic products.

- 19: Plastics in plates, sheets, film, foil, strip, etc. This narrows it down to flat plastic shapes.

- 10: Self-adhesive plates, sheets, film, foil, tape, strip and other flat shapes, of plastics. Specifically focuses on adhesive plastic products.

- 20: In rolls of a width not exceeding 20 cm. This specifies the form factor – rolled plastic tape under 20cm wide.

- 30: Other. This is a further sub-categorization.

- Description: Transparent tape, not exceeding 55 m in length, not exceeding 5 cm in width.

- Tax: 60.8% (Base Tariff: 5.8%, Additional Tariff: 25.0%, Post-April 2, 2025 Additional Tariff: 30%)

2. HS Code: 3919.90.50.40 – Self-adhesive plates, sheets, film, foil, tape, strip and other flat shapes, of plastics, whether or not in rolls

- 39: Plastics and articles thereof.

- 19: Plastics in plates, sheets, film, foil, strip, etc.

- 90: Other. This covers plastic plates, sheets, film, foil, tape, strip, etc. not specifically covered elsewhere in 3919.

- 50: Other. This is a further sub-categorization.

- Description: Transparent tape.

- Tax: 60.8% (Base Tariff: 5.8%, Additional Tariff: 25.0%, Post-April 2, 2025 Additional Tariff: 30%)

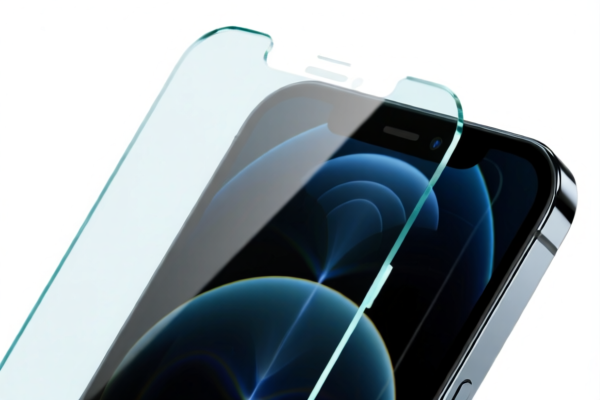

3. HS Code: 7007.19.00.00 – Safety glass, consisting of toughened (tempered) or laminated glass

- 70: Glass and glass articles.

- 07: Glass of a kind used for windows, doors, etc.

- 19: Toughened (tempered) safety glass. This specifically identifies tempered glass.

- 00: Other.

- Description: Toughened (tempered) safety glass.

- Tax: 60.0% (Base Tariff: 5.0%, Additional Tariff: 25.0%, Post-April 2, 2025 Additional Tariff: 30%)

4. HS Code: 7020.00.60.00 – Other articles of glass

- 70: Glass and glass articles.

- 20: Other articles of glass. This is a broad category for glass items not covered elsewhere.

- 00: Other.

- Description: Other.

- Tax: 60.0% (Base Tariff: 5.0%, Additional Tariff: 25.0%, Post-April 2, 2025 Additional Tariff: 30%)

5. HS Code: 9001.90.80.00 – Optical fibers and optical fiber bundles; optical fiber cables other than those of heading 8544; sheets and plates of polarizing material; lenses (including contact lenses), prisms, mirrors and other optical elements, of any material, unmounted, other than such elements of glass not optically worked

- 90: Optical, precision, medical, surgical, dental instruments and apparatus.

- 01: Optical fibers and optical fiber bundles; optical fiber cables.

- 90: Other.

- 80: Other.

- Description: Halftone screens designed for use in engraving or photographic processes.

- Tax: 55.0% (Base Tariff: 0.0%, Additional Tariff: 25.0%, Post-April 2, 2025 Additional Tariff: 30%)

Important Considerations & Recommendations:

- Material Composition: The HS code is heavily dependent on the material of the screen protector. Are they primarily plastic (PET, TPU, etc.), glass (tempered glass), or a combination? Ensure the HS code accurately reflects the dominant material.

- Adhesive Type: The type of adhesive used can sometimes influence the classification.

- Width and Length: For the 3919 codes, pay close attention to the width and length specifications.

- Functionality: What is the primary function of the screen protector? Is it purely protective, or does it have additional features (e.g., anti-glare, privacy filters)?

- Post-April 2, 2025 Tariffs: Be aware of the upcoming tariff changes. Factor the potential 30% additional tariff into your cost calculations.

- Certifications: Depending on the intended use and destination country, you may need certifications (e.g., RoHS, REACH) to demonstrate compliance with safety and environmental standards.

- Country of Origin: Confirm the country of origin for accurate tariff application.

- Detailed Invoice: Provide a detailed invoice with a clear description of the goods, material composition, and specifications to customs authorities.

Disclaimer: I am an AI assistant and cannot provide definitive customs advice. This information is for general guidance only. It is highly recommended to consult with a licensed customs broker or import specialist in your destination country to ensure accurate classification and compliance with all applicable regulations. They can review your specific product details and provide tailored advice.

Customer Reviews

The detailed HS Code info for plastic builder’s doors was exactly what I was looking for. Highly recommend this page to anyone in the trade.

This page was a lifesaver for my export business. The HS Code and tariff info for plastic doors is exactly what I needed.

I appreciated the straightforward explanation of the 5% tariff rate. It made the export process less confusing for me.

The page provided good trade details and tariff info. It would have been better if it included more countries, but overall it was helpful.

I found the information on exporting plastic doors to the US extremely useful. The HS Code details were spot-on.