| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8708295160 | Doc | 2.5% <u></u>+105.0% | CN | US | 2025-05-12 |

| 3923900080 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3926904590 | Doc | 58.5% | CN | US | 2025-05-12 |

| 8418998050 | Doc | 105.0% | CN | US | 2025-05-12 |

| 4008115000 | Doc | 58.3% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for sealing strips based on the provided HS codes and tariff details:

✅ HS CODE: 8708295160

Product Classification: Sealing strips used as parts or accessories for automotive bodies.

Tariff Summary:

- Base Tariff Rate: 2.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Steel/Aluminum Products Additional Tariff: 50%

Key Notes:

- This classification applies to sealing strips used in automotive applications.

- The total effective tariff rate is 2.5% + 25.0% = 27.5%, and after April 11, 2025, it increases to 30.0%.

- If the sealing strip contains steel or aluminum, an additional 50% tariff will be applied.

Proactive Advice:

- Confirm the material composition of the sealing strip (e.g., whether it contains steel or aluminum).

- Check if any certifications (e.g., automotive compliance) are required for import.

✅ HS CODE: 3923900080

Product Classification: Plastic sealing strips, classified under packaging materials.

Tariff Summary:

- Base Tariff Rate: 3.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This classification applies to sealing strips made of plastic and used as packaging materials.

- The total effective tariff rate is 3.0% + 25.0% = 28.0%, and after April 11, 2025, it increases to 30.0%.

Proactive Advice:

- Ensure the product is indeed used for packaging purposes and not for industrial or automotive applications.

- Verify the material (e.g., type of plastic) to avoid misclassification.

✅ HS CODE: 8418998050

Product Classification: Sealing strips used in refrigerators or cooling equipment.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Steel/Aluminum Products Additional Tariff: 50%

Key Notes:

- This classification applies to sealing strips used in refrigeration equipment.

- The total effective tariff rate is 0.0% + 25.0% = 25.0%, and after April 11, 2025, it increases to 30.0%.

- If the sealing strip contains steel or aluminum, an additional 50% tariff will be applied.

Proactive Advice:

- Confirm the product is used in refrigeration equipment (e.g., refrigerator doors).

- Check if the product is part of a complete set or sold separately.

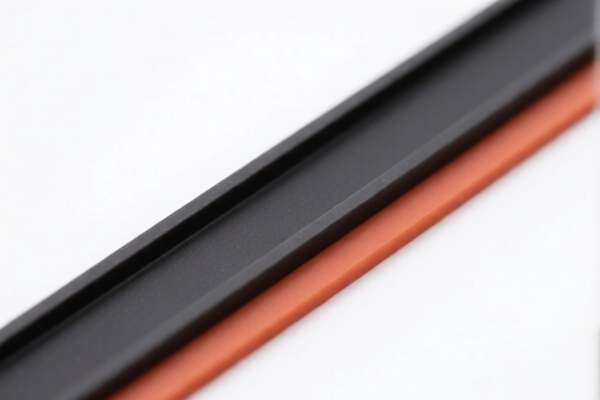

✅ HS CODE: 4008115000

Product Classification: Rubber sealing strips, classified under vulcanized rubber products.

Tariff Summary:

- Base Tariff Rate: 3.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This classification applies to sealing strips made of vulcanized rubber.

- The total effective tariff rate is 3.3% + 25.0% = 28.3%, and after April 11, 2025, it increases to 30.0%.

Proactive Advice:

- Ensure the product is made of vulcanized rubber and not synthetic or other types.

- Confirm the intended use (e.g., automotive, industrial, or packaging).

✅ HS CODE: 4016935050

Product Classification: Rubber sealing strips, classified under gaskets, seals, and similar items.

Tariff Summary:

- Base Tariff Rate: 2.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This classification applies to sealing strips used as gaskets or seals.

- The total effective tariff rate is 2.5% + 25.0% = 27.5%, and after April 11, 2025, it increases to 30.0%.

Proactive Advice:

- Confirm the product is used as a gasket or seal (e.g., for industrial or mechanical applications).

- Check if the product is part of a larger assembly or sold as a component.

📌 Important Reminder:

- April 11, 2025 Special Tariff: All products will be subject to an additional 30.0% tariff unless exempted.

- Steel/Aluminum Products: If the sealing strip contains steel or aluminum, an additional 50% tariff will be applied.

- Certifications: Depending on the application (e.g., automotive, refrigeration), certain certifications may be required. Always verify with local customs authorities or a customs broker.

Customer Reviews

This page gave me exactly what I needed for my plastic door export project. The details on tariff rates were very helpful.

The information on HS code 3925 was spot-on. I just wish the page had included more countries for comparison.

I was impressed by how clearly the tariff rates were explained. This helped me save time on my export paperwork.

The page made it easy to understand the trade regulations for exporting plastic doors. I wish there were more examples, though.

I was looking for HS code information for plastic doors, and this page had all the details I needed in one place. Great resource!