| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5901904000 | Doc | 59.1% | CN | US | 2025-05-12 |

| 3919905060 | Doc | 60.8% | CN | US | 2025-05-12 |

| 8310000000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8479899599 | Doc | 57.5% | CN | US | 2025-05-12 |

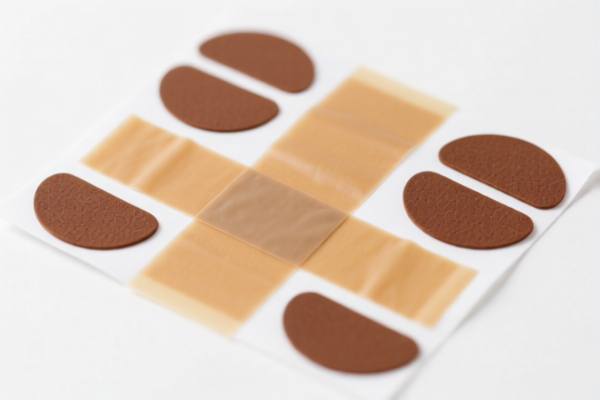

HS Code Classification & Customs Guidance for "SELF ADHESIVE FELT PAD"

Based on the provided information, here's a breakdown of potential HS code classifications for "SELF ADHESIVE FELT PAD", along with relevant customs details. It's important to note that the most accurate classification depends on the precise composition and intended use of the pads.

Understanding HS Codes:

HS (Harmonized System) codes are internationally standardized codes used to classify traded products. They are crucial for determining import duties, taxes, and regulations. The first two digits generally indicate the chapter, the next two the subheading, and further digits provide more specific classifications.

Here's an analysis of the provided HS codes and their potential relevance to "SELF ADHESIVE FELT PAD":

1. 5901.90.40.00 – Textile fabrics coated with gum or amylaceous substances…

- Chapter 59: Textile fabrics.

- Subheading 59.01: Textile fabrics impregnated, coated, covered or laminated with plastics or rubber.

- 59.01.90: Other.

- 59.01.90.40.00: Other.

- Tax Rate: Base Duty: 4.1%, Additional Tariff: 25.0%, Post April 2, 2025: Additional Tariff 30%. Total Tax: 59.1%

- Relevance: This code could apply if the felt pad is primarily a textile fabric with an adhesive coating. However, it's crucial to determine if the adhesive is considered a significant component altering the fabric's fundamental character. If the adhesive is a minor coating, this code might be suitable.

- Important Note: The description specifies use for book covers. If your pads are not used for this purpose, this code may be less appropriate.

2. 3919.90.50.60 – Self-adhesive plates, sheets, film, foil, tape, strip and other flat shapes, of plastics…

- Chapter 39: Plastics and articles thereof.

- Subheading 39.19: Self-adhesive plates, sheets, film, foil, tape, strip and other flat shapes, of plastics.

- 39.19.90: Other.

- 39.19.90.50.60: Other.

- Tax Rate: Base Duty: 5.8%, Additional Tariff: 25.0%, Post April 2, 2025: Additional Tariff 30%. Total Tax: 60.8%

- Relevance: This is a strong contender if the felt pad is made of plastic material with an adhesive backing. The description directly addresses self-adhesive products.

- Important Note: The material must be plastic. If it's primarily felt (a textile), this code is not appropriate.

3. 8310.00.00.00 – Sign plates, name plates, address plates and similar plates…

- Chapter 83: Miscellaneous articles of base metal.

- Subheading 83.10: Sign plates, name plates, address plates and similar plates.

- 83.10.00.00: Other.

- Tax Rate: Base Duty: 0.0%, Additional Tariff: 25.0%, Post April 2, 2025: Additional Tariff 30%. Total Tax: 55.0%

- Relevance: This code is unlikely to be appropriate unless the felt pad is specifically used as a sign plate, name plate, or address plate. The material would also need to be base metal.

4. 8479.89.95.99 – Machines and mechanical appliances…

- Chapter 84: Nuclear reactors, boilers, machinery and mechanical appliances.

- Subheading 84.79: Machines and mechanical appliances having individual functions.

- 84.79.89: Other machines and mechanical appliances.

- 84.79.89.95.99: Other.

- Tax Rate: Base Duty: 2.5%, Additional Tariff: 0.0%, Post April 2, 2025: Additional Tariff 30% (for steel/aluminum products). Total Tax: 57.5%

- Relevance: This code is highly unlikely to be appropriate for a simple felt pad. It applies to complex machinery.

Recommendations & Next Steps:

- Material Composition: Crucially, determine the primary material of the felt pad. Is it primarily textile felt, plastic, or a combination?

- Adhesive Type: What is the adhesive made of?

- Intended Use: What is the specific application of the pad?

- Consult a Customs Broker: The most reliable approach is to consult a licensed customs broker in your importing country. They can review the product specifications and provide a definitive HS code classification.

- Official Ruling (Optional): For complex cases, you can request an official binding ruling from your customs authority. This provides legal certainty.

- Review Trade Agreements: Check if any trade agreements between your country and the exporting country offer preferential tariff rates.

- Prepare Documentation: Ensure you have accurate documentation, including a detailed product description, material composition, and intended use.

Disclaimer: This information is for general guidance only and does not constitute professional customs advice. HS code classifications can be complex and subject to interpretation. Always consult with a qualified customs professional for accurate and up-to-date information.

Customer Reviews

No reviews yet.