| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 7319901000 | Doc | 62.5% | CN | US | 2025-05-12 |

Declaration Analysis: Sewing Needles (HS Code 7319.90.10.00)

Here's a breakdown of your declared item, "Sewing Needles," based on the provided HS Code and tax information. This analysis aims to provide clarity on classification, duties, and important considerations for customs clearance.

1. HS Code Breakdown (7319.90.10.00)

The HS Code is a globally standardized system used to classify traded products. Let's dissect 7319.90.10.00:

- 73: Chapter 73 covers articles of iron or steel. This broadly defines the material category of your product.

- 7319: This specifies "Needles of iron or steel." This narrows down the category to specifically iron or steel needles.

- 7319.90: This further defines "Other needles." This indicates that your sewing needles fall into a category other than specifically defined types of needles (like surgical needles, etc.).

- 7319.90.10.00: This is the most specific code, denoting "Other sewing, darning or embroidery needles." This is the code assigned to your particular type of sewing needles.

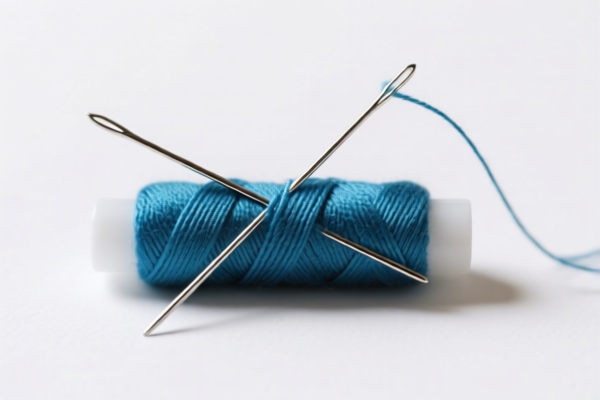

2. Product Classification

Your declared item is correctly classified under 7319.90.10.00 as "Other sewing, darning or embroidery needles" made of iron or steel. This includes standard sewing needles used for hand sewing, darning, or embroidery. It excludes needles specifically designed for medical purposes or other specialized applications which would fall under different HS codes.

3. Tax Implications (Based on Provided Data)

- Basic Duty: 0.0% - Currently, there is no basic customs duty applied to these needles.

- Additional Tariff: 7.5% - An additional tariff of 7.5% is currently in effect.

- Post-April 2025 Additional Tariff: 30% - Important: Effective after April 2025, the additional tariff will increase to 30% for steel and aluminum products.

- Total Tax: 62.5% - This is the combined rate based on the current basic duty and additional tariff.

4. Important Considerations & Recommendations

- Material Verification: Confirm the exact material composition of the needles. While classified as iron or steel, any significant alloy content could potentially affect classification.

- Single Price Check: The declared value (single price) of the needles is crucial. Customs authorities may scrutinize prices to ensure they align with market values.

- Certification (Potential): Depending on the importing country's regulations, you may need to provide certificates of origin or compliance documentation. Check the specific requirements of the destination country.

- Post-April 2025 Tariff: Be prepared for a significant tariff increase after April 2025. Factor this into your pricing and import planning.

- Country of Origin: Ensure the declared country of origin is accurate. This is vital for tariff eligibility and trade agreements.

- Packaging & Labeling: Confirm that the packaging and labeling comply with the importing country's regulations.

Disclaimer: This analysis is based solely on the information provided. Customs regulations are subject to change. It is highly recommended to consult with a licensed customs broker or the customs authorities of the importing country for the most accurate and up-to-date information.

Customer Reviews

No reviews yet.